As a seasoned analyst with years of experience in the cryptocurrency market, it is undeniably impressive to witness Uniswap’s meteoric rise and dominance in the decentralized finance (DeFi) sector. With over $2 trillion in cumulative volume processed on Ethereum since its launch in late 2018, the DEX has proven itself as a robust and reliable platform that is here to stay.

Over the years, Uniswap, a well-known decentralized exchange (DEX) on Ethereum, has been continuously developing and expanding based on the increasing transaction volumes it handles.

Uniswap Processes Over $2 Trillion On Ethereum

Ever since I jumped aboard the DEX train towards the end of 2018, it’s been a fascinating ride watching this decentralized exchange churn out impressive numbers. As I track its progress, I can’t help but marvel at the fact that on-chain data indicates it has handled a staggering $2 trillion in total volume right here on the Ethereum mainnet.

Over time, the consistent increase in total trading volume indicates Uniswap’s continuous growth and the team’s commitment to maintaining the platform according to its initial design. In contrast to traditional exchanges like Binance or Coinbase, Uniswap uses self-executing contracts, known as smart contracts, for trades.

Each transaction originates directly from a self-managed wallet like MetaMask, giving the asset owner full control over their holdings. Approval for any transaction is only granted once the wallet’s proprietor explicitly gives consent.

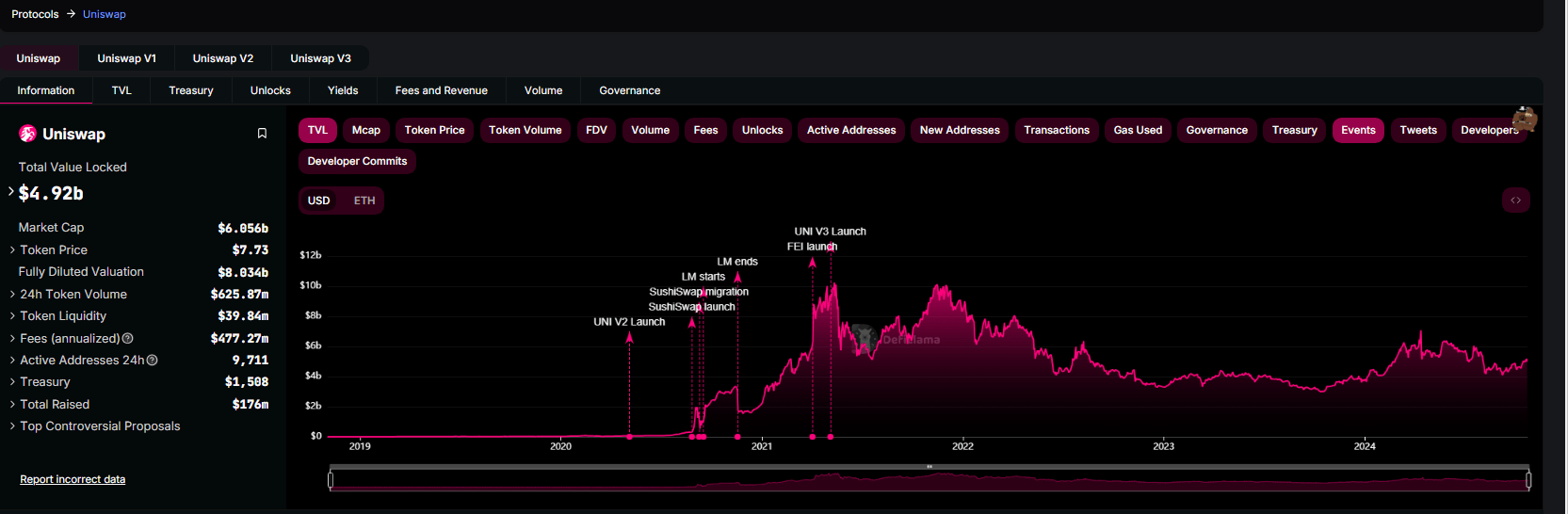

Due to its distinct advantage, the Uniswap platform has experienced remarkable expansion. As per recent reports from DeFiLlama, this decentralized exchange now handles more than 4.9 billion dollars’ worth of assets.

Currently, Uniswap ranks as the sixth most significant Decentralized Finance (DeFi) platform, reinforcing the preeminence of Ethereum-based decentralized applications (dApps).

Users have the option to select among three different protocol versions, with version 3 being the most extensive, handling transactions worth more than $3 billion. Uniswap v3 was pioneering as it was the first decentralized exchange (DEX) to implement concentrated liquidity, a feature designed to boost capital efficiency.

Apart from version 3, users also have the option to trade tokens not just on Ethereum, but additionally on networks such as Binance Smart Chain and Avalanche using Uniswap. Nonetheless, it’s worth noting that the majority of Uniswap trading activity occurs on Ethereum, with the exchange handling over $3.9 billion in transactions.

DeFi Dominance, UNI To $12?

With DeFi becoming increasingly popular and traders preferring trustless swaps, it’s expected that Uniswap will handle even more transactions. Significantly, this decentralized exchange could lead DEX trading on Ethereum layer-2 networks, given current trends. Notably, data from DeFiLlama indicates that the dapp has a total value locked (TVL) of approximately $277 million.

Looking at the significant impact of Decentralized Exchanges (DEX) on Ethereum, particularly in driving gas fees, UNI might see some advantages in upcoming trading periods. On the daily chart, UNI is displaying noteworthy progress with rising highs and nearing a crucial resistance point.

Following a drop to $4.7 early in August, this token has nearly doubled its value and is poised to set new record highs for Q4 2024. If it manages to surpass the $8.5 mark, a surge of interest could propel the UNI token as high as $12.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-10-23 07:34