As a seasoned crypto investor with a keen interest in Bitcoin, I find the recent analysis from Material Indicators both intriguing and thought-provoking. The insight into the manipulations of major stakeholders, or “whales,” is an essential piece of information that can significantly influence price movements.

As a researcher studying the dynamics of the Bitcoin market, I’ve noticed some intriguing trends emerging from the latest FireCharts 2.0 analysis. The actions of major players in the market, frequently referred to as “whales,” are showing up in a big way and influencing Bitcoin’s price fluctuations. These whales are making notable adjustments to liquidity patterns, hinting at an intentional effort to establish a more constricted trading band for Bitcoin.

What Bitcoin Whales Are Up To

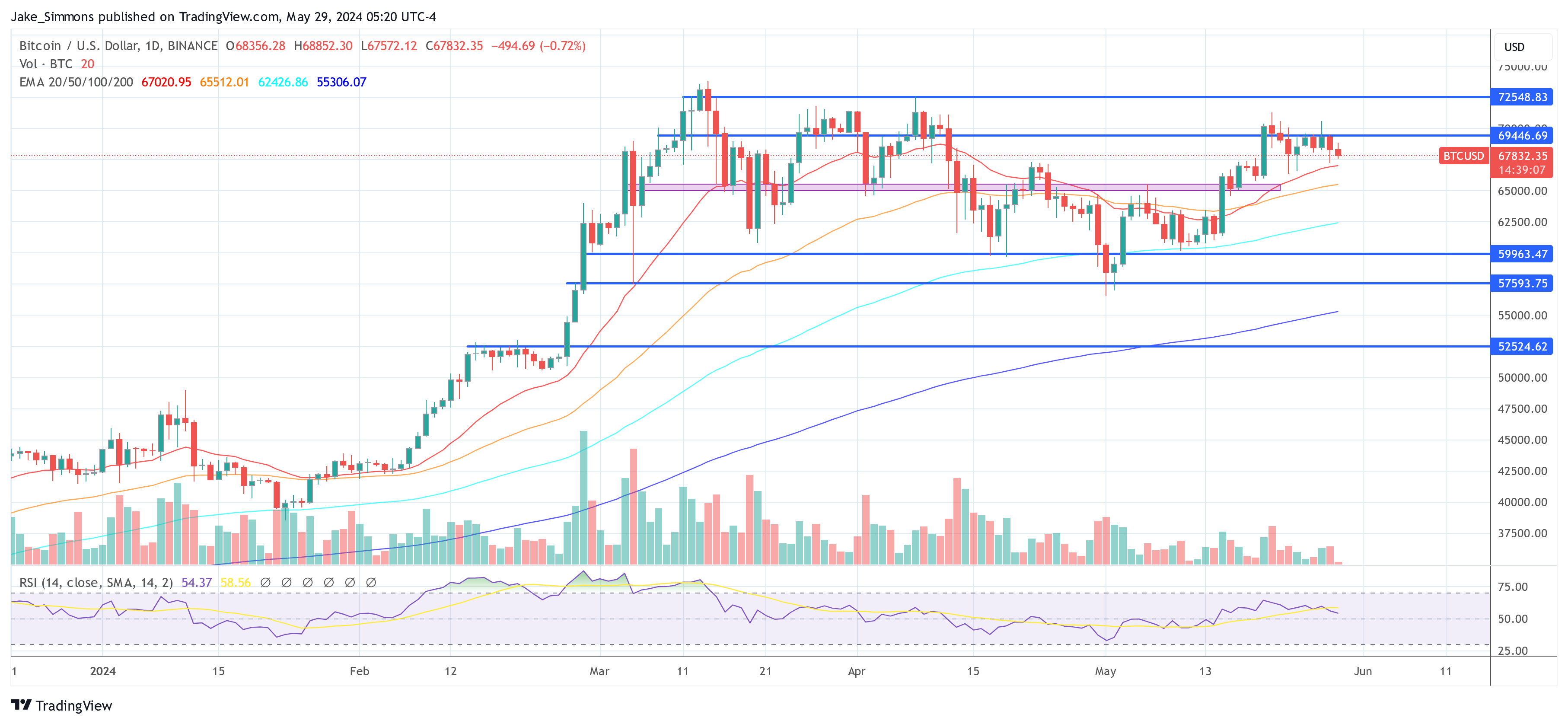

Based on Material Indicators’ analysis, a significant shift in Bitcoin’s order book liquidity distribution has occurred. Ask liquidity has diminished at higher price levels, while bid liquidity has grown between $60,000 and $67,000. This trend could potentially confine Bitcoin’s price movement within a narrower range, a possibility Material Indicators had forecasted once the digital asset surpassed $52,000.

Bitcoin’s price has sparked much debate regarding its potential ascent to hit $73,000. This speculation intensified after a significant bounce from a low of $52,000. Although Bitcoin reached a high of around $70,600, resulting in a sharp decline, there is still a cautiously optimistic outlook among investors. Material Indicators explained, “There has been considerable buzz since last week predicting a surge towards $73k, and there are valid reasons supporting this forecast as well as the possibility that it could still transpire despite Monday’s rejection at $70.6k.”

From a broad economic standpoint, Bitcoin’s future looks extremely promising. A representative from Material Indicators expressed this optimistically during a live broadcast, stating, “The viewpoint on Bitcoin is as bullish as it has ever been.” They chose not to go into detail but encouraged listeners to review the previous week’s analysis for further insights.

Instead of contrasting, let’s say that technical analysis provides a more intricate perspective. While the broader economic conditions appear promising, Bitcoin has repeatedly failed to reverse its previous resistance into support at $69,000 – a crucial level for signaling bullish energy. This ongoing failure represents the bulls’ efforts to sustain uptrend and achieve a new record high (ATH). By merging order book statistics with technical signals, analysts have detected a consistent shift in ask liquidity, moving from initial offers around $75,000-$76,000 to recent levels near $70,000-$71,500.

Moving forward, the crucial query is: how low can Bitcoin potentially drop before encountering significant buying interest? To shed light on this issue, the team at Material Indicators employs a mix of technical analysis and real-time order book information. The fact that Bitcoin’s 21-day, 50-day, and 100-day Moving Averages (MA) are converging around $65,000 to $66,000 provides a strong argument for possible support. Among these moving averages, the 21-day MA holds particular significance due to its past effectiveness as both resistance and support.

The order book information supports this assessment, revealing an increasing demand for ask prices above $70,000, while bids are strategically positioned as low as $58,000. The most significant concentrations of bid liquidity suggest robust support at $60,000 and $65,000, with moderate backing around $66,000 and $67,000.

In the long run, the market’s outlook is optimistic despite the intricate interplay of short-term factors. The crucial question for investors is not if but when a significant price surge will occur. Analysis of the order book reveals over $200 million in buy orders ranging from $71,000 to $75,000, contrasted with approximately $90 million in sell orders between $65,000 and $67,000. If ask offers do not decrease, the bid offers must substantially increase to instigate a lasting price rise above $70.

Based on my analysis of Material Indicators, the optimal outcome for Bitcoin involves establishing a strong consolidation zone above $65,000, confirming a Relative Strength Index (RSI) flip above $69,000, and maintaining a stable position above this level. This positive development would not only reinforce the bullish trend but also set the stage for continued upward momentum according to current order book trends and technical assessments. This trajectory represents the most advantageous market progression under existing conditions.

At press time, BTC traded at $67,832.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-05-29 12:40