As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by this recent whale bet on AAVE. The sheer magnitude of the position taken by this investor signals a strong conviction in the potential for price appreciation.

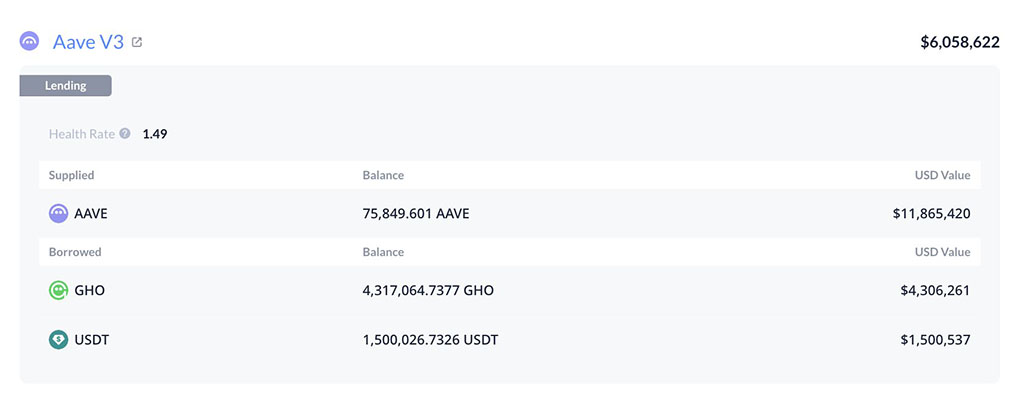

A significant investor has exploited the midweek market dip to amass a colossal long position in AAVE, as reported by blockchain analytics firm Lookonchain. By borrowing approximately $1.5 million, this investor purchased over 9,000 units of AAVE, boosting their portfolio to an impressive 75,400 AAVE tokens, currently valued at around $11.57 million. This expansion has been ongoing since October.

Source: LookOnChain

Placing large wagers on whales implies strong optimism about price increase soon. However, it’s important to consider the risk-reward balance, and whether the current Aave valuation presents a favorable opportunity for investors who are bullish.

Is AAVE Cheap or Expensive?

Currently, AAVE appears underpriced based on its 30-day Market Value to Realized Value (MVRV) ratio. This MVRV ratio measures an asset’s current price against the average purchase cost of each token held. A surge in this ratio signifies significant unrealized gains and suggests a possible opportunity for realizing profits, which could slow down price growth.

Source: Santiment

To put it simply, a higher MVRV value implies that an asset might be overpriced, whereas a lower or negative MVRV indicates a potential bargain. At the moment, the 30-day MVRV for AAVE stands at -4%, suggesting it could be considered relatively inexpensive and potentially worth purchasing at its current price.

At this point in time, when we’re looking at the latest updates, it seems that significant long positions on AAVE by major traders on the Binance exchange, particularly in the perpetual markets, have yet to be established.

Source: Hyblock

On U.S. election day, just like other players in the market, the whales increased their holdings. However, shortly following Donald Trump’s win, they reduced their involvement. This shift was highlighted by the Whale vs. Retail Delta indicator.

If significant investors decide to buy at around $160 or the historical Q4 support level of $120, a robust comeback in AAVE’s price is quite plausible.

Source: AAVE/USDT, TradingView

In the price charts, a dip presented a strong chance for swing traders to enter the market, particularly if the market recuperates over the next few days. Interestingly, the price has fallen to a significant intersection point ($160) where a moving average and resistance level (highlighted in cyan) meet.

Additionally, the region between $125 and $135 (indicated in white) serves as a significant support area and a potential location for a substantial market recovery for AAVE. Thus, investors might want to keep an eye on levels around $160 and $125 for potential entry points, with bullish objectives immediately set at $180 and $200.

Essentially, AAVE appeared to be underpriced and presented an excellent investment opportunity at its current cost. Yet, if Bitcoin‘s declines escalate over the coming days or weeks, the optimistic forecast could potentially prove incorrect.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-15 15:24