As a seasoned analyst with over two decades of experience in the financial market, I’ve seen my fair share of bubbles and bursts. The RTR token debacle is yet another lesson in the unpredictable nature of the crypto world, particularly memecoins.

As someone who has closely followed the cryptocurrency market and its connections to political figures over the years, I must say I am not surprised by the sudden collapse of Restore the Republic (RTR). Having witnessed similar situations in the past where crypto projects linked to politicians have failed spectacularly, I’ve learned to be cautious when it comes to such investments.

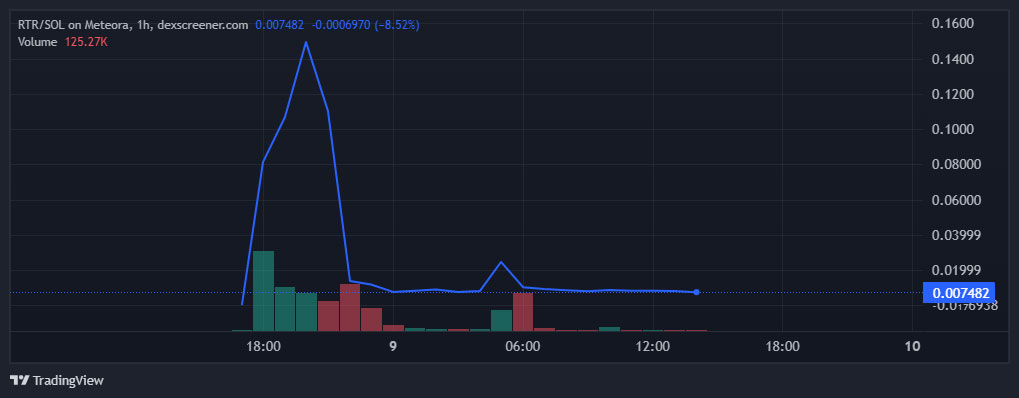

Photo: Dex Screener

On August 8, 2024, Eric Trump, Donald Trump’s son, openly declared that there was no relationship between the Trump family and the RTR token. He cautioned the public about false tokens, stressing that no legitimate cryptocurrency endorsed by the Trumps had been introduced. This denial from Eric led to a significant drop in the token’s value, with DexScreener reporting it fell to $0.0076.

Prior to the market’s sudden drop, the RTR market value peaked at $155 million due to speculative activities and a tweet by Eric Trump suggesting potential DeFi news. This tweet fueled rumors, causing a trading frenzy. However, Eric’s later denial swiftly put an end to the speculation.

Prior to Trump’s denial, whispers emerged within the cryptocurrency sphere about his son potentially being involved in the launch of a new memecoin. These rumors were sparked when he posted vaguely about X on social media, leading many to speculate that he might be connected to a DeFi project.

Prepare for a groundbreaking change in the cryptocurrency sphere! The future lies in decentralized finance, so make sure you’re not left out. #Crypto #DeFi #StayAheadOfTheCurve

— Donald Trump Jr. (@DonaldJTrumpJr) August 7, 2024

The dismissal by Eric Trump echoed loudly within the cryptocurrency sector, causing dismay among traders who had initially invested in a memecoin associated with the Trumps. Notably, well-known crypto personalities like Kaiko, Ben Werkman, and SlumDOGE millionaire breathed a sigh of relief as they worried that such a token might have harmed Trump’s presidential campaign.

RTR Debacle Highlights Meme Coin Risks

The recent chaos surrounding RTR is merely another demonstration of the erratic and unforeseeable behavior found within the meme coin trading sector. Initial investors managed to secure substantial earnings in a matter of hours before the market plummeted, as it’s said that five accounts purchased approximately 105 million RTR tokens for $882,000 using Solana (SOL) and then sold 95 million tokens at a staggering $5 million.

As a seasoned investor with years of experience under my belt, I’ve witnessed numerous instances where meme coins have taken center stage, only to swiftly collapse and leave investors high and dry. The recent incident involving tokens reminiscent of Trump-themed assets, such as TrumpCoin (DJT) and MAGA (TRUMP), is a stark reminder that the world of meme coins remains fraught with peril. Time and time again, I’ve seen the volatile nature of these coins lead to significant losses for those who fail to heed the warning signs. In my view, it’s essential for investors to exercise caution when dabbling in meme coins, as scams and sudden collapses are all too common in this unpredictable market.

After the commotion subsides, this incident underlines the risky nature of cryptocurrencies, especially when hype is driven by influential individuals lacking solid foundations. Crypto enthusiasts continue to watch closely, eagerly anticipating any potential Trump-associated projects that may surface down the line.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-09 16:11