Uniswap, a decentralized crypto exchange, has announced its intention to respond after being issued a regulatory notice by the US Securities and Exchange Commission (SEC).

Reacting to the SEC’s Wells notice on X, Uniswap CEO Hayden Adams noted:

“I’m not surprised. Just annoyed, disappointed, and ready to fight.”

The value of UNI, the native token of the DEX, took a hit following the announcement and fell below $10. For your information, a Wells notice is a warning that an investigation by regulatory authorities is imminent, as was the case with Coinbase before its ongoing legal dispute started.

Crypto Industry Supports Uniswap to Defend DeFi

Reacting to the notice, Uniwap Chief Legal Officer, Marvin Ammori, stated:

According to legal definitions, the Uniswap Protocol, its web application, and wallet do not function as exchanges or brokers for securities.

A few weeks ago, the judge in the SEC versus Coinbase case ruled that crypto wallets do not qualify as brokers, regardless of whether the involved tokens were classified as securities.

Industry experts, including Paul Grewal, the legal chief of Coinbase, are backing Uniswap to challenge and protect the Decentralized Finance (DeFi) sector. In response to the SEC’s actions against Uniswap, Grewal reminded that the SEC’s claim on Uniswap being considered a broker was not valid, drawing parallels from the recent dismissal of the SEC lawsuit against the Coinbase Wallet.

One possible paraphrase for “Sometimes you have to laugh or else you’ll cry” is “Laughing may be the only way to cope when situations seem overwhelming.”

— paulgrewal.eth (@iampaulgrewal) April 10, 2024

Mary Lader, Uniswap’s COO, stressed that “Uniswap represents an advancement in the financial sector, regardless of the SEC’s acknowledgement.”

Marc Boiron, the CEO of Polygon, expressed his approval of Uniswap’s determination not to back down. He commented, “I’m excited to see Uniswap Labs face the SEC challenge, and I support their eagerness to put up a fight.”

Uniswap is a prominent Decentralized Exchange (DEX) that initially launched on Ethereum, yet has since broadened its presence to include other networks such as BNB Chain.

Based on DefiLlama’s figures, Uniswap held approximately $6.2 billion in total value locked, reflecting the strong faith and belief of its users in the platform. Nevertheless, an enforcement notice triggered apprehension among some users.

UNI Dumps over 15% as Bearish Bets Increase

Based on information from CoinMarketCap, the value of UNI decreased by approximately 16% and fell from around $11 to under $10 in a short period following the announcement. At the moment of this composition, UNI was being exchanged for roughly $9.33.

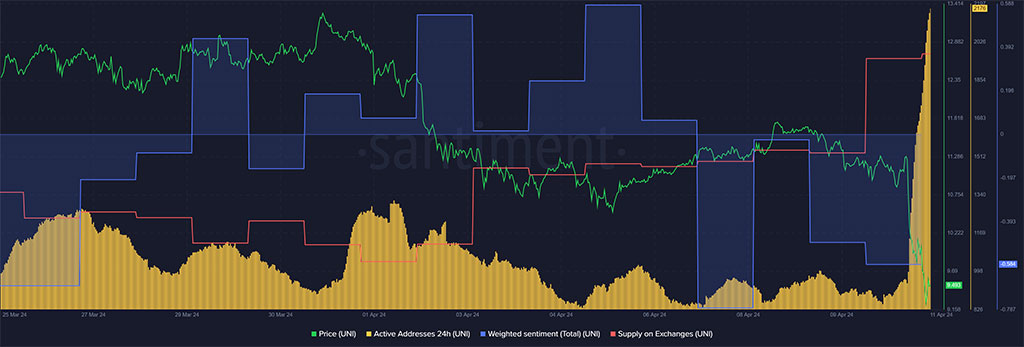

Photo: Santiment

Santiment’s intelligence data also revealed that the sentiment towards the token shifted negatively (turned blue), suggesting pessimism among social media users. Moreover, there was an increase in active addresses (yellow) and supply on exchanges (red), hinting at a surge in selling activity by UNI holders.

Photo: CoinGlass

In the derivatives market, there was a pessimistic outlook towards UNI reflected in an increase of wagers against it. According to CoinGlass data, the number of bearish bets soared, with over half (52%) of the trades representing short positions on the 12-hour chart.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Brody Jenner Denies Getting Money From Kardashian Family

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Capcom Spotlight livestream announced for next week

- What Is Going On With Justin Bieber?

2024-04-11 13:51