As a seasoned crypto investor with a keen interest in market trends and analysis, I find Ki Young Ju’s prediction of a prolonged bullish phase for Bitcoin through April 2025 highly compelling. The rapid growth of Bitcoin’s market capitalization relative to its realized capitalization is a classic indicator of a strong bull cycle that has historically signaled extended upward momentum.

Based on the analysis of Ki Young Ju, the CEO of CryptoQuant, the present market conditions for Bitcoin indicate a potentially lengthy bullish trend that may continue until April 2025.

Ju’s assessment emerges during Bitcoin’s present price increase, seemingly an extension of the uptrend initiated in March. This surge reached unprecedented heights as Bitcoin broke through its previous record of $73,000 for the very first time.

Bitcoin Market Cap Growth Indicates Prolonged Uptrend, Says CryptoQuant CEO

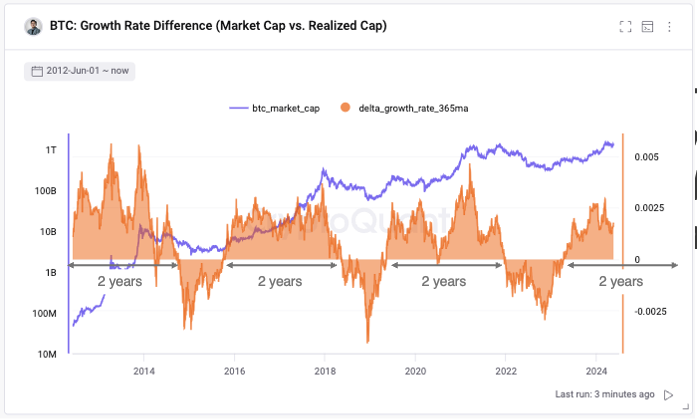

Significantly, Ki Young Ju’s forecast is based on Bitcoin’s market capitalization expansion, which has surpassed its realized capitalization – representing the total cost basis for all transactions in the market.

This trend serves as a time-tested sign of a robust bull market, consistently foreshadowing prolonged price growth in historical market trends.

Based on his examination, it appears that the swift expansion of the market capitalization, relative to the actualized capitalization, indicates growing investor trust and market dynamism.

As a researcher studying historical market trends, I’ve observed that this particular pattern has consistently indicated extended periods of bullishness for Bitcoin. Should current tendencies remain unchanged, I anticipate this cycle to carry on, resulting in substantial price growth for Bitcoin over the ensuing 18 months.

#Bitcoin is in the middle of the bull cycle.

The market capitalization of the company is expanding at a faster pace than its current valuation based on earnings, which is a trend that usually persists for approximately two years.

If this pattern continues, the bull cycle might end by April 2025.

— Ki Young Ju (@ki_young_ju) May 17, 2024

I’ve noticed an upward trajectory in Bitcoin’s price lately. Over the last day, its value has risen by approximately 1.9%. Moreover, in the previous two weeks, there has been a significant surge of over 12%. Currently, I see Bitcoin being traded near the $67,201 mark.

Institutional Adoption And Market Sentiments Underpin Bullish Outlook

From a hopeful perspective, the bright future of Bitcoin isn’t solely reliant on past patterns and market value assessments. New institutional endorsements add substantial weight to this promising trend.

I’ve come across some intriguing news lately. Anthony Scaramucci, the head honcho at SkyBridge Capital and an ardent Bitcoin supporter, shared insights on CNBC’s Squawk Box about US pension funds gradually venturing into Bitcoin investment.

“During your Bitcoin homework session, you’re moving closer to Bitcoin…At times, being among the first can result in minor setbacks, but I strongly believe that being an early adopter of Bitcoin is advantageous, and we are still in its early stages.”

— Squawk Box (@SquawkCNBC) May 16, 2024

As an analyst, I would interpret the State of Wisconsin Investment Board’s $100 million investment in Bitcoin (BTC) as a clear indication of a growing trend towards accepting and integrating this digital asset into conventional investment portfolios. This move by institutional investors underscores the increasing recognition of BTC’s potential value and stability within traditional financial structures.

Scaramucci highlighted the swift progress of institutional Bitcoin adoption and expressed his belief that an increasing number of pension funds will soon invest in the cryptocurrency. He underscored the significance of regulatory approvals, which have paved the way for substantial involvement by large institutions in Bitcoin.

As a crypto investor, I believe Scaramucci’s endorsement of Bitcoin signifies that this digital currency will become a regular component in institutional investors’ long-term investment plans. To fully grasp Bitcoin’s potential, it’s essential for us all to study the history and fundamental concepts of money itself.

“He commented, ‘It’s beneficial to jump on the Bitcoin bandwagon early on.’ And he added, ‘We’re not there just yet… sometimes being early comes with its share of setbacks and mishaps.'”

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-18 01:17