As a seasoned crypto investor with a decade of experience under my belt, witnessing the meteoric rise and transformation of US Spot Bitcoin ETFs has been nothing short of astonishing. I remember the early days when Satoshi Nakamoto was the largest holder of BTC, a figure that seemed untouchable at the time. But here we are, with these ETFs surpassing even the elusive creator himself!

The introduction of U.S. Spot Bitcoin Exchange-Traded Funds (ETFs) has brought about substantial changes not only in Bitcoin but also across the entire crypto sector. Since their debut in January 2024, these ETFs have experienced exponential growth in value and holdings, setting new records in traditional finance by outperforming other ETFs.

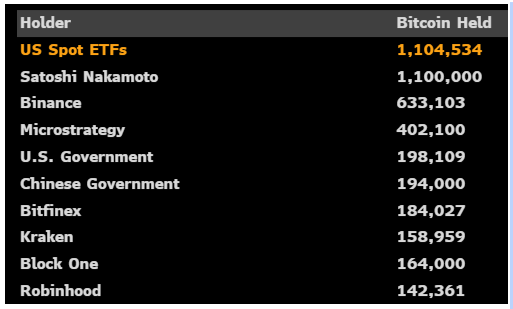

Currently, United States Spot Bitcoin Exchange-Traded Funds (ETFs) now control more Bitcoin than Satoshi Nakamoto, the mysterious inventor of Bitcoin.

A Historic Milestone For Bitcoin ETFs

12 U.S. providers offering Spot Bitcoin ETFs have hit a significant achievement, amassing the largest quantity of Bitcoin among all holders. In total, they control approximately 5.62% of the entire Bitcoin market value, holding about 1,104,534 BTC. This surpasses Satoshi Nakamoto’s original stash of 1,100,000 BTC, which has remained unchanged since his departure from the scene. It is important to note that these 1,100,000 BTC, mined during Bitcoin’s early days, have been static for over ten years.

The impressive rise in the price of U.S. Spot Bitcoin Exchange Traded Funds (ETFs) can be attributed to a series of steady investments, which have been instrumental in pushing its value above the significant $100,000 psychological level. According to SosoValue’s latest findings, these U.S. Spot BTC ETFs have experienced seven consecutive days of investment inflows, with the largest influx amounting to approximately $376.59 million on December 6.

It’s worth noting that the recent pattern of inflows into US Spot Bitcoin ETFs isn’t just limited to the last week, but has been ongoing for about 40 trading days. On 32 out of these 40 days, there have been inflows, indicating a persistent surge in investor interest. As a result, the value of these ETFs, currently standing at $112.74 billion, has increased substantially due to these consistent inflows. This is based on the current price of the digital currency.

Implications Of Growing ETF Dominance

The expansion of Spot Bitcoin ETFs as major Bitcoin owners indicates a maturing market, signifying a change in the attractiveness of cryptocurrency towards institutional investors. With institutional participation on the rise, these ETFs provide a regulated avenue for investors to access the crypto market without actually owning the digital currency. Consequently, some market observers propose that Bitcoin could be evolving into an asset primarily held by institutions rather than individual retail investors.

Regardless, the surge in Spot ETFs isn’t expected to slow down any time soon. In fact, experts predict that the inflow will continue to grow as more people adopt these funds and they gain approval in significant markets such as Europe. However, this trend also brings up concerns about market control and consolidation of cryptocurrency holdings.

It’s worth noting that a significant number of long-term Bitcoin owners who keep their coins in personal custody are moving their assets into Bitcoin spot ETFs, presumably for the benefits of regulatory transparency they offer.

Currently, as I’m typing this, Bitcoin’s price stands at approximately $99,650, aiming for a significant surge beyond the $100,000 mark.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Gold Rate Forecast

2024-12-07 23:10