Ah, the whimsical world of cryptocurrency, where fortunes are made and lost faster than a magician’s rabbit can disappear! In this latest act of financial theater, we find Uniswap, the once-mighty exchange, bleeding a staggering 20% in a single week. And who do we have to thank for this delightful debacle? A whale, of course! 🐋

Yes, dear reader, while Uniswap was busy counting its dwindling tokens, Kraken was rubbing its hands in glee. A colossal investor, perhaps feeling a tad too heavy with their UNI tokens, decided to offload a whopping 2.25 million of them to Kraken. Analysts, with their crystal balls, speculate this was a desperate attempt to staunch the bleeding. After all, who wouldn’t want to cut their losses like a chef slicing through a particularly stubborn piece of meat? 🍖

Uniswap’s Downward Spiral

As the dust settled, it became clear that UNI, the native token of Uniswap, had taken a nosedive of 20%—a drop so steep it could rival a rollercoaster ride! 🎢 In the last 24 hours alone, it plummeted by 2.80%, landing at a rather sad $5.80 on Wednesday. One can almost hear the collective gasp of investors echoing through the digital ether.

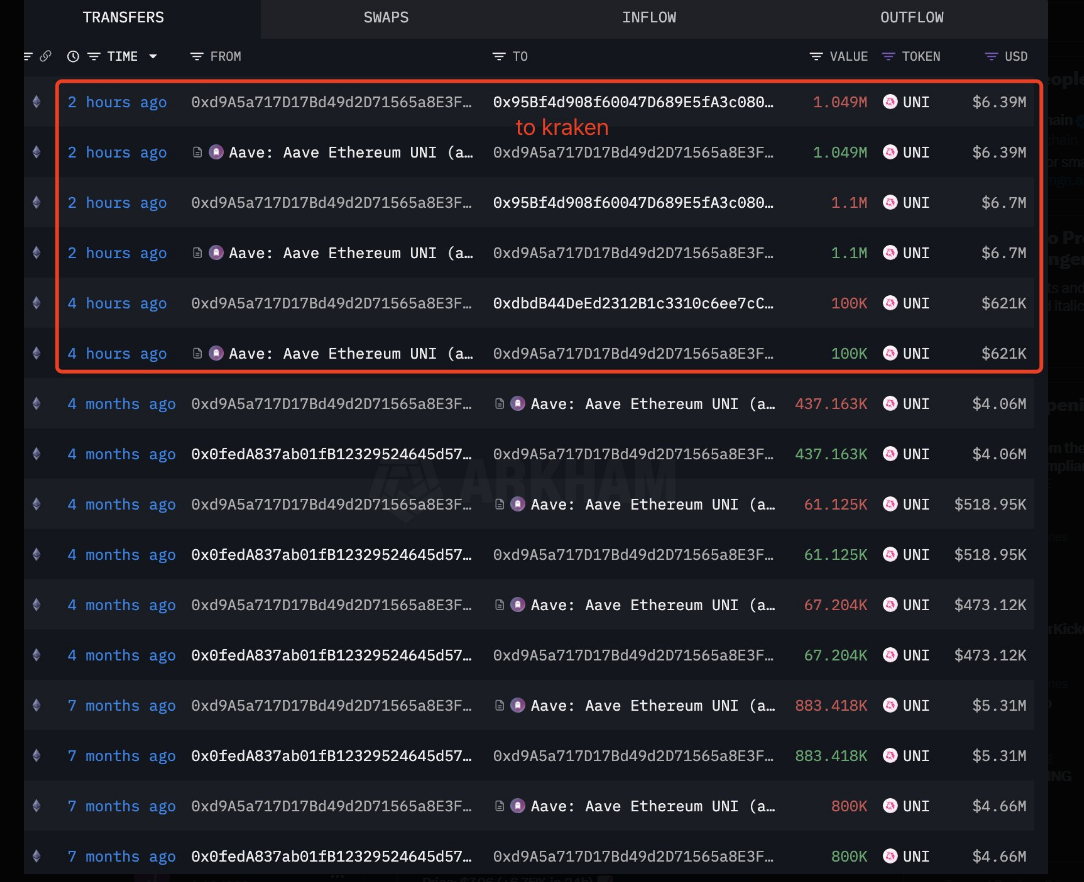

According to our ever-watchful crypto analysts, this unfortunate turn of events can be traced back to our whale friend, who decided to lighten their load and transfer a hefty chunk of UNI tokens to another exchange. “A whale deposited all 2.25M $UNI ($13.71M) to #Kraken 2 hours ago,” chirped Lookonchain, as if announcing the latest celebrity gossip.

A whale deposited all 2.25M $UNI ($13.71M) to #Kraken 2 hours ago, likely to cut losses.

The whale accumulated 2.25M $UNI ($15.57M) at an average price of $6.92 between Sept 7, 2023, and Nov 18, 2024.

At its peak, the whale had an unrealized profit of $26.5M but is now down…

— Lookonchain (@lookonchain) March 12, 2025

‘Cutting Losses’—A Whale’s Tale

In a post that could rival the best of soap operas, Lookonchain speculated that our whale was simply trying to “cut losses” after watching their once-bountiful unrealized gains evaporate like morning mist. 🌫️

“The whale accumulated 2.25M $UNI ($15.57M) at an average price of $6.92 between Sept. 7, 2023, and Nov. 18, 2024,” Lookonchain shared, as if revealing a family secret. At one point, this whale was swimming in a sea of profits, but alas, the tides have turned, and now they’re left with a mere $1.86 million in unrealized earnings. No wonder they decided to make a beeline for Kraken!

Bearish Signals Galore!

Meanwhile, another crypto analyst, perhaps channeling their inner Nostradamus, observed that the indicators were painting a rather gloomy picture for Uniswap. Santiment, the oracle of on-chain metrics, reported a surge in the Exchange Flow balance, jumping from -428,920 to 2.23 million in just two days. Talk about a dramatic plot twist! 📈

This metric, which tracks the net movement of tokens into and out of exchange wallets, suggested a potential surge in selling pressure. It seems many tokens are being ushered into exchange wallets like guests at a particularly chaotic party. 🎉

Another metric, the Supply on Exchanges, revealed a 2.67% increase in the last 24 hours, reinforcing the notion that traders are offloading their UNI holdings faster than a hot potato. Previous data suggests that such trends usually lead to further declines in token prices. Oh, the irony!

As if that weren’t enough, market observers delved into UNI’s technical

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2025-03-14 18:45