Approaching the psychological level of $100,000, Bitcoin (BTC) currently stands at around $98,868 with a daily volatility of 1.2% and a market capitalization of approximately $1.96 trillion, backed by a 24-hour trading volume of $26.30 billion. On the other hand, Ethereum (ETH) has surpassed the $3,639 mark, indicating a strong bullish trend. This upward momentum is pushing the Ethereum market cap towards the $450 billion milestone, with a daily volatility of 0.7%, a current market capitalization of around $438.29 billion, and a 24-hour trading volume of $16.42 billion.

Over the last seven days, the cost of Ethereum has surged by 8.5% and is currently maintaining its upward trajectory this week. The strong beginning to the week suggests that the rally could extend further, leading our Ethereum price prediction to point towards a potential trend reaching $4,000.

Ethereum Price Trajectory to $4,000

Looking at the 4-hour chart, Ethereum’s price movement indicates a robust rebound, breaking past the significant resistance area around $3,500. According to Fibonacci ratios, Ethereum has maintained its bullish momentum, consistently holding above the 50% level at approximately $3,604.

The surge in purchasing activity has pushed the 4-hour Relative Strength Index (RSI) above the overbought threshold. Additionally, the 50 and 200 Exponential Moving Averages (EMAs) on the 4-hour chart have formed a bullish crossover, which is often referred to as a “golden cross.

Therefore, technical indicators are becoming optimistic during this recovery trend and suggest a chance for buying. At present, Ethereum is being traded at $3,666, encountering an early resistance from the 61.80% Fibonacci level situated at $3,723.

If Ethereum’s bullish supporters find it tough to push prices above $3,700, there might be a temporary dip ahead. This could extend the ongoing price range, keeping the value within the Fibonacci levels of 50% and 61.80%.

If either important support or resistance levels are breached, it will significantly influence the direction of Ethereum’s price movement. A bullish breakthrough might lead to an attempt to surpass the prior peak at $4,109.

On the flip side, the crucial support remains at $3,500.

Major Ethereum Balance Holdings Rise to Almost $480 Billion

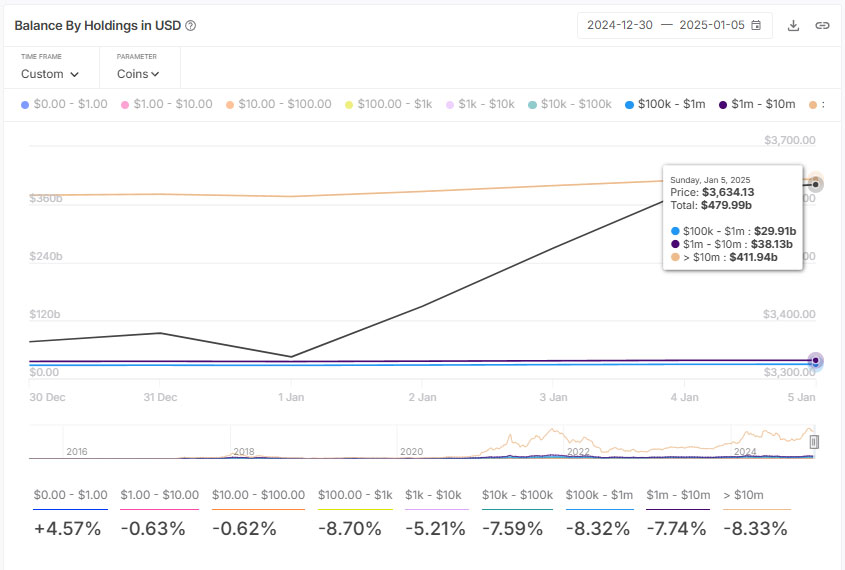

Over the last week, there’s been a significant increase in the amount of Ethereum held by large investors (whales). As of December 30th, the total balance held between $100,000 and over $10 million was approximately $442.67 billion USD.

The total amount has reached an impressive $479.99 billion, marking a substantial rise of approximately $37.32 billion. Notably, the significant change is observed in the investment category exceeding $10 million, which has gone up from $379.07 billion to $411.91 billion.

In the past week, the value in the price range of $100,000 to $1 million rose from approximately $27.81 billion to $29.91 billion. On the other hand, the price band between $1 million and $10 million has surged to around $38.13 billion, up from its previous value of about $35.79 billion a week ago.

Ethereum ETFs on a Rocky Road

Based on blockchain data, it appears that large investors are increasing their involvement, signaling a return of institutional backing for Ethereum ETFs. On January 3rd, specifically on Friday, the daily inflow of U.S. Ethereum spot ETFs amounted to approximately $58.79 million.

In summary, our weekly deposits ended with a loss of approximately $38.2 million, but overall, our current net assets have grown substantially to $13.03 billion – this is a notable rise compared to just $6.94 billion seen over the past two months.

Conclusion

The robust upward trend of Ethereum continues, as technical signals and blockchain data indicate growing investor assurance. A surge beyond $3,700 may point towards $4,109, while the $3,500 level serves as a protective cushion. Moreover, institutional investments and large-scale transactions add strength to the optimistic outlook for its recovery.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Brody Jenner Denies Getting Money From Kardashian Family

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

2025-01-06 13:25