As a seasoned researcher who has witnessed the cryptocurrency market’s volatility since its inception, I must say that the current Bitcoin correction is reminiscent of a rollercoaster ride – exhilarating one moment and nerve-wracking the next. The decline in exchange reserves and the lack of retail participation are indeed intriguing indicators that suggest we might be on the brink of another bull run.

The surge in Bitcoin‘s price trajectory has been capturing considerable interest lately, as it moderately lets go of some of the accumulated increases from the previous weeks.

To date, Bitcoin has experienced a decline of approximately 7.6% compared to its record high of $99,645 reached just recently. Currently, it’s being traded at around $92,476, representing a decrease of about 4.6% in the last 24 hours.

What To Expect From This Current Bitcoin Decline

In the midst of Bitcoin’s current price adjustment, an examination by CryptoQuant’s BaroVirtual suggests a consistent drop in Bitcoin holdings on significant cryptocurrency trading platforms. The analyst interprets this trend as signs of a thriving “bull market.

In the same way as the trend from March to November 2020, the analyst pointed out a comparable decrease in exchange reserves during that time. This was followed by significant inflows in December 2020, which intensified the demand for buying and pushed prices upwards.

In simpler terms, it appears that people who didn’t take advantage of previous chances to stockpile are now likely joining the market ahead of another potential price increase, based on the current decrease in exchange reserves.

BaroVirtual noted:

Some market players who didn’t adequately stockpile Bitcoin previously might be buying it now, as they believe this dip could be the final one before another significant price increase.

Retail Traders Yet to Join The Market

Currently, it seems that institutional investors and wealthy individuals hold a significant position in the market, while individual retail traders appear to trail behind.

A CryptoQuant analyst called Woominkyu has provided insight into this phenomenon, pointing out that the Korea Premium Index, which is significant for gauging retail participation, stays under -0.5. This value indicates a low level of engagement by retail investors during the current market surge.

Based on Woominkyu’s findings, it’s been noticed that the Korea Premium Index often reaches unusually high levels before Bitcoin’s price peaks. He underlined that keeping an eye on this index might offer crucial clues about predicting possible market high points.

It is worth noting that the absence of retail traders in the recent crypto rally is quite noteworthy, as their eventual participation could lead to heightened buying pressure and potentially drive Bitcoin’s price higher.

Currently, the cryptocurrency market is experiencing a significant downturn, as the total market capitalization has dropped approximately 6% within the last day, bringing it down to around $3.34 trillion at present.

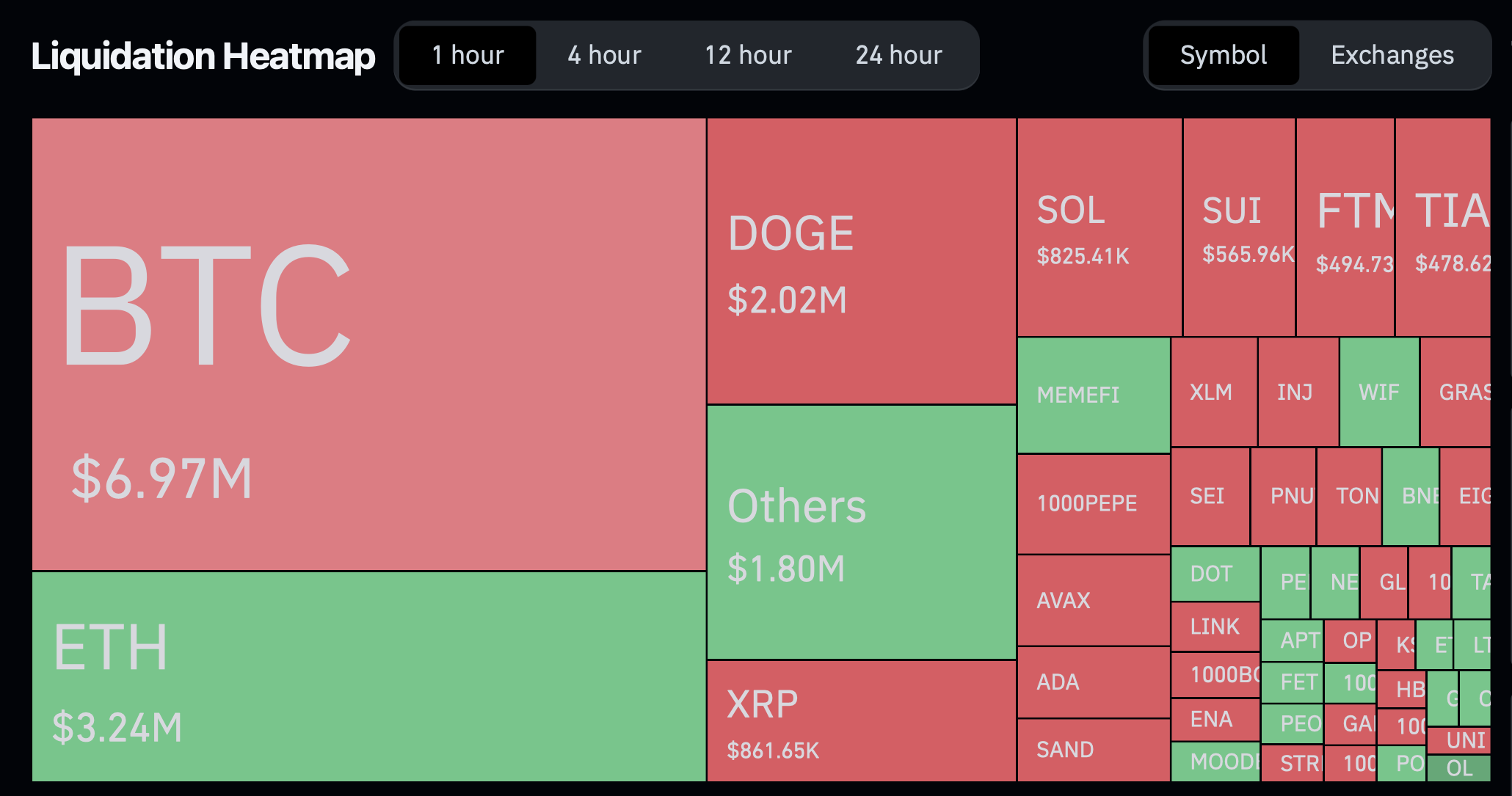

Based on information from CoinGlass, approximately 206 thousand traders were forced to close their positions over the last 24 hours, resulting in a total liquidation value of around $624.99 million in the cryptocurrency market.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-27 04:35