Over the last several weeks, the surging price of Bitcoin has lost steam, raising doubts about the continuation of its bullish trend. On April 12, there was a sudden market downturn that led Bitcoin’s value to plummet from around $70,000 to below $67,000.

The current drop in Bitcoin’s price serves as a reminder of its difficulty to reach its previous record high of $73,737, achieved in mid-March. According to the analytics company Santiment, there is a specific Bitcoin indicator that could indicate the start of another bull market.

Bitcoin Bull Run May Resume If This Metric Falls

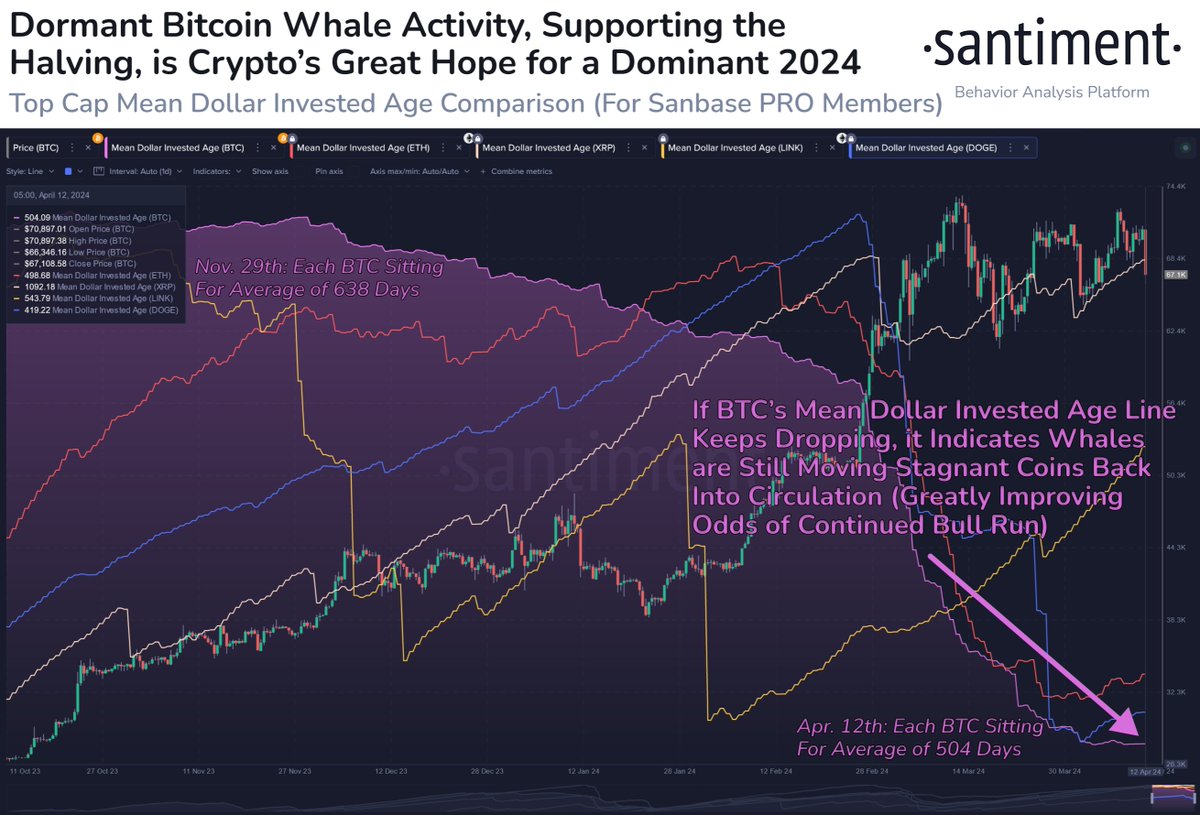

Santiment, a well-known blockchain analytics company, recently shared some intriguing information about Bitcoin’s current cycle and pricing trends in a blog post. They identified the Mean Dollar Invested Age metric as an important factor to keep an eye on while Bitcoin hovers around the sideways trend.

Based on Santiment’s analysis, the Mean Dollar Invested Age metric signifies the typical age of an investment in a specific asset that remains in the same digital wallet. An increasing Mean Dollar Invested Age suggests that investments are becoming less active and older coins are being kept in the same wallets for longer periods.

In other words, when the Mean Dollar Invested Age metric is declining, it means that older investments are being sold and reinvested more frequently. This trend indicates a heightened level of activity within the investment network.

Looking back historically, Bitcoin’s Average Dollar Age (the amount of time each dollar spent in the Bitcoin market) has been declining during past bull markets. Based on Santiment’s analysis, this trend has continued in the ongoing bull run that began in late October 2023.

Over the last few weeks, Bitcoin’s Mean Dollar Invested Age trend on the on-chain analytics platform has remained stable. Surprisingly, this occurs just days before the much-awaited halving event.

The Bitcoin reward for miners will be reduced by half during the halving, from 6.25 BTC to 3.125 BTC. This event is generally viewed positively by investors and is a significant reason for their bullish sentiment towards Bitcoin in the year 2024.

Based on Santiment’s most recent analysis, it could be worthwhile for investors to monitor Bitcoin’s Mean Dollar Invested Age metric. A potential bull market may persist if the BTC‘s Mean Dollar Invested Age trend descends once more, signaling that significant investors (such as whales) are re-entering the market by transferring their coins.

BTC Price At A Glance

At present, Bitcoin is approximatedly priced at $66,548, representing a significant 6% decrease in value over the previous 24-hour period.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- What Happened to Kyle Pitts? NFL Injury Update

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-04-13 14:10