As a seasoned researcher with over two decades of experience in financial markets and technology trends, I have witnessed the evolution of cryptocurrencies from a niche concept to a global phenomenon. The upcoming US presidential election has undeniably brought renewed attention to its potential impact on this burgeoning industry.

With the U.S. presidential election fast approaching, discussions about potential impacts on financial markets, specifically cryptocurrencies, are growing more frequent. Notably, Donald Trump, who is known for his pro-crypto stance, has sparked analysts from Bernstein to revise their previous predictions in this area.

According to Bernstein’s analysis, if Trump wins the presidency soon, Bitcoin could potentially rise to as high as $80,000 or even $90,000. This optimistic view is based on Trump’s supportive stance towards digital currencies. His proposed actions include encouraging Bitcoin mining within the U.S. and selecting a Securities and Exchange Commission (SEC) chair who is pro-cryptocurrency.

Harris Victory May Drop Bitcoin to $40K

Trump’s campaign has drawn notice due to its robust backing of cryptocurrencies. In fact, his team is open to receiving digital currency donations, and they are advocating for a country-wide Bitcoin reserve. Such actions indicate that he leans towards incorporating cryptocurrency within the American financial infrastructure.

In contrast to this, Vice President Kamala Harris supports the use of blockchain technology and digital assets, but she hasn’t provided a comprehensive plan for cryptocurrencies yet. Instead, her attention is mainly on safeguarding consumers and enhancing America’s dominance in blockchain technology, which aligns with her broader “opportunity economy” objectives.

Experts from Bernstein, specifically Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, propose that if Trump wins the election, Bitcoin could surpass its previous high of $74,000. Conversely, they predict that a victory for Harris might lead to a decline in Bitcoin’s value, potentially dropping as low as $40,000, considering the prevailing market dynamics and political uncertainties.

If Trump wins, our forecast indicates that Bitcoin could reach record heights between $80,000 and $90,000, surpassing its previous peak of $74,000. Conversely, if Harris wins, we anticipate a potential drop to lower levels, possibly testing uncharted territory in the range of $40,000s (a level not previously seen during the recent correction), as shared with our clients on Wednesday.

The Role of Polymarket and Election Odds

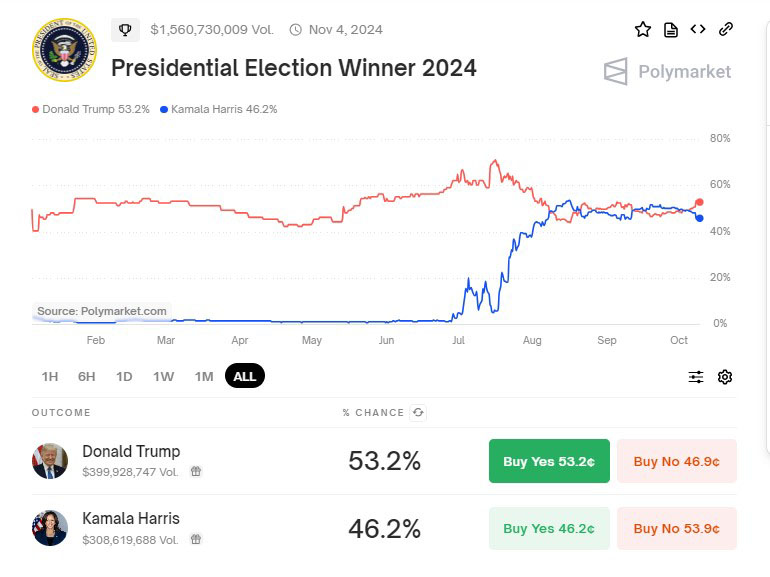

On the blockchain betting site Polymarket, more than $1.5 billion has been placed as bets on the U.S. presidential election. Given his supportive stance towards cryptocurrency, the odds appear to favor Trump. Yet, analysts from Bernstein suggest that while there may be some bias involved, the platform’s significant liquidity and active market engagement make it a trustworthy indicator of public sentiment.

Source: Polymarket

Bitcoin could potentially surge if Trump wins, but analysts from Bernstein predict that Ethereum and Solana might hold steady until after the elections. The future trajectory of these cryptocurrencies may be affected by the regulatory landscape, which will become clearer as new regulatory leaders are appointed post-election, and their policies take effect.

As the U.S. Presidential Election nears on November 5th, there’s growing interest in how it might impact the trends within the cryptocurrency market. This intersection could have substantial consequences for both investors and the overall financial industry. As we watch these developments unfold, we’ll be closely examining their potential effects on the crypto world.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-10-09 16:51