As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear runs. The recent surge in Ethereum prices, coupled with the six-week high whale activity, has caught my attention. While the projected growth is enticing, as a pragmatist, I am cautiously optimistic about Ethereum’s potential to reach $4,000 or even $6,000.

Experts anticipate that Ethereum‘s price might significantly rise due to growing interest among large investors (whales) in cryptocurrency assets, as whale involvement has recently reached its highest point in six weeks.

Despite the projected growth, an Ethereum insider suggested that the cryptocurrency should address several key issues to ensure that it can continue to flourish.

Ethereum: Projected Price Upsurge

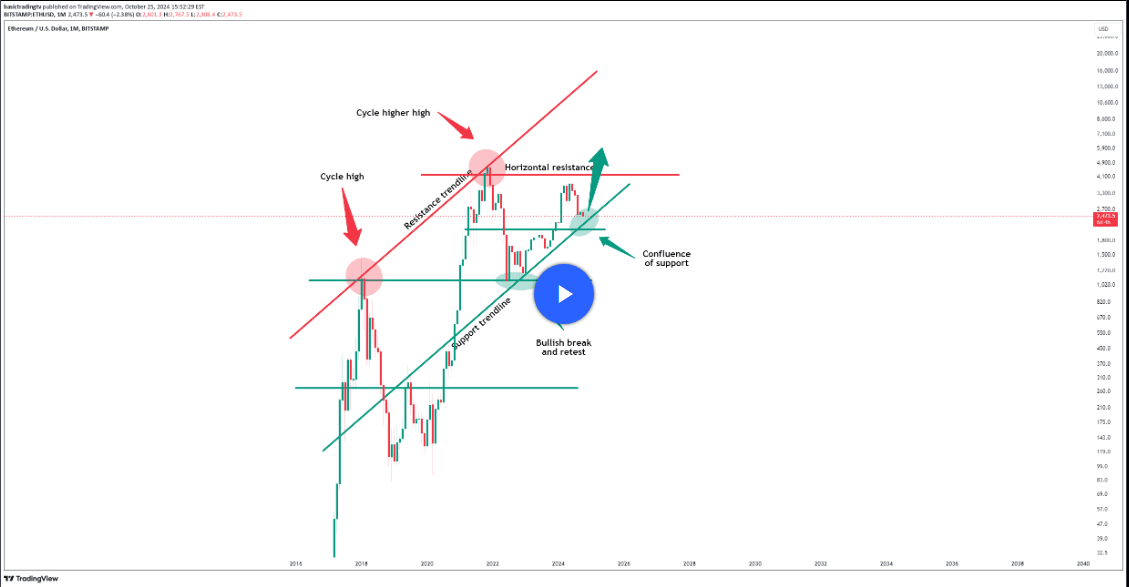

According to BasicTradingTV’s analyst, there’s a significant surge in investor interest towards Ethereum, leading them to predict a possible 60% increase in its price.

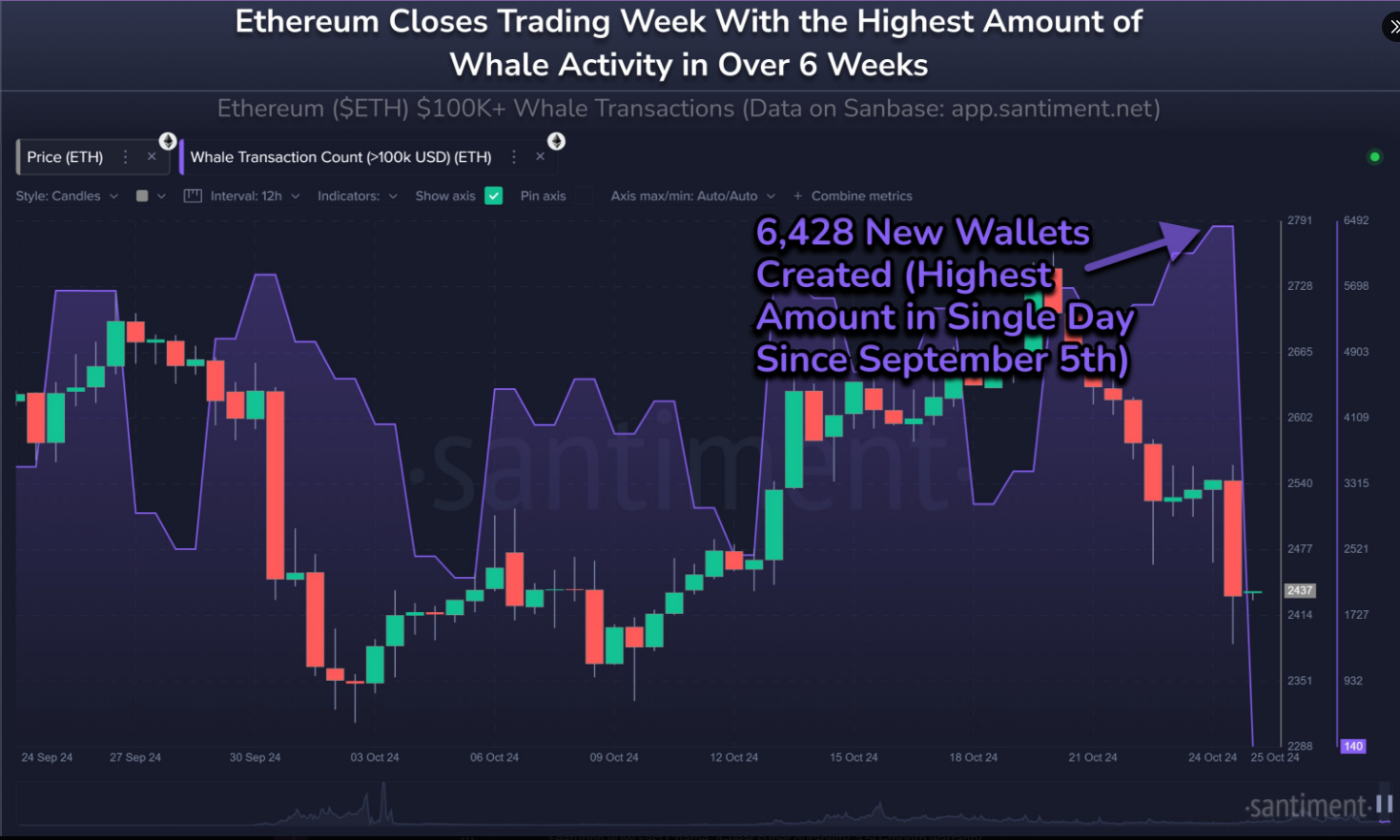

A blockchain data analysis company named Santiment noticed an increase in large-scale transactions, or “whale activity,” on the Ethereum network, hinting at possible increased buying activity.

Based on the latest information, there’s been a significant increase in whale activity – a six-week peak – as the typical investors have been purchasing Ethereum following a recent drop in its price.

Ethereum has seen increased activity by large investors (whales) recently, with levels not seen for six weeks, coinciding with a price drop to around $2,380 last Friday. This pattern typically indicates that substantial investors are amassing more of the cryptocurrency. While this doesn’t necessarily mean an immediate jump in prices, it certainly is promising!

— Santiment (@santimentfeed) October 26, 2024

Market experts’ predictions indicate a potential rise in Ethereum values, possibly reaching as high as $4,000, while some analysts anticipate it could potentially surpass $6,000.

The increase in Ethereum’s price might be driven by its rising popularity among large investors, as indicated by a surge in whale activity over the past six weeks, resulting in over 6,400 newly created wallets by these big players.

According to Basictradingtv, Ethereum prices might surge up to $4,000. Yet, he suggested that such a bullish surge could be canceled if the Ethereum price were to drop to $2,000. He emphasized that this $2,000 region is an important marker to watch closely.

Recalibrating Protocol For Growth

In a recent post, Ethereum’s co-creator Vitalik Buterin noted that there are several challenges Ethereum must overcome to remain competitive and adaptable within the rapidly changing cryptocurrency marketplace.

Vitalik Buterin pointed out one challenge is to streamline Ethereum’s protocol for ongoing development, stating that the current complexity of the coin’s protocol poses a threat to its credibility and safety. He suggested that making the protocol less complex might aid in resolving this problem.

He explained that Ethereum has already implemented changes in the past, citing the removal of the SELFDESTRUCT opcode as an example. The SELFDESTRUCT opcode was known to complicate interactions among users and posed potential security risks.

Yet, Buterin advised that any elimination of these features should be done methodically, allowing developers to observe the effects of their actions prior to making any adjustments.

Solving The Storage Problem

A significant concern brought forth by Buterin revolves around the storage challenges encountered within the realm of cryptocurrencies.

According to Buterin, Ethereum requires a minimum of 1.1 terabytes of storage space to accommodate its vast amount of historical data.

He suggested the implementation of “cryptographic proofs of the state”, adding that this solution will allow nodes to retain only a fragment of the histories.

He mentioned that this method operates similarly to a torrent system, where each node stores fragments of data that overlap between one node and the next.

As I pen down these words, Ethereum is currently exchanging hands at approximately $2,470, marking a 2.84% decline over the past 24 hours. Contrastingly, Ethereum’s trading volume has experienced a significant surge, increasing by more than 30% to a staggering nearly $22 billion within just one day.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-10-28 00:05