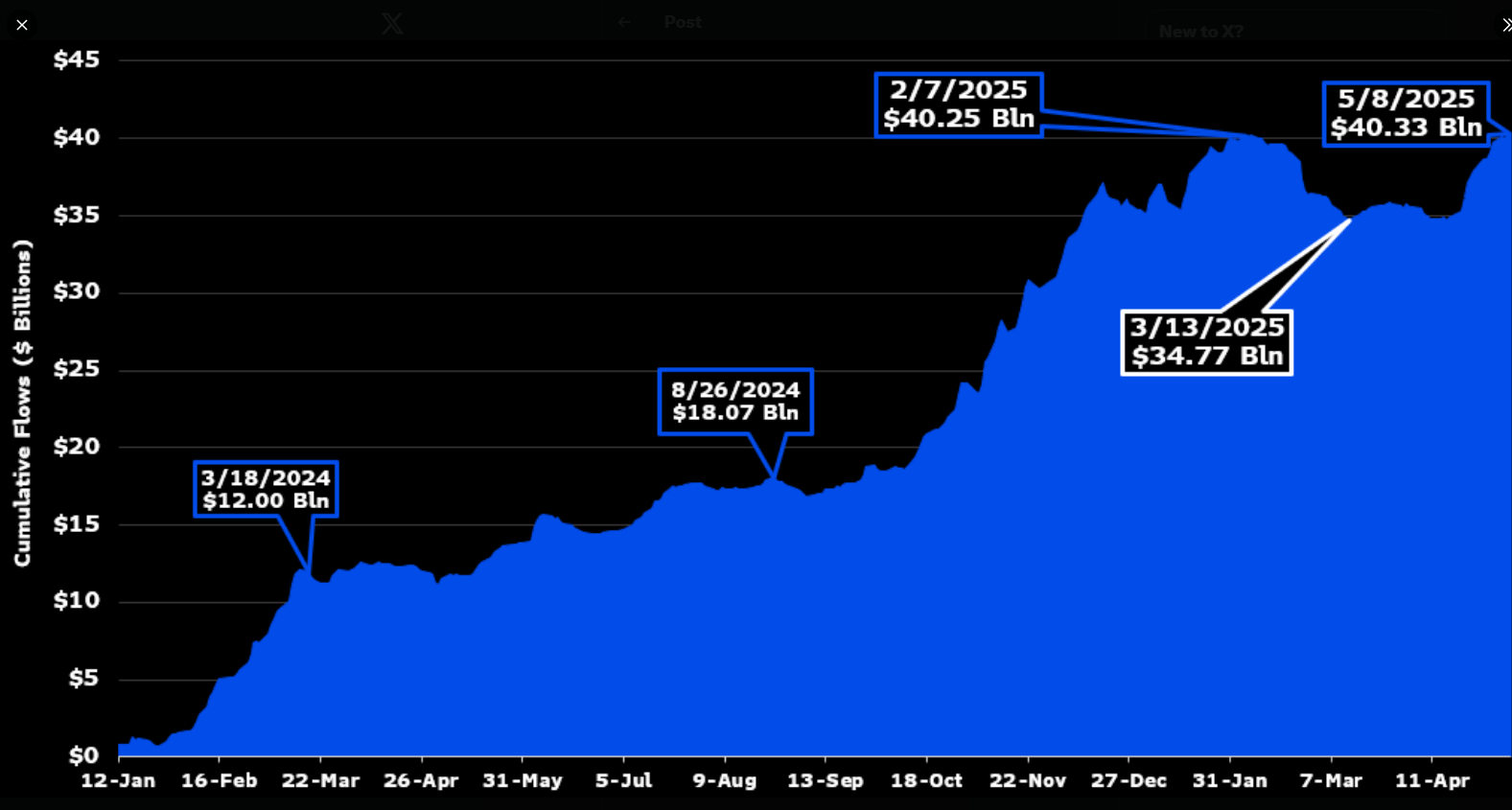

They say money talks, but lately it just laughs—a graveyard laugh, echoing down the marble halls of finance. Bloomberg’s prophet, James Seyffart, with the weary certainty of a stevedore counting coal, announces: spot Bitcoin ETFs, that latest invention for rich and poor alike to chase elusive digital gold, have drunk in over $40 billion. Yes, May 8, 2025—don’t forget the date—the world’s savers, clutching their future as if it were a ticket to the Bolshoi, hurled their coins into this abyss. Some call it confidence. Others call it a refusal to learn from history. Tomato, tomato, comrade.

Spot ETF Inflows Hit New High (It Wasn’t Even a Monday)

Who could blame them? $40.33 billion, they say—a day of new records, as if fortune herself took a cigarette break and left her register open. These Bitcoin ETFs, sturdy as a peasant’s wheelbarrow, keep filling up while prices wobble about like half-drunk poets. The money comes in, steady, unfazed by the storm. If only bread queues moved this quickly.

“After yesterday’s inflows, the spot Bitcoin ETFs are now at a new high water mark for lifetime flows. Currently at $40.33 billion.”

— James Seyffart (@JSeyff) May 9, 2025

😮🏦

Growth Since Launch: Baby’s First Billion

Remember March 2024? Back then, lifetimes inflows were a modest $12 billion, which barely bought you a politician’s yacht. By August—perhaps the hottest month since the revolution—it swelled to $18 billion. Capital finds its way into any crack, like the winter wind in a broken tenement. Come March 2025, the pot stood at $35 billion—by May, $40 billion. Yes, the world’s appetite for “no-frills” Bitcoin exposure has all the subtlety of a dockworker at a banquet. Still, at least ETFs don’t come with ransomware. Yet.

Institutional Investors Find a New Soup Kitchen

If you thought ETFs were for warm milk drinkers, think again. Now it’s the trench coat crowd—hedge funds, asset managers—elbowing their way in, happy to hand off risk to paperwork and fluorescent lighting. Analysts grumble about “hedging” and “regulation,” as if these iron gates ever kept an honest man out. Maybe, just maybe, this turns Bitcoin into a respectable asset—if you call anything respectable that you can lose in a boating accident.

Fans Cheer, Critics Nap

Twitter burns bright: “Bitcoin is dominating,” shouts one. Many love the thrill of buying digital assets with all the government bells and whistles. A few mutter about price slowdowns, but no real panic—yet. $40 billion is a nice round number, the sort you paint on a barn door, though Bitcoin itself is passed around by miners and traders faster than a bottle at a midnight wake.

The future? Eyes will watch the ETFs like hungry wolves eyeing the last bakery in town. Should more cash stumble in, believers will toast “confidence!” If not, maybe some will rediscover the humble joys of holding their own keys—or grow nostalgic for mattresses stuffed with cash. Ah, the endless farce of finance.🐾💰😏

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-05-11 03:16