As a researcher with a background in financial analysis and experience in studying cryptocurrency markets, I find Santiment’s Opportunity and Danger Zone Model intriguing. The use of the MVRV ratio to determine profitability status and identify potential buying or selling opportunities is an innovative approach.

According to the fair value model used by on-chain analytics company Santiment, certain altcoins are presently considered undervalued and are situated within their historical buy zones.

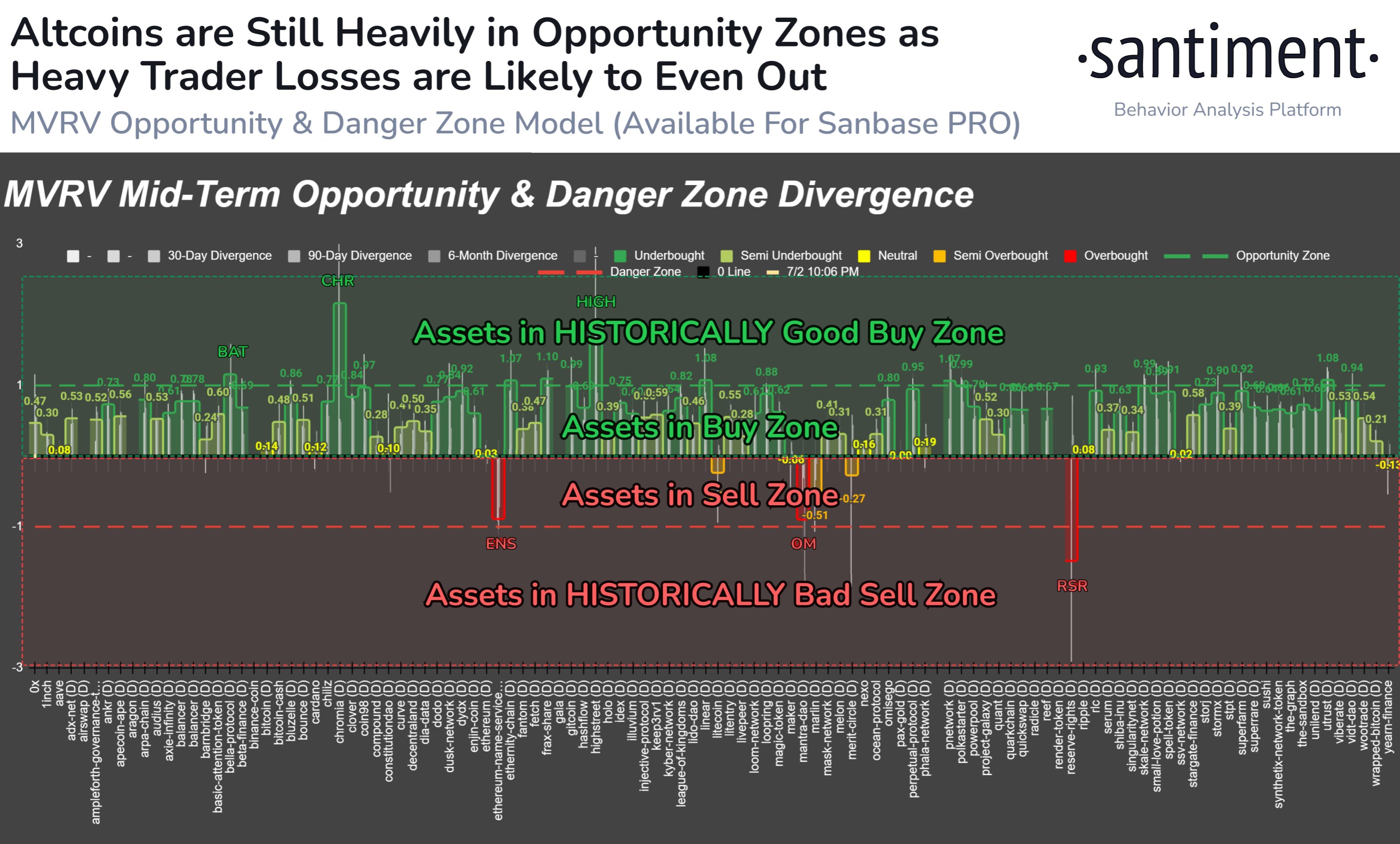

A Large Amount Of Altcoins Are Currently Near The Opportunity Zone

As a crypto investor, I’m always keeping an eye on market trends and analysis from industry experts. In their latest post on X, Santiment discussed some insights into the current state of various cryptocurrencies based on their Market Value to Realized Value (MVRV) ratios. The MVRV ratio is a valuable indicator for me as it provides information about the profitability or loss status of individual addresses within a specific network.

When the value of this indicator exceeds 1, it signifies that investors currently hold more profits than losses. Conversely, a value below this mark indicates that losses outweigh profits in the market.

In simple terms, when the MVRV ratio equals 1, it indicates that the total unrealized losses and profits for the network are balanced out. This means that on average, each holder is neither making a profit nor incurring a loss.

As a crypto investor, I’ve observed that market corrections tend to occur more frequently when my profits have significantly increased. It becomes harder to resist the temptation to sell when my gains are substantial. Conversely, when I’m underwater – meaning my investments are losing value – it can lead to bottom formations as sellers become exhausted and less willing to continue selling during such conditions.

Using the information provided, Santiment has created a model called the Opportunity and Danger Zone Model. This approach employs the MVRM (Moving Average Realized Value) ratio’s disparity across various timeframes to assess whether an asset presents a potential buying or selling opportunity more accurately.

As a crypto investor, I’d like to share some insights based on the chart presented by the analytics firm. This graph illustrates the current positioning of various altcoins in relation to their potential growth prospects, as suggested by the model employed by the firm.

In this model, the zero point assumes the function of the neutral level in the Moving Average Risk-Reward Ratio (MVRV). Additionally, it’s essential to note that the polarity has been reversed. Values below zero indicate profitable positions, while values above zero represent losing ones.

The graph indicates that the majority of altcoins currently lie in the positive zone, implying that their investors are presently underwater due to previous purchases being priced higher than their current market value. Notably, Basic Attention Token (BAT), Chromia (CHR), and Highstreet (HIGH) are notable exceptions with their MVRV ratios surpassing 1.

As a crypto investor, I’d describe it this way: The area above the line of 1 on the chart holds the greatest potential for profitable investments in cryptocurrencies. Historically, assets in this region have yielded the best returns for me and other investors. So, we refer to it as the “Opportunity Zone.”

Amongst the altcoins presently in circulation, some, including Ethereum Name Service (ENS), MANTRA (OM), and Reserve Rights (RSR), are not undervalued but rather teeter on the edge or even exceed the threshold of the Danger Zone. The Danger Zone represents a situation where coins exhibit values below -1 on our analysis. Contrastingly, the Opportunity Zone pertains to coins that become overvalued with a value above 1.

Ethereum Price

In the past 24 hours, Ethereum, the biggest altcoin, experienced a decline of over 4%, causing its value to dip below the $3,300 mark.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-07-04 00:41