As a seasoned researcher with over two decades of experience in the financial markets, I find the latest Grayscale report intriguing. The addition of six new altcoins to their Top 20 list for Q1 2025 is a testament to the ever-evolving landscape of the cryptocurrency sector.

The projects listed, such as Hyperliquid (HYPE) and Ethena (ENA), showcase innovation and potential in areas like decentralized exchanges, stablecoins, AI, and DeFi. It’s fascinating to witness how blockchain technology continues to disrupt traditional finance and create new opportunities for growth.

However, it’s essential to remember that investing in cryptocurrencies carries inherent risks, and past performance is not indicative of future results. As I always say, “The only certainty in crypto is uncertainty.”

On a lighter note, I can’t help but chuckle at the irony of a decentralized exchange (HYPE) reaching rank #19 on the list of largest cryptocurrencies by market cap. After all, if it were truly decentralized, wouldn’t it be number one? But alas, we are still in the realm of centralized exchanges for now!

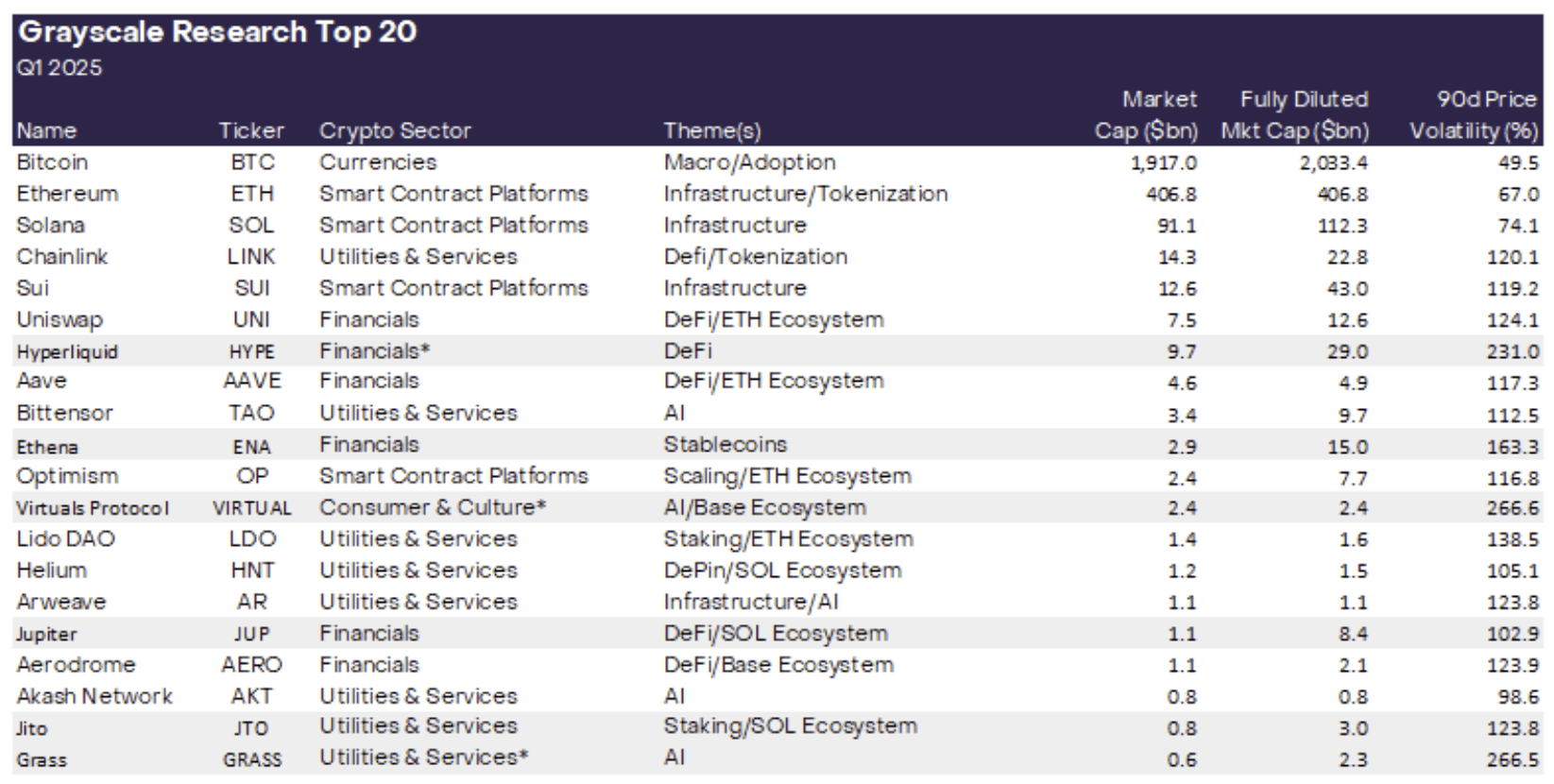

In a recent release, Grayscale Investments shares their Q1 2025 quarterly report, featuring the top 20 cryptocurrencies in their portfolio. Every quarter, the Grayscale Research team examines and assesses numerous digital assets to help adjust the FTSE/Grayscale Crypto Sectors collection of indexes.

According to the research summary, our strategy takes into account various aspects such as the expansion of networks, impending triggers, the durability of fundamental principles, the assessment of token value, the inflation of token supply, and potential unforeseen risks. The entries that have recently joined the top 20 are influenced by three primary market trends that Grayscale anticipates will significantly impact the upcoming period: the U.S. election and any related regulatory changes, rapid advancements in decentralized artificial intelligence, and the growth of the Solana system.

In the latest report, we’re introducing six new cryptocurrencies to our Top 20 list for Q1 2025, which includes Bitcoin, Ethereum, Solana, Chainlink, Uniswap, SushiSwap, Aave, Bittensor, Optimism, Lido DAO, Helium, Arweave, and Akash Network. The report highlights that each of these new additions shares a significant connection with one or more of the previously mentioned themes.

Best (New) Crypto Assets For Q1 2025

Hyperliquid (HYPE): This is a Layer 1 blockchain designed primarily for financial applications on-chain, with its main offering being a decentralized exchange (DEX) for perpetual futures contracts. The platform is based on a fully on-chain order book, aiming to cater to the increasing interest in sophisticated derivatives trading within a decentralized setting. Recently, HYPE has experienced an unprecedented growth spurt, currently ranking #19 among the top cryptocurrencies by market capitalization.

As someone who has been closely following the cryptocurrency market for several years now, I must say that Ethena’s introduction of USDe stablecoin has caught my attention. Being a long-time investor in Bitcoin and Ether, I understand the importance of having a stable coin that is backed by these two major assets. The fact that Ethena holds long positions in Bitcoin and Ether while shorting perpetual futures contracts on the same assets is a unique approach that I find intriguing.

Grayscale’s explanation of this protocol highlights its potential to leverage pricing differentials between spot and futures markets, which could provide a distinct yield profile for participants. This yield profile could be particularly attractive to investors looking for stable returns in the volatile cryptocurrency market.

Having experienced multiple market cycles and seeing various projects come and go, I am always on the lookout for innovative solutions that can add value to my investment portfolio. The staked version of USDe token, which leverages this pricing differential, seems like a promising addition to my holdings. It’s worth keeping an eye on Ethena and its USDe stablecoin as they continue to develop and grow in the crypto space.

As a Crypto Investor Exploring the Virtual Protocol: I’ve found myself intrigued by the Virtual Protocol, which operates on Base, an Ethereum Layer 2 network. This innovative platform facilitates the development of autonomous AI agents, as Grayscale explains, “designed to replicate human decision-making processes.” What sets it apart is its ability to tokenize these AI agents, essentially allowing for shared ownership. By doing so, it seamlessly integrates AI capabilities with the robustness of blockchain technology.

Jupiter (JUP): It’s been noted that Jupiter has become a top DEX aggregator on the Solana network, holding the highest total value locked (TVL) among all Solana applications. As the user base on Solana expands and anticipation heightens regarding memecoins and AI agent tokens, it is believed that Jupiter is poised to profit from this burgeoning market activity, according to the report.

As a seasoned cryptocurrency investor with years of experience under my belt, I must say that Jito has caught my attention lately. Having closely followed the crypto market for quite some time now, it is not often that I come across a project that demonstrates such impressive growth in adoption as quickly as Jito has over the past year.

Grayscale’s endorsement of the project’s financial prowess only serves to bolster my interest even further. With a projected revenue of over $550 million in 2024 fees, it is clear that Jito offers one of the most promising financial profiles in the entire crypto space. As someone who values strong returns on investment, I believe that Jito could be an excellent addition to any diversified portfolio.

In conclusion, based on my personal experience and analysis of the market, I would highly recommend taking a closer look at Jito for anyone interested in maximizing their returns in the crypto space.

Grass (GRASS): This tool, known as GRASS, compensates users for making their unused internet bandwidth available through a Chrome extension. Essentially, the bandwidth is utilized to gather online data, which is subsequently sold to artificial intelligence firms and developers for the purpose of teaching machine learning algorithms. The project generates income by redistributing rewards to individuals who lend their idle bandwidth.

Additionally, Grayscale expresses ongoing enthusiasm for topics from past quarters like Ethereum scalability solutions, tokenization, and decentralized physical infrastructure (DePIN). Notable examples of these recurring themes are Optimism, Chainlink, and Helium, which have managed to stay within the Top 20 because they cater to scaling, tokenization, and DePIN applications respectively.

Significantly, six cryptocurrencies – NEAR, Stacks, Maker, CELO, UMA, and TON – have been moved out of the Top 20 rankings this quarter. Even though Grayscale Research still appreciates these projects and considers them crucial components of the crypto market, they believe that the updated Top 20 list could potentially deliver better risk-adjusted gains for the upcoming quarter.

At press time, HYPE traded at $29.45.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-30 18:41