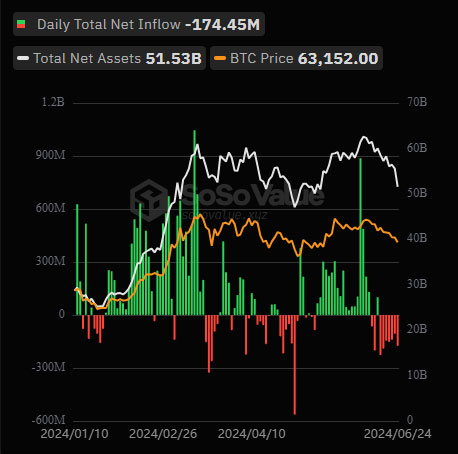

As a researcher with experience in the cryptocurrency market, I’ve witnessed firsthand the volatile nature of Bitcoin and its associated investment vehicles, such as Spot Bitcoin ETFs. The recent wave of investor pessimism towards these funds, with combined net outflows of $174.45 million on June 24, 2024, is a cause for concern.

Investor pessimism towards US-listed Bitcoin ETFs is on the rise, with a total net withdrawal of $174.45 million recorded on June 24, 2024. This marks the seventh consecutive day of negative inflows, suggesting waning confidence in Bitcoin’s short-term prospects as the world’s leading cryptocurrency.

Photo: SoSoValue

Grayscale Fund Leads Outflow Movement

As a researcher studying the trends in the Grayscale Bitcoin Trust (GBTC) industry, I’ve observed that GBTC led the way in significant outflows, with a loss of approximately $90 million on a particular day. Fidelity’s Bitcoin Index Fund (FBTC) followed closely, recording net outflows totaling around $35 million on the same day. This outflow trend continued to affect other major players, including Franklin Templeton’s EZBC, which experienced its first net outflow since May 2nd, amounting to roughly $20.8 million.

As a crypto investor, I’ve noticed some recent developments in the flow of funds from various cryptocurrency investment products. VanEck’s HODL ETF saw a withdrawal of approximately $10 million. Bitwise’s BITWIT ETF and Ark Invest/21Shares’ ARK Crypto Innovation ETF experienced outflows to the tune of $8 million and $7 million, respectively. Even Invesco’s QQQQ and Galaxy Digital’s Bitcoin Access Active ETF reported net outflows totaling around $2 million.

It’s intriguing that BlackRock’s IBIT, the largest Bitcoin Spot ETF by net assets, achieved a balanced position on June 25th with no inflows or outflows. Meanwhile, Valkyrie, WisdomTree, and Hashdex funds remained unchanged, neither reporting positive nor negative inflows.

Bitcoin Price Drop Influences ETFs

The recent departure of Spot Bitcoin ETFs can be attributed to bitcoin’s significant price decrease. On Monday, bitcoin experienced its lowest point in nearly six weeks, momentarily dipping beneath the crucial $60,000 threshold. At present, Bitcoin (BTC) is priced at $60,719 on CoinMarketCap, representing a 3.36% decrease over the past 24 hours.

Experts opine that the recent price drop is likely due to the shocking announcement made by Mt. Gox, the notorious cryptocurrency exchange, which filed for bankruptcy in 2014 following a string of devastating hacks. On Monday, Mt. Gox revealed its intention to distribute approximately $9 billion in bitcoin and bitcoin cash reimbursements to affected creditors, with disbursements set to commence in July.

The announcement sparked a “typical panic-selling situation” according to Coinspeaker’s report, with investors worried about an oversupply in the market that might result in even lower prices.

The unstable price of Bitcoin and the substantial withdrawals from Spot Bitcoin ETFs add an element of uncertainty to the ongoing Mt. Gox repayments. It is yet to be determined how these developments will influence Bitcoin’s price trend. Investor behavior – whether they choose to re-enter the market or remain cautious – will play a significant role in shaping the market dynamics.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-25 13:33