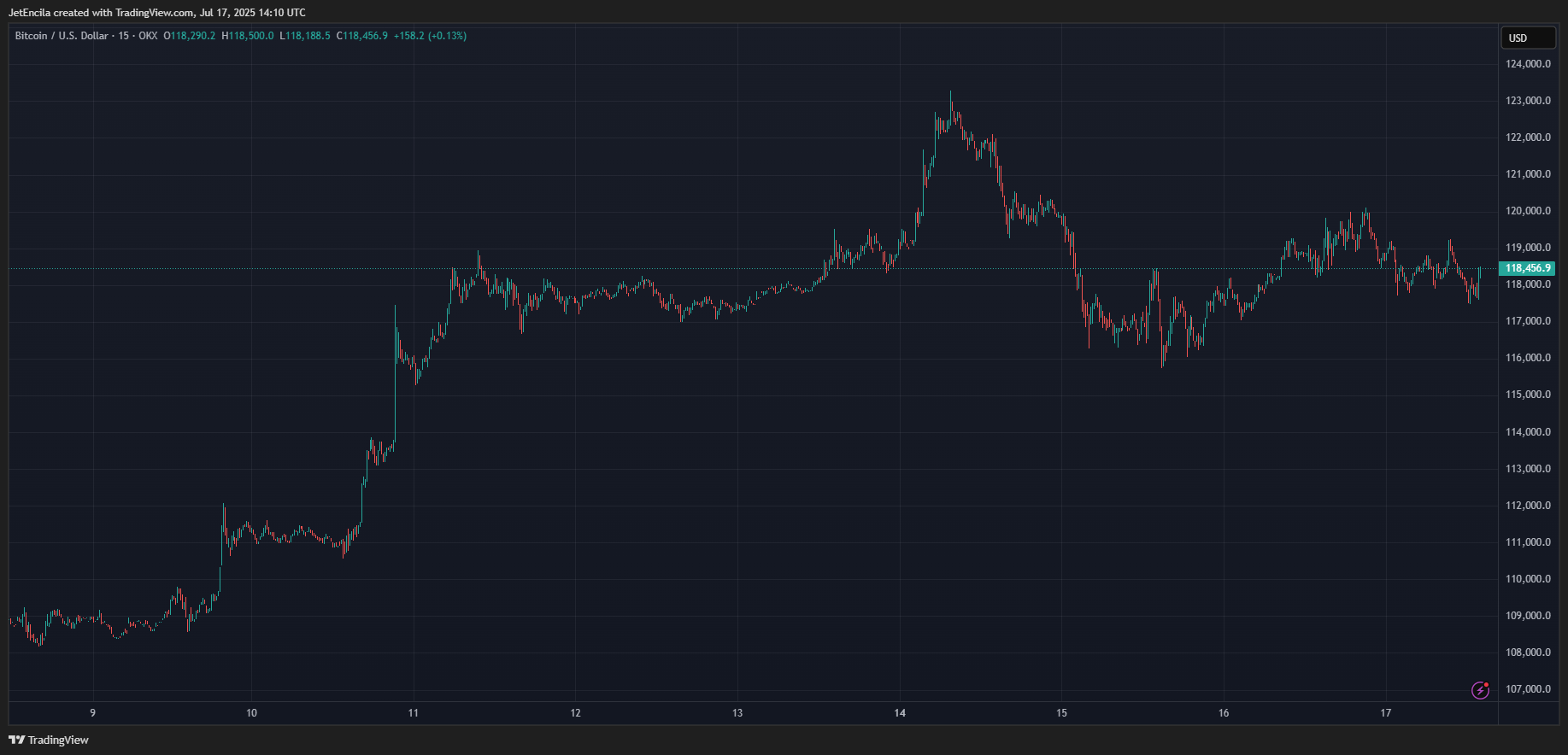

Bitcoin has been on a tear lately. Prices jumped past $123,000 this week. Now, new figures show that fresh money is flowing into the market again. That’s a sharp change after months of muted retail interest.

Fresh Capital Flooding In

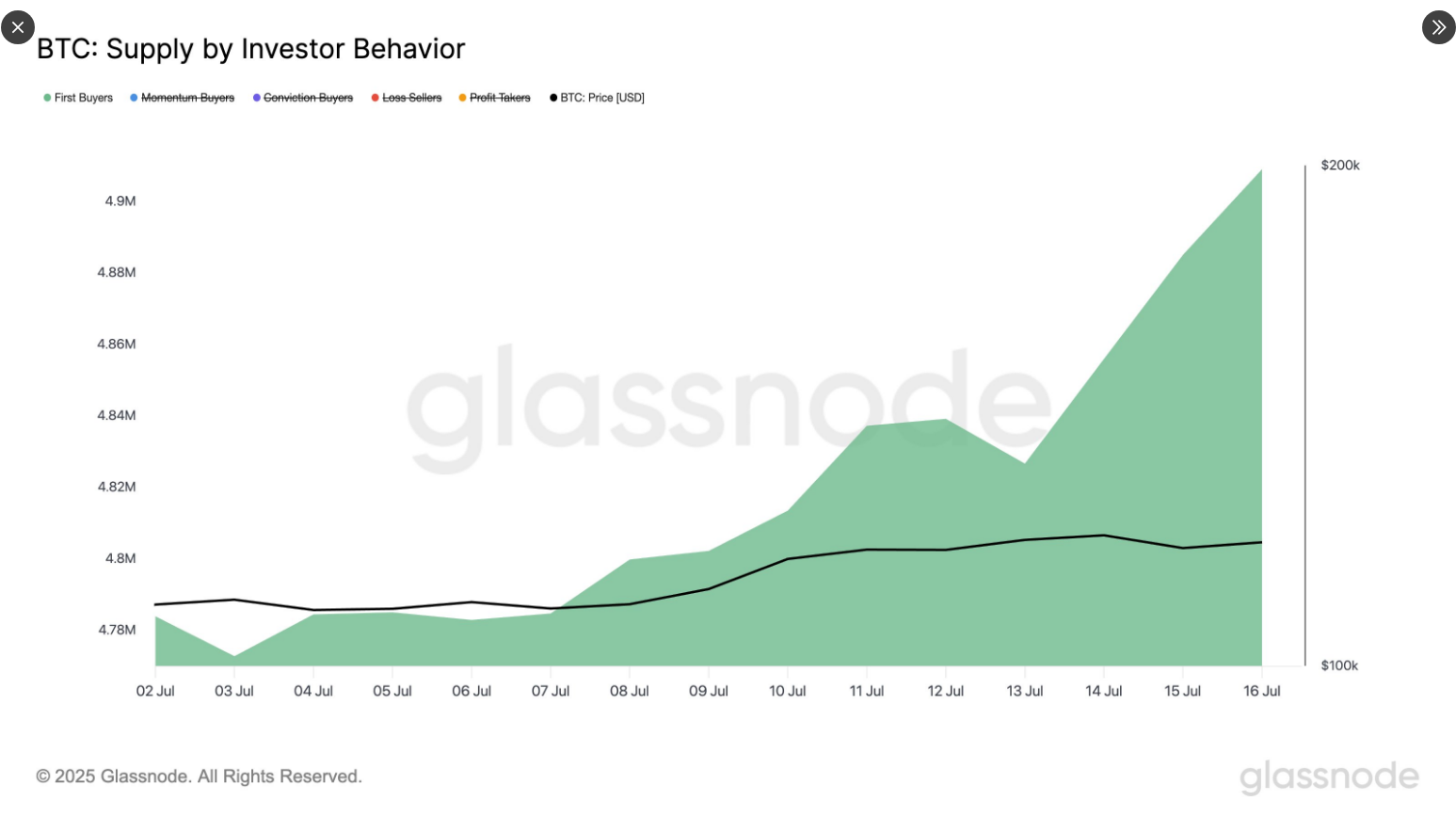

According to on‑chain data from Glassnode, first‑time buyers picked up an extra 140,000 BTC over the past two weeks. Their holdings climbed from 4.77 million to nearly 5 million BTC—a 2.86% rise.

That influx of fresh coins helped push Bitcoin past its latest high. It also shows that new investors are gaining confidence in the world’s biggest cryptocurrency.

Over the past two weeks, the supply held by first-time $BTC buyers rose by +2.86%, climbing from 4.77M to 4.91M #BTC. Fresh capital continues to enter the market, supporting the latest price breakout.

— glassnode (@glassnode) July 17, 2025

Short‑Term Holders Hit A New Cost Base

Newer players aren’t the only ones getting active. Based on reports, entities that bought Bitcoin within the last six months now sit on a cost basis above $100,000 for the first time.

They’ve held on through price swings and have not yet sold at a loss. That suggests many expect the rally to continue. At the same time, holding on tight could create pressure if prices dip below their average buy‑in point.

Dip Buyers Act Fast

Glassnode’s cost‑basis heatmap revealed that buyers moved quickly when Bitcoin dipped below $116,000 earlier this week. About 196,600 BTC changed hands between $116,000 and $118,000.

That buying spree added over $23 million in value near what looks like a local top. It’s a sign of strong resolve from those backing the market at lower levels.

While whales and newer buyers are busy, the crowd on Google seems less thrilled. Search activity for “Bitcoin” ticked up modestly in the last fortnight, but it’s well below the highs seen when BTC first broke $100,000 this year.

At the same time, data from Santiment indicate chatter has shifted toward altcoins. With Ethereum grabbing the spotlight, many retail investors appear more excited by tokens promising bigger short‑term moves.

Despite soaring prices, everyday investors haven’t jumped back in en masse. Based on reports, the broad public’s FOMO hasn’t shown up in a big way yet. That lack of widespread buzz could limit how far and how fast Bitcoin goes from here.

In past rallies, it was the flood of curiosity from casual buyers that turned spikes into parabolic runs.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2025-07-18 06:06