As a seasoned crypto investor with battle-scarred fingers from navigating multiple market cycles, I find these indicators presented by Checkmate particularly intriguing. The Short-Term Holder Realized Profit/Loss Momentum and the Short-Term Holder MVRV Ratio Momentum seem to be reliable signals in predicting bearish phases, as they focus on recent market activity.

A cryptocurrency expert has outlined various indicators in different measurements to determine whether Bitcoin is experiencing a downtrend or bear market.

These Bitcoin Indicators Could Be To Follow For Bear Market Signals

In a new post on X, on-chain analyst Checkmate replied to a user asking about an on-chain metric indicating when it’s time to turn bearish on cryptocurrency.

Checkmate has provided two performance indicators for short-term Bitcoin investors: the Short-Term Holder Realized Profit/Loss Speed and the Short-Term Holder MVRV Ratio Speed. In this context, “Short-Term Holders” (STHs) are those who purchased their coins within the last 155 days. As a result, these metrics focus on the behavior of recent market participants.

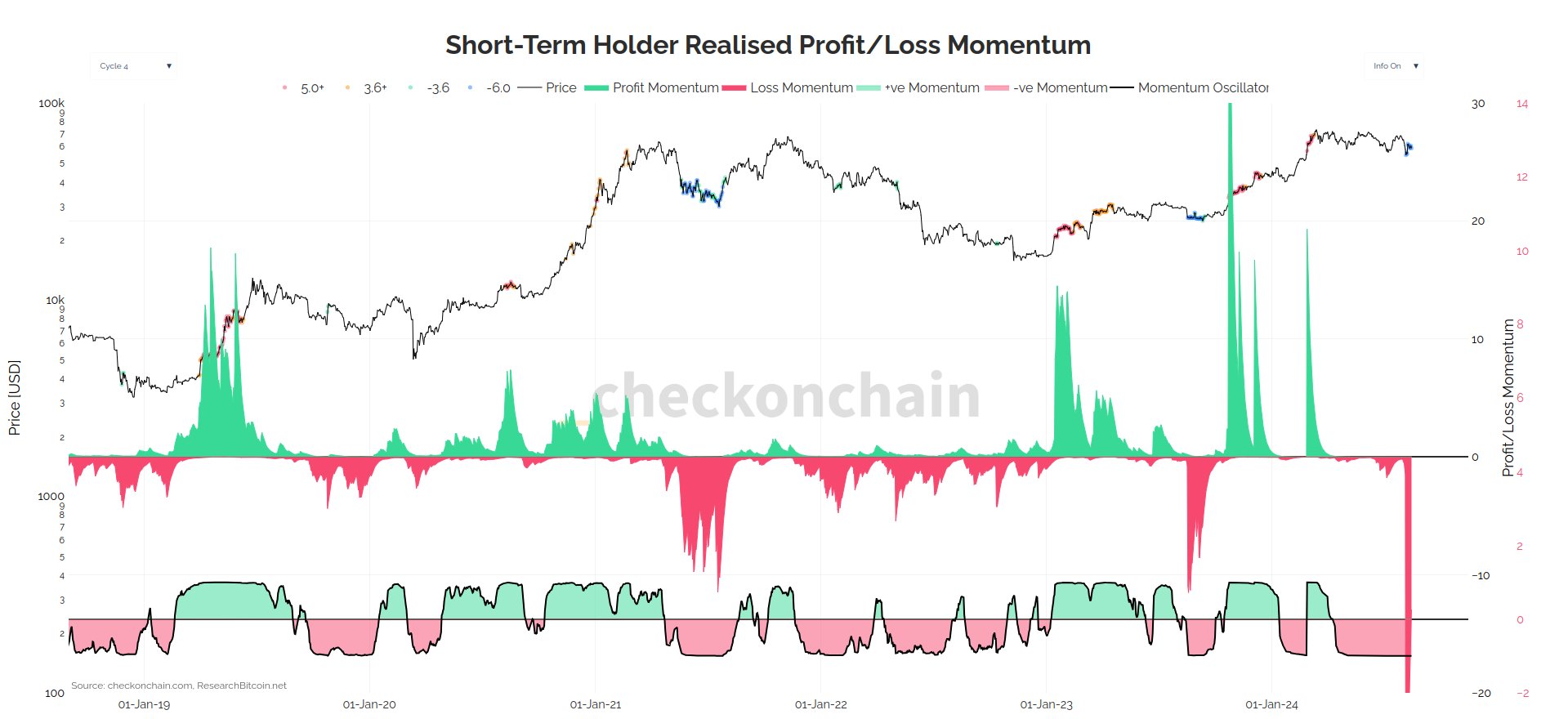

To clarify, “Realized Profit/Loss Momentum” gauges the rate at which Strategic Temporary Holders (STHs) are experiencing gains or losses by selling off their positions. In simpler terms, it’s a way to track how quickly STHs are cashing out their profits or cutting their losses.

Below is the chart for the indicator posted by the analyst.

Based on the analyst’s viewpoint, it’s advisable to adopt a pessimistic stance once the oscillator at the chart’s base changes to red, signifying downward momentum in the Short-Term Hold (STH) Realized Profit/Loss.

The graph shows that this oscillator assumed negative values soon after the price set its new all-time high (ATH) and has since remained in the region. And indeed, while the indicator has seen these values, Bitcoin has been going through a rough phase.

As a seasoned investor with years of experience under my belt, I’ve come to appreciate the value of keeping tabs on various indicators that help me gauge market trends and make informed investment decisions. One such tool that I find particularly useful is the STH MVRV Ratio Momentum’s second indicator. This nifty little gadget works by comparing the Market Value to Realized Value (MVRV) Ratio for a specific group of assets, and its moving average over a 155-day period. In simpler terms, it measures the distance between the current MVRV ratio and its previous 155 days’ worth of data, providing me with a clearer picture of whether the asset I’m considering is overvalued or undervalued compared to its historical trends. This information helps me make more informed decisions when navigating the ever-changing crypto market, allowing me to potentially avoid potential pitfalls and capitalize on opportunities that might otherwise slip through my fingers.

The MVRV Ratio is a commonly-used tool that measures the relationship between an investment’s current market value and its original cost (Realized Cap). Essentially, it helps us understand if investors are sitting on potential profits or losses from their holdings, as it indicates their unrealized gains or losses.

In other words, while the Realized Profit/Loss measures the actual net profit/loss that investors have already realized by selling, this metric indicates the profit/loss that the investors have not yet realized or taken.

Here is the data for the momentum indicator for the MVRV Ratio specifically for the STHs:

From my perspective as a researcher, just like the initial metric, this one too suggests a downturn or bearish signal when the momentum transitions into red. As you can see from the graph, the STH MVRV Ratio has been below its 155-day moving average during the same period where the bearish momentum in Realized Profit/Loss was present. This alignment strengthens the reliability of the signal.

BTC Price

Earlier this week, Bitcoin surged close to $62,000, however, it has since experienced a drop and is currently trading around $57,800 again.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-08-17 01:16