As a seasoned cryptocurrency analyst with years of experience navigating the tumultuous seas of digital assets, I find myself constantly astounded by the resilience and potential of Bitcoin. The recent price action has been nothing short of remarkable, and it’s clear that the bull run is far from over.

Over the last 24 hours, the crypto market experienced liquidations worth over $500 million. During this period, Bitcoin (BTC) dipped to a 24-hour low of $94,306, but subsequently recovered and is now trading at a price of approximately $97,727. The 24-hour volatility stands at 0.4%, while the market capitalization remains around $1.94 trillion with a 24-hour volume of $133.06 billion.

The surge in Bitcoin’s price aligns with an increase in institutional interest. Additionally, the upward trend seems to weaken the brief market correction, offering a gradual recovery.

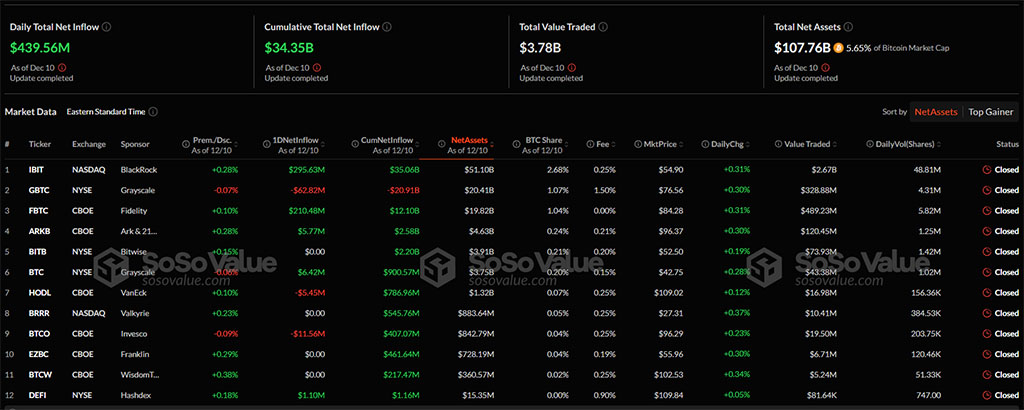

US Spot ETF Nets ~$440 Inflows

Inflows of approximately $440 million into U.S.-based Bitcoin ETFs for institutions have been recorded on a daily basis, as these entities compete to acquire Bitcoin.

Yesterday, BlackRock took the lead with a $295.63 million investment in Bitcoin. Afterward, Fidelity added $210.48 million to its Bitcoin holdings during the previous day.

As a result, the combined value of U.S. spot ETFs holding Bitcoin has grown to approximately $107.76 billion, which equates to around 5.65% of the total market capitalization of Bitcoin. Among the 12 Bitcoin ETFs that are currently registered, half (5) have experienced a positive inflow of funds, while three have seen a decrease (outflow). This leaves four ETFs with no net change in their holdings.

As the recovery in BTC gains momentum, the on-chain indicators are starting to flash a buy signal.

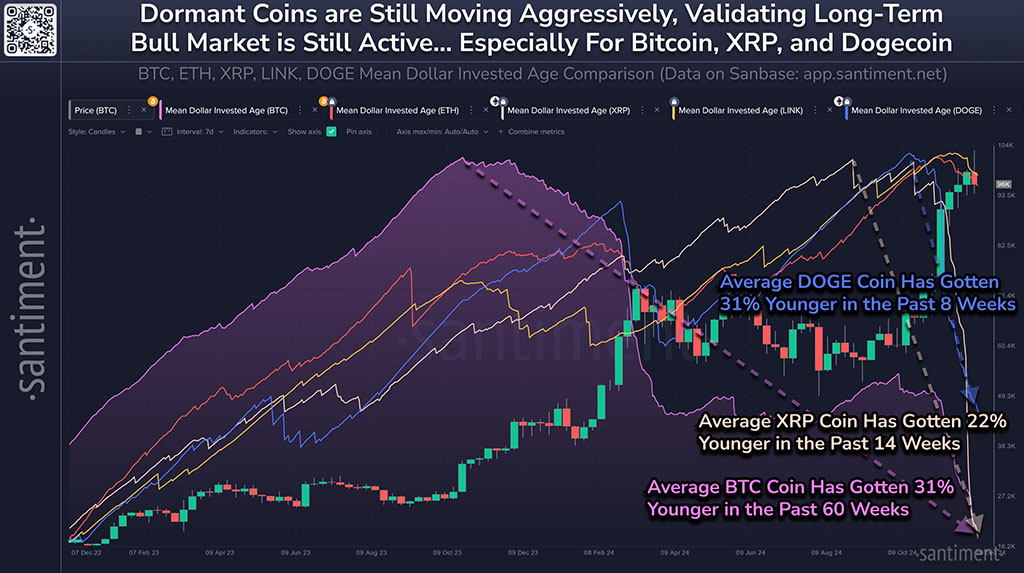

Bitcoin’s Mean Age of Investment Turns 31% Younger

One of the underrated metrics in crypto, mean dollar invested age, supports this signal as the market gradually recovers from the recent retracement.

According to the data from the blockchain, the average length of time Bitcoin investors have held their coins has decreased to approximately 439 days. Over the last 60 weeks, this represents an approximately 31% drop in the average investment age.

Examining XRP‘s current status, I find that its average holding duration has decreased significantly, now standing at approximately 865 days and showing a 22% decrease over the last 14 weeks. Conversely, Dogecoin‘s average investment age has plummeted to around 370 days, marking a 31% reduction in holding duration over the past eight weeks. Here are the latest statistics for both:

The average dollar investment per Bitcoin decreases, while the leading altcoins suggest that older, dormant wallets are transferring prominent cryptocurrencies. This movement is likely originating from significant investors or “whales,” making an uptick in network activity a promising indicator for a bull market rally.

The mean age of investment is a critical indicator that has proved its mettle in the 2017 and 2021 bull markets. In the previous bull runs, the markets peaked and started going down when the mean ages started increasing or getting older again.

Therefore, even though there may be temporary changes in the prices of Bitcoin and leading altcoins, the decrease in the average time investors have held their assets points towards a potentially optimistic outlook for the mid to long-term market.

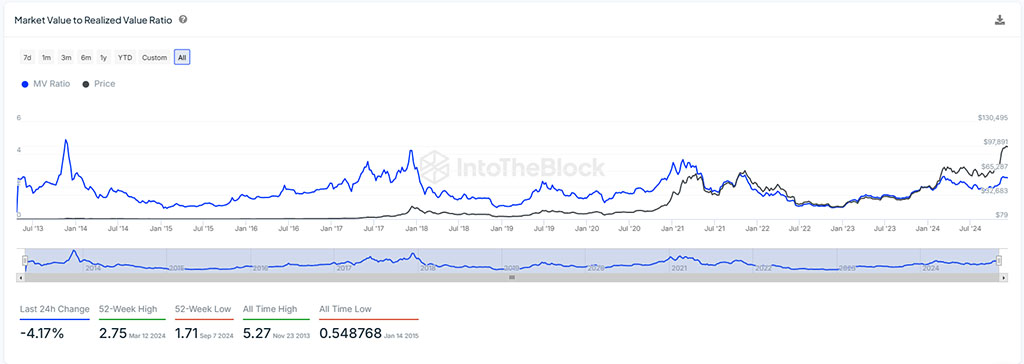

MVRV Ratio Reveals Room for Growth

As a researcher, I’ve discovered that the Market Value to Realized Value (MVRV) ratio serves as another essential on-chain indicator for forecasting the peak of a bull market. Essentially, this ratio compares the total market capitalization with the average purchase price for each address. This metric can help us gauge when investors might start realizing their profits, potentially signaling the top of a bull run.

At present, the MVRV ratio is 2.55, which is lower than its peak during the 2021 bull run of 3.68. In comparison, the MVRV ratio reached higher levels, at 4.24 during the 2017 bull run and 4.91 back in 2013.

In my analysis, as the MVRM (Moving Average Ratio of Value) consistently decreases during the zenith of each bull run, it serves as an essential clue pointing towards potential market saturation or exhaustion. At the current reading of 2.55, this on-chain indicator suggests there’s still room for further growth and potential opportunities ahead.

Bitcoin Targets New All-time High

With Bitcoin’s price rebounding from the significant support at $94,425, it signifies a V-shaped revival, aiming to breach the temporary resistance trendline. This upward surge has managed to surpass the 50 Simple Moving Average (SMA) line in the one-hour chart.

Additionally, it examines the merging point of resistance at the Fibonacci level of 38.20%, which is around $97,945, with the existing resistance trendline. The temporary decline has led to a “death cross” formation early on, indicating a potential bearish convergence between the 200 and 100 Simple Moving Average lines.

Source: Tradingview

With more investors pouring money into Exchange Traded Funds (ETFs), it appears that the Bitcoin recovery is gathering pace. This strengthens the possibility of a significant price surge. Nevertheless, the Bitcoin market’s behavior indicates the creation of smaller price movements as it nears the resistance level, suggesting a possible cap on its upward trend.

This indicates another possible drop to reevaluate the 23.60% Fibonacci level at $96,600. However, since the on-chart indicator suggests an upcoming bullish rally, the breach of the local support trendline will create a good opportunity for traders following price action to make a purchase.

As the current surge pushes Bitcoin prices, the Fibonacci sequence indicates potential resistance at approximately 61.80% around the symbolic $100,000 level. Clearing this hurdle could boost the probability of BTC reaching its next target of $103,647, potentially setting a new record high.

Based on the Fibonacci levels, the price targets for a new all-time high are $106,145 and $109,333.

In summary, given the daytime rebound and indications from blockchain activities, it appears that the upward trend in Bitcoin may be able to weather this temporary setback.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-11 12:19