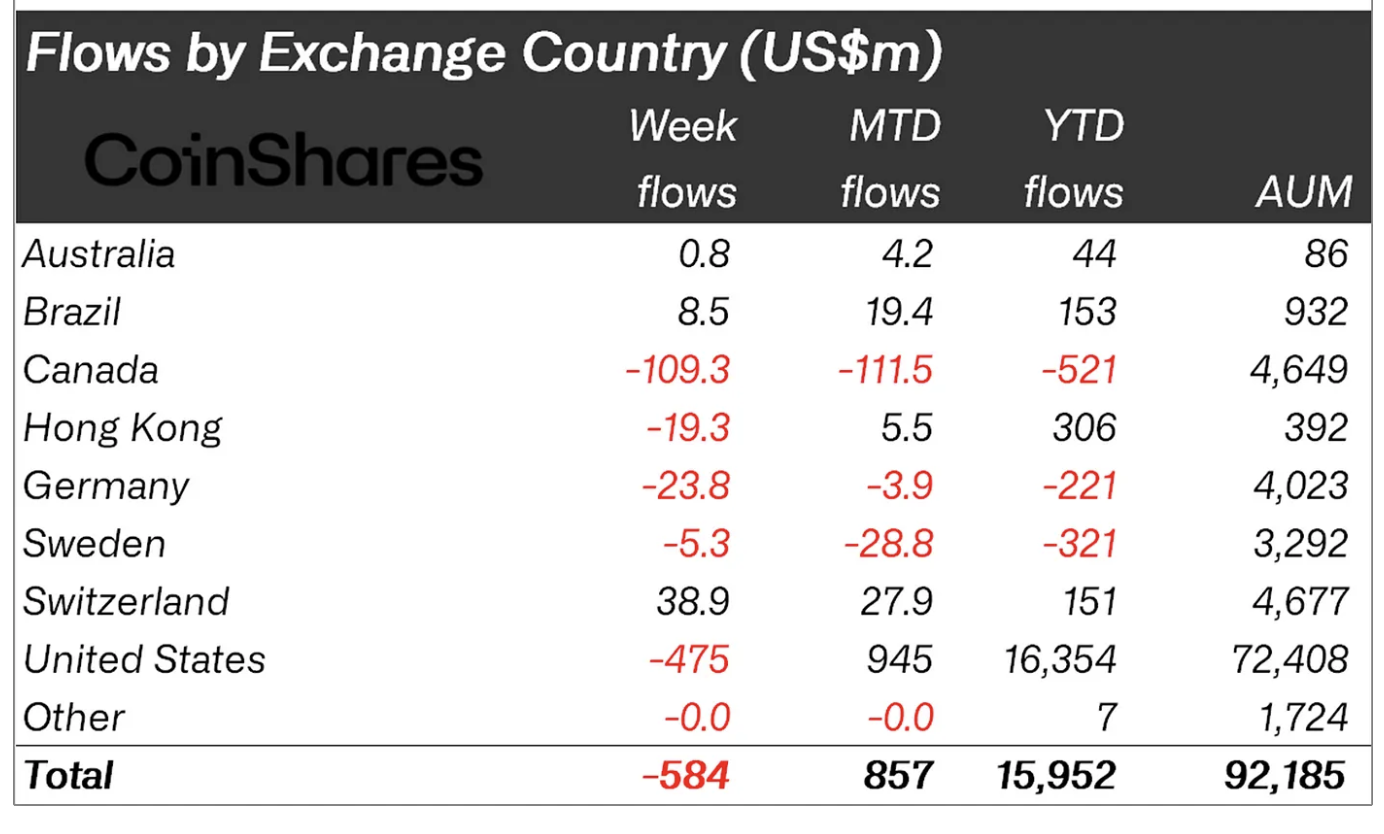

As an experienced financial analyst, I believe that the recent data from CoinShares indicating substantial outflows from US spot Bitcoin ETFs, totaling over $1.1 billion in the past two weeks, represents a significant shift in investor sentiment towards Bitcoin. This trend is not exclusive to the US market, as similar withdrawals were observed in funds based in Canada, Germany, and Hong Kong.

As an analyst examining the latest trends in the cryptocurrency market, I’ve noticed some intriguing shifts in investor sentiment towards Bitcoin based on recent data from CoinShares. Specifically, there was a notable outflow of $544.1 million from US spot Bitcoin Exchange-Traded Funds (ETFs) over the past week.

Based on the analysis of James Butterfill, a prominent figure at CoinShares, the substantial sum of funds exiting the market signifies a “true correction process” underway, as this trend continues beyond a week’s timeframe, with over $1.1 billion being withdrawn in just the previous two weeks.

Global Outflows Amidst Economic Uncertainty

As a crypto investor, I’ve noticed that James Butterfill has attributed recent withdrawals in the market to a loss of confidence among investors. He believes that this may be due to anticipated interest rate cuts, which are making some investors wary and uncertain about their investments. When commenting on these consistent outflows, Butterfill stated:

Based on current investor sentiment, we assume that the Federal Reserve’s decision to lower interest rates in 2023 is a source of concern.

Significant amounts of money were withdrawn from funds situated in the US, Canada, Germany, and Hong Kong, among others. In contrast, funds located in Brazil and Switzerland experienced net inflows, reflecting diverse reactions from different parts of the world to the present economic situation.

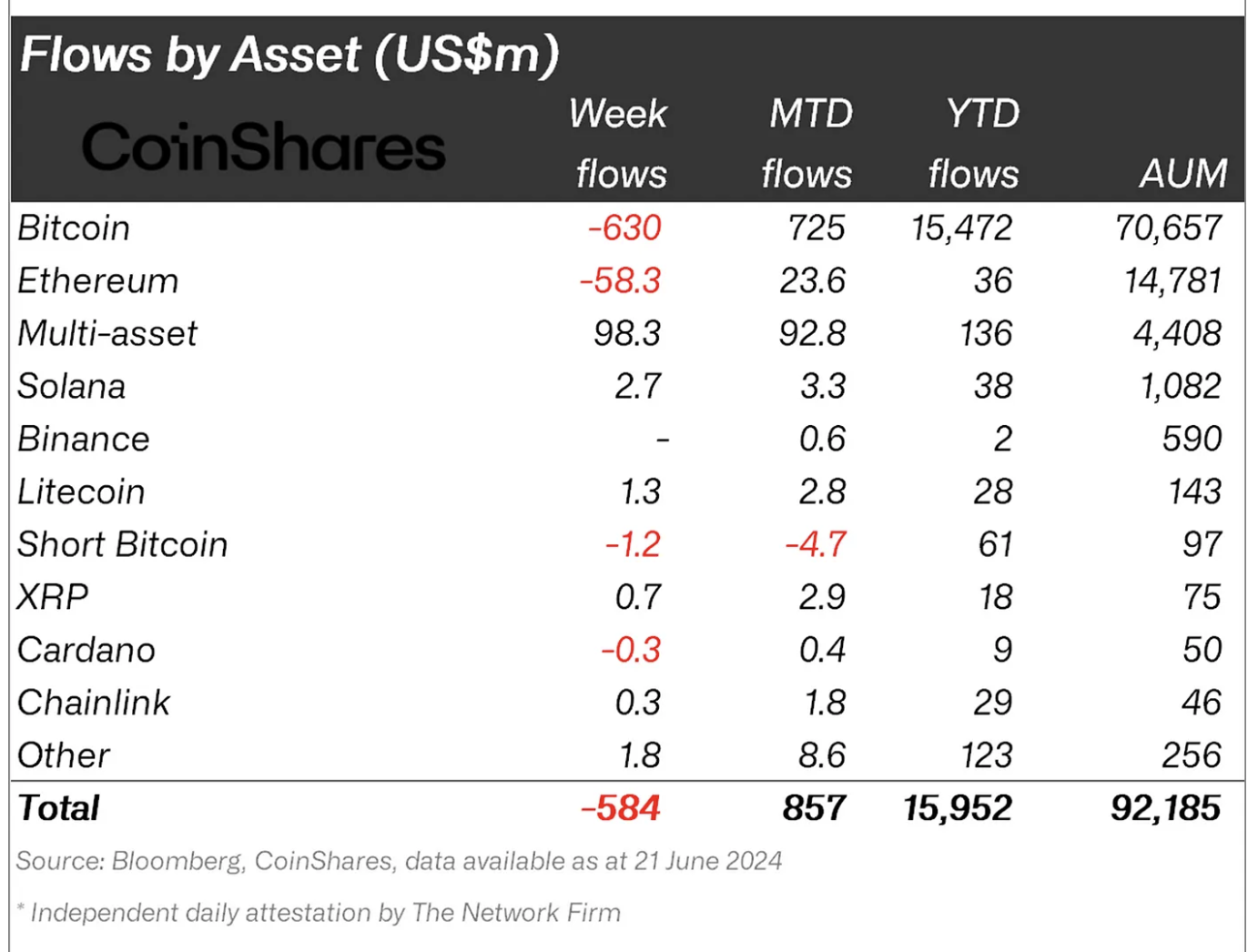

As a crypto investor, I’ve noticed that Bitcoin took the largest hit with significant outflows totaling $58 million from Ethereum-based investment products worldwide. This unexpected move came despite the buzz surrounding new issuers filing S-1 registration documents with the SEC, which could potentially lead to launches.

Despite the fact that many cryptocurrencies encounter challenges during this period, not all do. For instance, Solana, Litecoin, and Polygon have seen an influx of funds, indicating that some investors view the present market instability as a chance to buy at lower prices, based on Butterfill’s analysis.

Bitcoin Market Turbulence and Optimistic Forecasts

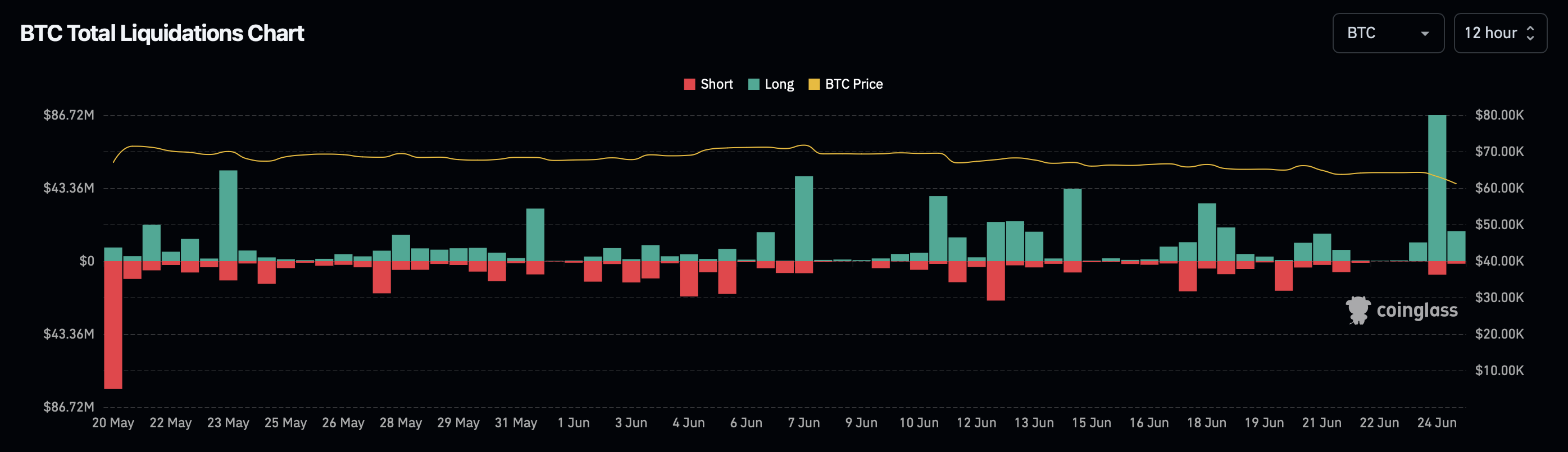

In the midst of recent financial fluctuations, the broader cryptocurrency market has been affected, causing Bitcoin’s price to decrease by 4.7% within the last day and 6.6% over the past week. Now trading around $61,186, this downturn has resulted in substantial liquidations among traders.

As an analyst, I’d interpret the data from Coinglass as follows: In the last 24 hours, a staggering 91,772 traders have experienced liquidations, which translates to a substantial total loss of $308.97 million. Among these losses, Bitcoin traders bore the brunt with a hefty $123.35 million in red numbers.

In the midst of market fluctuations, Jack Mallers, the head of Strike – a globally used Bitcoin app – remains optimistic about Bitcoin’s future prospects.

During a conversation with analyst Scott Melker, Mallers voiced optimism that Bitcoin’s current price volatility notwithstanding, it could potentially hit values between $250,000 and $1 million during the upcoming market cycle.

This anticipated expansion he believes is due to the persistent weakening of the dollar, and he considers Bitcoin an effective shield against the erosion of currency value through debasement.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-06-25 07:01