As a seasoned analyst with years of experience navigating the tumultuous seas of cryptocurrency markets, I find myself intrigued by Santiment’s latest findings. The trend of heavy shorting on Binance for AAVE, GRT, and MANA is indeed noteworthy, especially given the broader market’s bullish momentum.

According to the analysis by chain data company Santiment, it’s possible that these three cryptocurrencies could witness price increases in the near future.

These Altcoins Are Being Heavily Shorted On Binance Right Now

In a new post on X, Santiment has discussed about some altcoins that could be worth keeping an eye on because of a trend forming in their Binance Funding Rate. The Funding Rate here refers to an indicator that tracks the periodic amount of fees that traders on a given derivatives exchange (in this case, Binance) are paying each other right now.

When this metric has a positive value, it signifies that long investors are actually compensating or paying fees to the short holders, in order to maintain their investment positions. This pattern indicates that most derivative users generally hold a bullish outlook on the market.

In contrast, when the indicator shows a negative value, it suggests that short positions are more prevalent than long ones. This might lead us to infer that a bearish sentiment is likely to be the prevailing attitude within the sector.

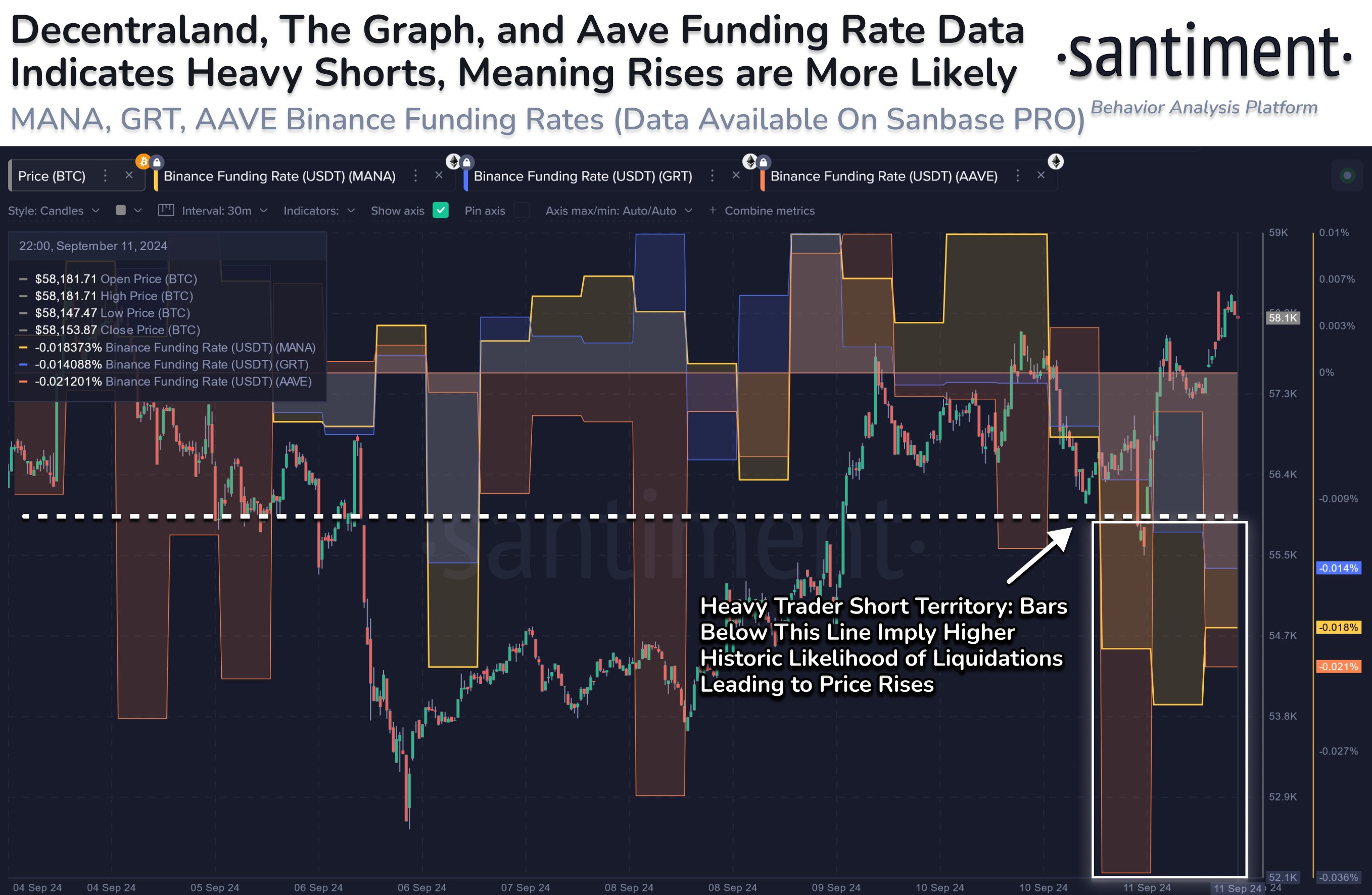

Currently, I’m presenting a graph provided by an analytics company. This graph illustrates the evolution of the Funding Rates for three cryptocurrencies – Aave (AAVE), The Graph (GRT), and Decentraland (MANA) – over the last seven days.

From the provided chart, it’s clear that the Binance Funding Rates for these three altcoins have turned from positive (green) to negative (red). This might imply that investors have taken a significant number of short positions on the exchange for these assets, thereby altering the overall balance.

As a crypto investor, I’ve noticed an intriguing trend: despite the overall cryptocurrency market rebound, particularly with Bitcoin surging back above $58,000, it seems derivatives users are skeptical about AAVE, GRT, and MANA continuing their bullish run. However, this pessimism could potentially work in favor of these altcoins’ prices, creating opportunities for investment.

As an analyst, I’m pointing out that during mass liquidation events, it’s typically the market sector with the highest number of positions that experiences the impact. Currently, the prevailing sentiment appears to be bearish, which suggests a potential surge in short liquidations might occur in the upcoming days.

In instances where numerous liquidations occur simultaneously (often referred to as a ‘squeeze’), there can be a sudden surge in market volatility. Consequently, Santiment posits that if these short positions are caught up in a liquidation event, it might lead to significant price increases for the altcoins.

Time will tell if Aave and other similar platforms will experience price increases, potentially causing disappointment for those who are betting on a downturn in prices.

Aave Price

In recent times, the value of Aave has been on an upward trend, reaching a high of $147 following a significant increase of more than 11% in the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-09-13 03:04