As a seasoned researcher with over a decade of experience in the crypto market, I must admit that the recent price surges of Bitcoin and Solana have piqued my interest. My personal journey in this digital frontier has taught me to never underestimate the power of technological advancements and market dynamics.

In the midst of a wider market rebound, both Bitcoin (BTC) at approximately $66,000 and Ethereum Layer-1 rival Solana (SOL) near $158, show signs of growth. The former has a 24-hour volatility of 1.7% with a market cap of $1.31 trillion and a 24-hour volume of $38.10 billion. Meanwhile, Solana exhibits a 24-hour volatility of 2.9%, boasting a market cap of $74.36 billion and a 24-hour volume of $4.34 billion.

Beyond the general market uptrend boosting Solana’s (SOL) price increase, it’s primarily fueled by worldwide interest rate reductions and improved liquidity within the market. According to VanEck’s research division, MarketVector, Solana has the potential to make up half of Ethereum’s (ETH) total market value. Translated, this suggests that Solana’s price could more than double from its current levels, potentially reaching over $320.

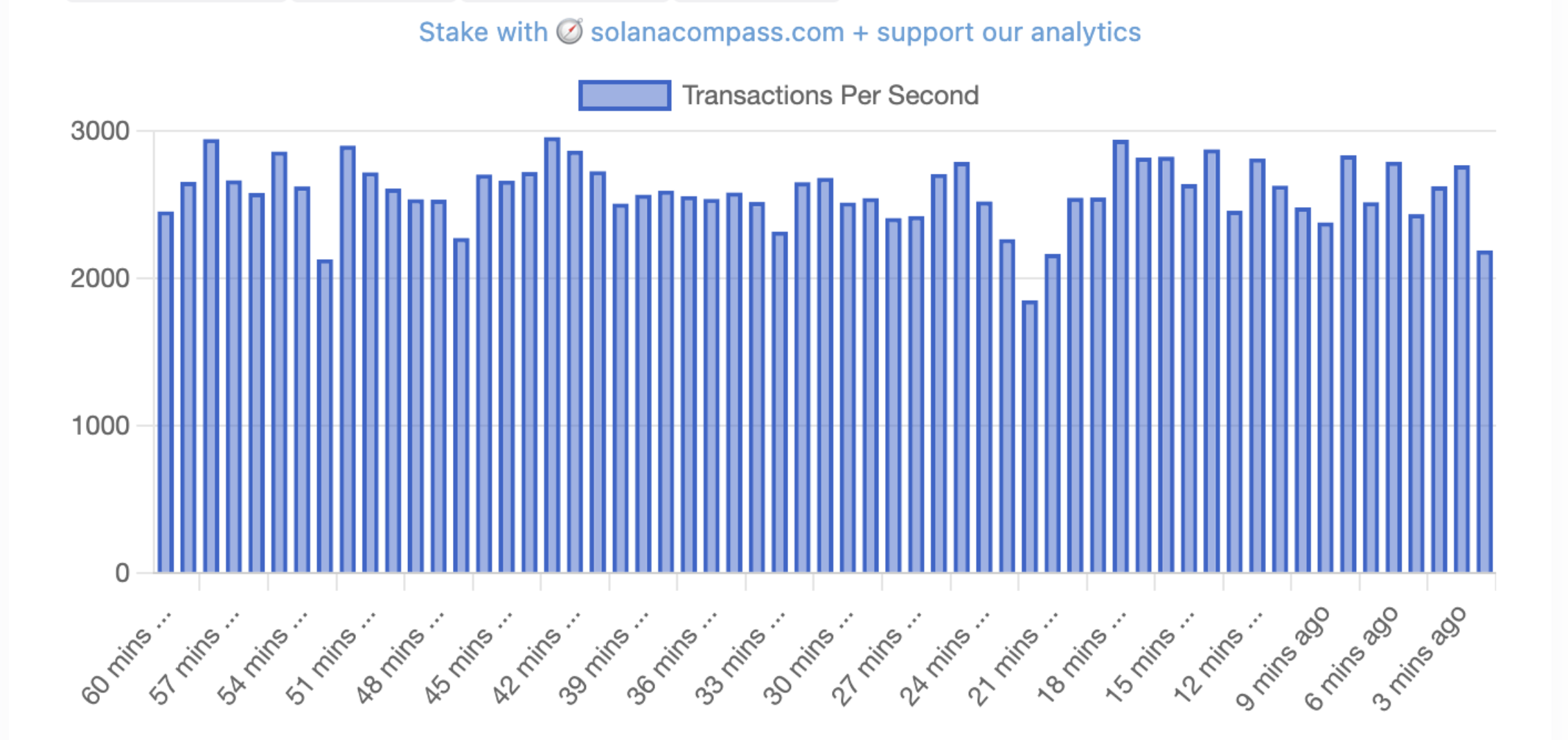

VanEck suggests several viable reasons for this belief, highlighting Solana’s exceptional transaction speed and processing power as a significant factor driving its optimistic perspective. Notably, the Solana blockchain can process around 3000% more transactions per second than Ethereum, which could be a major contributing factor to its bullish trend. As a reminder, Ethereum is currently trading at $2678 with a daily volatility of 1.2%, and has a market cap of $321.30 billion and a 24-hour volume of $17.20 billion.

Courtesy: Solana Compass

In a comparison by VanEck, Solana’s daily active users outperform Ethereum by an impressive 1300%, while its transaction fees are almost 5 million times lower. This significant advantage in both volume and cost makes Solana extremely appealing for high-volume transactions, particularly within industries such as payments and remittances where speed and cost-effectiveness are paramount.

From another perspective, the increasing use of Solana within the Decentralized Finance (DeFi) sector might significantly contribute to the surge in SOL prices in the future.

Solana Price Breaks Past Key Trendline, Interest to Boost Further Action

In the month of September, the SOL price has fluctuated between approximately $113 and $125, with these zones acting as robust support after earlier market drops.

In the picture you see, it’s the area where investors intervened to halt the drop, causing Solana to stabilize. The current surge in SOL price, originating from this accumulation phase, suggests increasing demand and a resurgence of buying activity, all while maintaining high trading volume.

Courtesy: Trading View

A significant feature is the distinct downward trendline in black, which has acted as a barrier since Solana reached its peak in March around $205. However, on September 26, SOL managed to surpass this line, and it has continued to maintain its upward thrust from that breakout.

A significant factor behind this trend is the central bank reducing interest rates in September and shifting towards easier monetary policies due to decreasing inflationary pressures. This monetary easing makes conditions more favorable for investments in riskier assets, such as Solana, because lower interest rates mean cheaper borrowing costs and increased liquidity, causing investors to seek higher returns in these markets.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The games you need to play to prepare for Elden Ring: Nightreign

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-09-27 17:30