As a seasoned researcher with over two decades of experience in the financial markets under my belt, I find Miles Deutscher’s analysis intriguing and insightful, especially considering his extensive following and deep understanding of the crypto space. His ability to identify key trends, such as the bullish outlook for Bitcoin and the potential impact of macroeconomic factors on its trajectory, is impressive.

As a passionate crypto investor, I recently came across a video by analyst Miles Deutscher, who boasts a following of 550,000 on X platform. The title of his latest video caught my attention: “My Millionaire-Making Strategy for Crypto by March 2025!” In this insightful analysis, Deutscher shares his strategic approach to capitalizing on the ongoing crypto bull run.

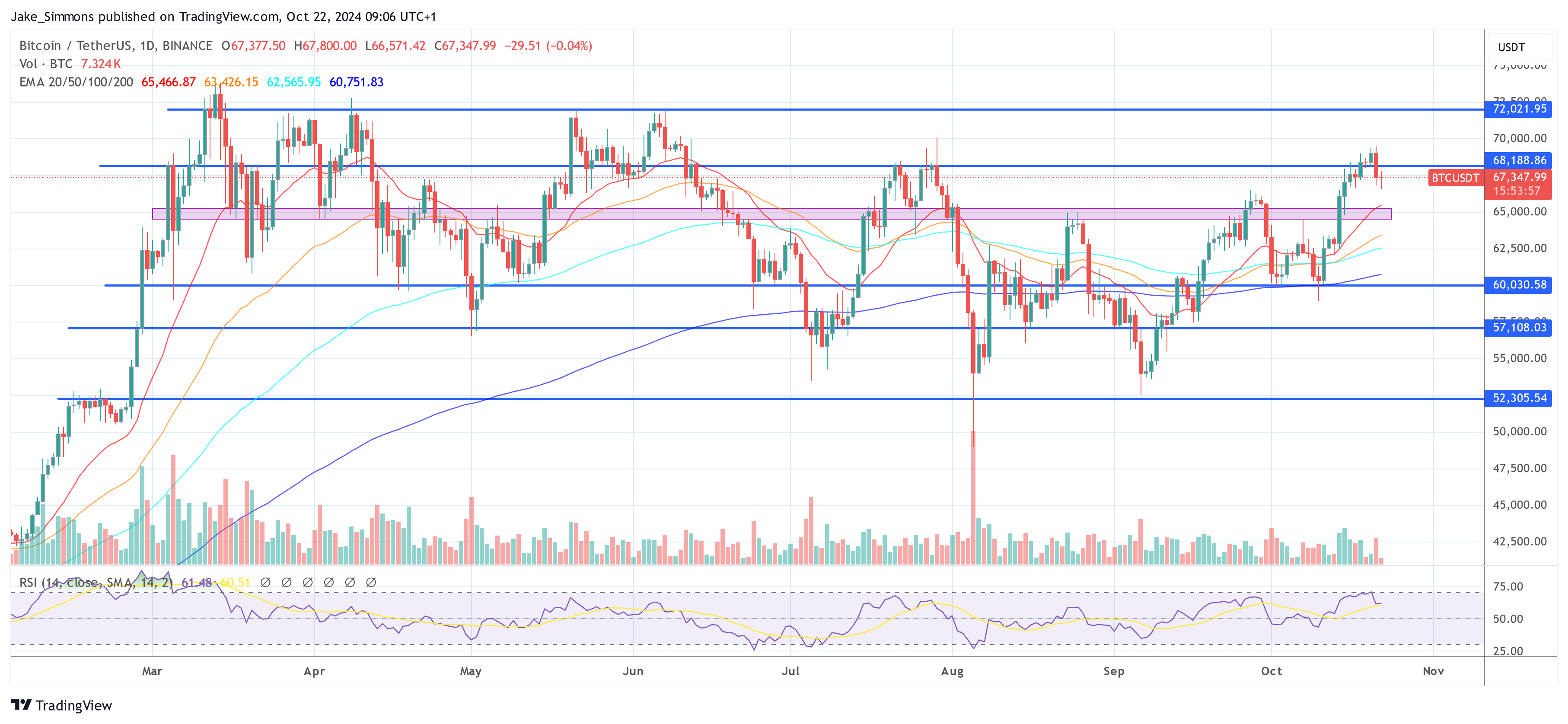

The Start Of The Bitcoin Bull Run

Initially, Deutscher emphasizes a positive perspective towards Bitcoin, especially on the monthly graph. He points out that for the past eight months, we’ve been holding above the peak achieved in February 2021. In other words, Bitcoin has been steadily consolidating above its previous high. On larger timeframes, he states, Bitcoin appears very strong and seems ready to grow further, possibly reaching the $100,000 range.

This bullish consolidation is being linked to substantial investments in Bitcoin ETFs by traditional finance investors, as indicated by over $2 billion in inflows last week, with an additional $273 million pouring in at the end of the week. This suggests a robust environment for Bitcoin from the perspective of Traditional Finance (TradFi).

Despite this momentum, Bitcoin is lagging behind gold, which has surged 30% above its yearly high to $2,700 per ounce. “Bitcoin is still sitting 10% below its yearly high,” Deutscher points out. “If Bitcoin were to catch up to the current price performance of gold this year, that would indicate a Bitcoin price of $96,400, which would be absolutely insane.”

German points out how macroeconomic conditions and political occurrences may influence Bitcoin’s path. He notices that Bitcoin’s price trends appear to align with the likelihood of former President Donald Trump winning an election, as he states, “Bitcoin seems to behave rather like Trump’s election odds according to Polymarket.” Although he admits this might be just a coincidence, he proposes the idea that “the market believes a Trump victory would be positive for Bitcoin.

As a crypto investor, I’m pondering over the shift from quantitative tightening to quantitative easing and its possible impact on the digital currency market. A tweet I recently read sparked my curiosity: “What do you imagine will transpire when we exit a seven, or even eight-month trading range at record low volatility, during an election, with the transition from quantitative tightening to quantitative easing, and towards the end of an 18.6-year real estate cycle?” To me, it seems like we’re setting the stage for a significant event – an “Explosion.

Strategy How To “Make Millions”

Instead of focusing solely on Bitcoin, Deutscher shifts his attention towards alternative cryptocurrencies (altcoins), offering a strategy that could potentially help investors amass substantial wealth by March 2025. He underscores the crucial role of strategic buying during market downturns and emphasizes the current uptrends as significant indicators. In simpler terms, he points out that altcoins are currently on an upward trend and have already surpassed their previous boundaries. Bitcoin, too, is experiencing an uptrend, breaking through key resistance levels and reaching new highs.

German advises against trying to predict and switch between Bitcoin and other cryptocurrencies (altcoins) based on market timing. He admits it’s possible to try and time when Bitcoin’s dominance over the market might shift, but stresses that precise timing is crucial for success. Instead, he suggests preparing for the final stages by holding altcoins that are likely to outperform Bitcoin in those later stages of its growth. Essentially, he claims that while it means having to hold onto altcoins even during periods where they underperform, in the long run, you could potentially earn more money by doing so.

He stresses the importance of focusing on strong narratives and being selective with investments. Quoting Warren Buffett, he notes, “Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.” Deutscher elaborates: “I think you should be selective. You don’t want to be over-diversified to the point where you hold six AI coins, six RWA coins, eight meme coins, five Layer-1s, three Layer-2s. This is a market where you’re better off to have maybe two plays from each narrative and just go higher conviction into those coins.”

Key Narratives and Top Altcoin Picks

German points out several popular trends in cryptocurrency and particular altcoins that he thinks could generate substantial returns. In the meme coin segment, German emphasizes the rise of AI-generated meme coins, where artificial intelligence agents develop and market tokens. His top pick for this area is GOAT. “This trend might reach billions and soar, making GOAT a potential billion-dollar coin, or it could flop and become worthless,” he acknowledges, recognizing the inherent risk.

Beyond exploring AI-based memecoins, Deutscher advises checking out Murad Mahmudov’s list of memecoins. “I believe SPX6900 is a good option. I’m fond of GIGA too, but perhaps not as much as SPX. I also fancy MOG. I find appeal in most of these, but I suggest choosing two or three that you feel the strongest connection with.

Instead of focusing solely on meme coins, Deutscher is significantly pouring resources into Artificial Intelligence (AI) initiatives. He has acquired stakes in tokens such as Bittensor and Near Protocol. “I’m encountering two to three AI founders daily,” he discloses. “I’m immersing myself deeply in AI research because it’s the field I’m most intrigued by at the moment.

German recently unveiled his holdings in ventures that convert tangible assets into digital tokens, including Mantra (OM), Ondo Finance (ONDO), and Pendle. Despite cashing out some of these investments due to substantial returns, he’s shifting funds towards projects like Clearpool (CPOOL), which he thinks could ascend to the elite tier of RWA protocols. He subtly suggests another RWA project he’s enthusiastic about but hasn’t publicly announced yet.

German underscores the significance of acquiring crypto positions during market downturns, particularly in areas showing potential growth. He mentions that the present market situation favors buyers who capitalize on dips. In essence, he explains, “We’re experiencing a new era where we’re seeing higher lows. The market is actually offering rewards to those who buy these dips and seize the opportunities presented by these dips.

He emphasizes the importance of being adaptable and prudently managing risks to maximize earnings and possibly amass large sums. In simpler terms, he suggests that one should continually adjust to market changes in order to be profitable, and that suboptimal or unappealing positions should be reduced and replaced with more promising ones for future growth.

As a crypto investor, I’ve learned the hard way that focusing excessively on specific price targets or portfolio milestones can be detrimental. In my experience, the biggest mistake investors made during previous cycles was becoming overly attached to arbitrary figures such as “I’ll sell when my portfolio reaches a million dollars” or “I’ll sell when Bitcoin hits 100K.” These numbers, as I’ve come to realize, are essentially foolish.

As a crypto investor, I’d advise setting up a gradual profit-taking strategy. In other words, for every coin you purchase, determine specific percentages to sell at certain multiples. This method enables investors like us to accumulate profits steadily and adapt to market fluctuations without the necessity of predicting exact high points.

At press time, Bitcoin traded at $67,347.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-22 15:05