Focusing on Bitcoin (BTC), it continues to grab the spotlight and worry among investors, particularly after the recent nonfarm payrolls report from the U.S. Bureau of Labor Statistics (BLS). The overall market vibe remains optimistic, but recent economic changes in the United States suggest that larger economic factors could work against Bitcoin by 2025.

At the moment, Bitcoin is being traded at around $94,000, reflecting another volatile period that resulted in a 3.45% drop over the last week.

Fed’s Pivot To Rate Cuts Is Dead – Analysts

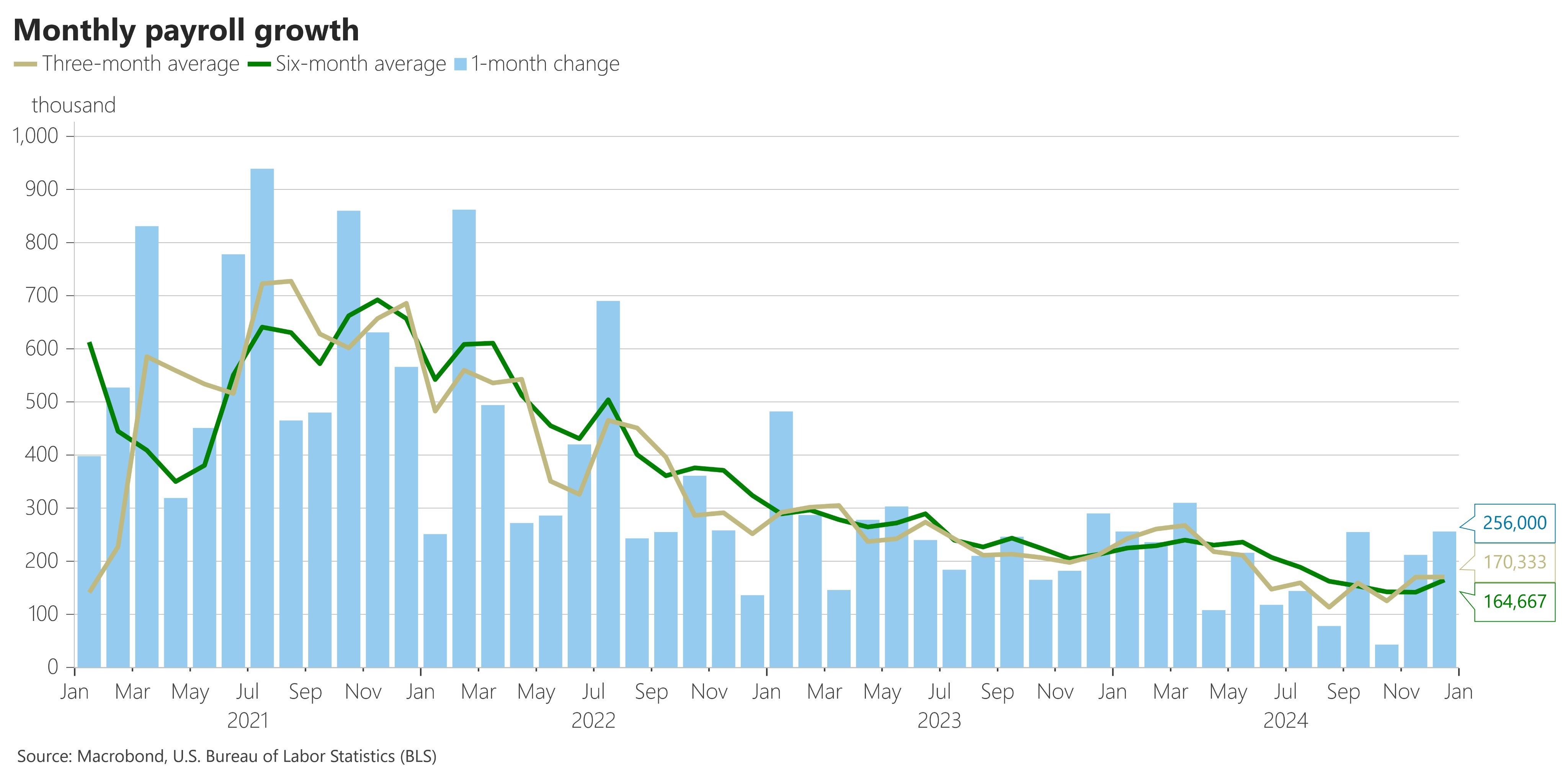

On December 10th, a post from The Kobeissi Letter, a renowned global capital market analysis firm, delved into the employment situation summary for December 2024. As per the Bureau of Labor Statistics (BLS), there was an increase in nonfarm payroll jobs by 256,000 this month. This figure exceeds the generally anticipated numbers by an additional 100,000 jobs.

According to a recent analysis by The Kobeissi Letter team, the U.S. job market has seen an impressive average growth of approximately 165,000 jobs per month over the past six months, marking the highest such period since July 2024.

In response to the U.S. Federal Reserve starting to reduce interest rates from September 2024 due to decreasing job growth and inflation, analysts at The Kobeissi Letter suggest that the Fed’s strategy might not be well-aligned with current events.

Thus, it’s anticipated that the Federal Reserve will pause its interest rate decreases to combat predicted increased inflation caused by robust job market data. They might also consider raising rates.

Typically, when there’s no reduction in interest rates or an increase (hike) is announced, it tends to be unfavorable for Bitcoin because lower interest rates give investors more room to invest in riskier assets like cryptocurrencies. For instance, after the Federal Reserve hinted at potential smaller rate cuts in 2025, Bitcoin experienced a sudden drop of over 9% around mid-December as investors chose to exit their volatile positions across all financial markets.

As per the Kobeissi Letter’s prediction, it appears that the Federal Reserve’s shift towards rate reductions might have already concluded, as there is approximately a 44% chance of no further rate cuts being implemented until June 2025.

Bitcoin Price Overview

Currently, Bitcoin is being exchanged for approximately $94,028 per unit, marking a 0.22% increase over the previous 24 hours. On the other hand, it has experienced a decrease of 3.72% in the last week and 6.35% over the past month.

In spite of speculations about less frequent interest rate reductions in 2025, Bitcoin enthusiasts are expected to maintain optimistic views, as factors such as past price growth during a bull market, a presumed crypto-friendly U.S. administration, and ongoing institutional investment through spot ETFs come into play.

Currently standing as the biggest digital currency, Bitcoin boasts a market value of approximately $1.84 trillion, making it the eighth most valuable asset globally.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-12 08:10