As the first month of 2025 whimpers to a close, Bitcoin (BTC) is still lingering within its post-election slumber like a teenager refusing to get out of bed. Despite nearing two historical closing candles, which sound more like something out of a witch’s cookbook, some analysts think the market’s decided to take a nap with all the good news tucked under its pillow.

Bitcoin Tiptoeing Around Historical Monthly Candle

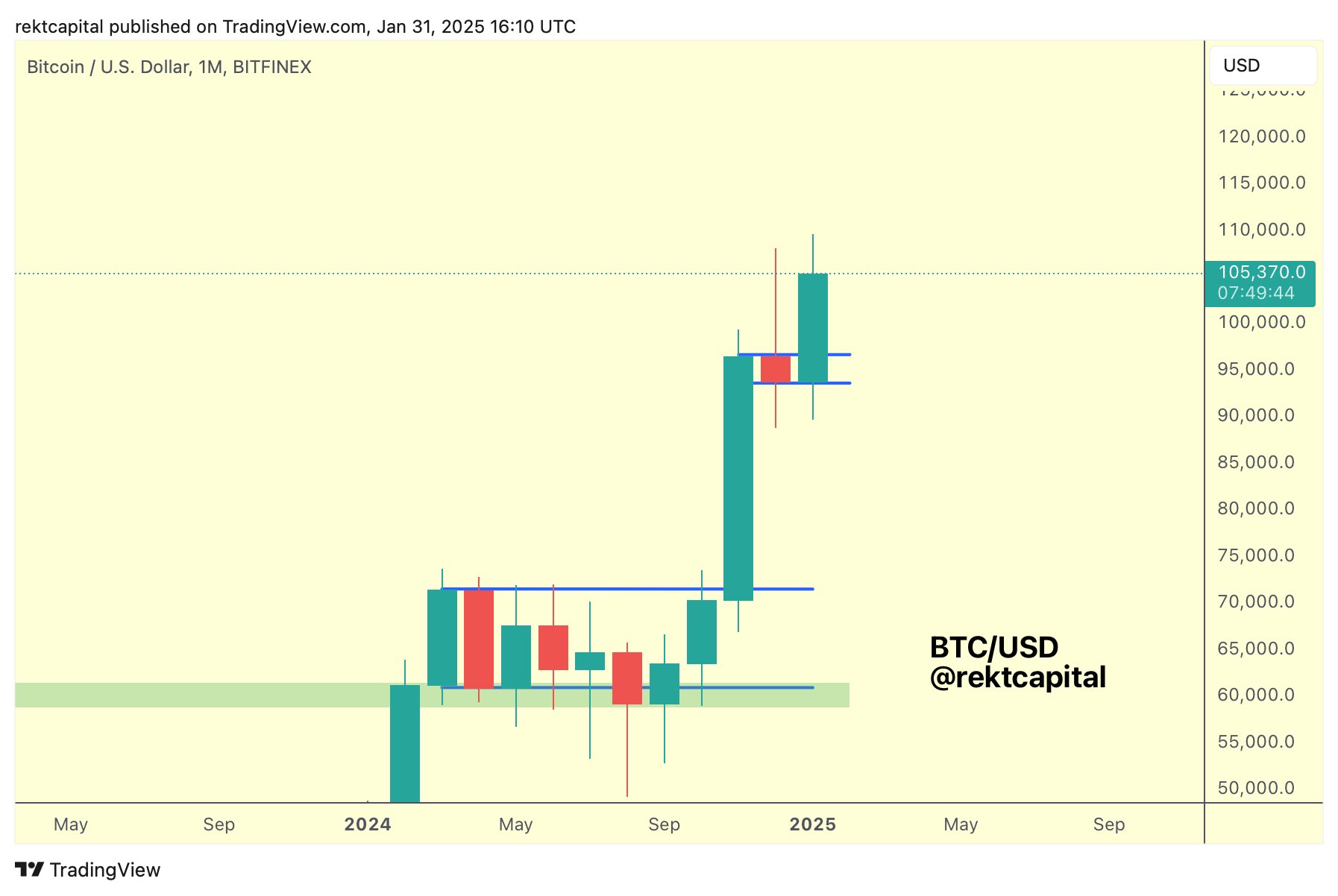

Despite multiple interruptions by market corrections, Bitcoin has been aimlessly wandering inside the unremarkable $90,000-$108,000 corridor since December 2024, finding comfort in the middle ground like a Goldilocks who can’t make up her mind.

Analysts have politely noted that BTC has performed decently, never straying far from the coveted $100,000 mark for long. Its recent stumble back into the $104,000-$105,000 zone is reportedly setting up for a candle that might just call down UFOs or play haunting melodies when seen under moonlight.

According to the ever-so-cheery analyst Rekt Capital, Bitcoin is a mere heartbeat away from closing the month above the mystical $100,000 threshold for the first time. Lo and behold, a new Monthly Candle is coming to confirm a breakout from its bullish lullaby.

Additionally, a “historic Weekly Close” could be upon us if Bitcoin wraps up the week above $104,416. Rekt Capital, wielding his crystal ball, suggests that similar closings have historically led to “continued upside to new all-time highs.” Just what we needed, more history in the making.

However, Rekt Capital also noted that Bitcoin is likely getting ready for the second act in its Post-halving Parabolic Play, with a new “Price Discovery rally” possibly debuting mid-February. Curtains up!

Apparently, the second leg starts around the 16th week of the Parabolic Phase, and Bitcoin is currently in its 14th week, harmoniously drifting from the first Price Discovery Correction. So strap in, dear investors, and “patiently HODL” like you’re holding onto a cat that’s just seen a cucumber.

Crypto Market Confidence: Shaken or Stirred?

Another market sage noted that Bitcoin has been “stuck in rage for a while now,” expecting a jolt of bullish energy post-FOMC news. But alas, BTC decided to mosey sideways, idly contemplating its navel for the next few days.

Aurelie Barthere, Principal Research Analyst at Nansen and occasional fortune teller, suggested that the market appears to be “satiated for now,” with bullish news gliding past like a tumbleweed.

The report spotlighted recent regulatory shake-ups, including the overturn of SAB 121 and the executive order for a US Crypto Stockpile, deemed “extremely bullish” and possibly paving the way for wider crypto adoption.

Meanwhile, the Elon Musk-led Department of Government Efficiency (DOGE) might use public blockchain for tracking expenses, though this news barely raised an eyebrow in the market, leading to “underwhelming price action” across the board.

Barthere emphasized that momentary satiation has rendered the market more responsive to negative vibes rather than positive tidings. Reflecting on a DeepSeek-triggered hiccup from Monday, she observed an initial tepid recovery as buyer confidence seemed somewhat wobbly.

Nonetheless, unlike the hyperactive high-beta tokens, Bitcoin’s Monday sell-off was barely a blip on the radar, showing an “interesting level of dispersion.” Bitcoin remains the darling of this new, policy-charmed market, like a pampered poodle at a dog show. 🐩

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-02-01 09:42