The Crypto Madness: Record Cash, Drama, and 4MB Bitcoin Shenanigans!

Oh, the labyrinthine whims of crypto capital! February 2025 unveiled its peculiar charm by seeing an increase–nay, a leap!–of 14.4% in venture funding compared to January. Humanity, which cannot help but chase both dreams and insanity, bore witness to 98 deals, up from January’s dreary tally of 86. Can ambition ever satiate itself? Of course not. The report by Wu Blockchain was no less dramatic than a Dostoevskian monologue.

VC Monthly Report: February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate Investments. Figure, Ethena, Bitwise, Raise, etc. are the projects with the largest amount of public financing this month. Read more

— Wu Blockchain (@WuBlockchain) March 3, 2025

But–and there is always a but, as life itself mocks us–the echoes of February 2024 whispered a different tune: funding had fallen by a despondent 35.1%. That year, 151 fortunate dreamers had basked in investor glory, a number that now dwindled like the sigh of a disappointed philosopher. “Et tu, Crypto-cycle?” one might ask.

Still, the monotony of despair had its fissure of hope. A grand total of $951 million meandered its way into crypto coffers, up from January’s paltry $831 million. Investors, those inscrutable alchemists, forged their focus on stablecoins and payment solutions as if trying to declutter some cosmic ledger. Stablecoins! The new Russia for humanity’s Napoleonic ambitions. 😂

Stablecoins and Payments Lead the Charge

Take Raise, for instance–a gift card startup playing crypto’s divinely ordained pied piper, pulling in $63 million as if it were mere crumbs. Stablecoins would, of course, make transactions “smoother.” How wonderfully dull and yet grotesquely necessary. Plasma, meanwhile, captured the attention of the masses with its $24 million haul, touting “zero-fee” Tether transactions as if announcing salvation for a congregation of crypto sinners. Framework Ventures, Bitfinex, and none other than Tether’s very own Paolo Ardoino lent their blessings. Amen. 🤑

Source: Wu Blockchain

Meanwhile, Ethena, seemingly born for Shakespearean drama, continued to mesmerize the world with its ambition to resurrect traditional finance through tokenized trinkets of trust. With Franklin Templeton and F-Prime Capital swirling in its orbit, one wonders: do they dream of a digital Hamlet too? Remote controlling finance while crying, “To digitize or not to digitize.”

Figure and Sixth Street, not ones to be outdone, tossed $200 million into a private liquidity bonfire, while Bitwise charmed investors to the tune of $70 million. Meanwhile, the Israelis at Blockaid raised $50 million–perhaps to protect us from our own folly in this ceaseless digital bacchanal.

Bitcoin and Modular Blockchain Projects Gain Traction

Ah, but let us tarry no longer! Bitcoin had its turn as the wounded hero in this tragicomedy. Taproot Wizards snagged $30 million to—wait for it—expand smart contracts through something about a 4MB block. Will the wizardry save, or will the block—dare I say—block them? Only the OP_CAT gods know. 😂

And Cygnus, the modular blockchain dreamer, found $20 million tucked in its hat from Manifold and OKX Ventures. One imagines them whispering fervently to their investors, “Efficient networks are the new Dostoevskian brothers—structured, scalable, and certainly full of intrigue.”

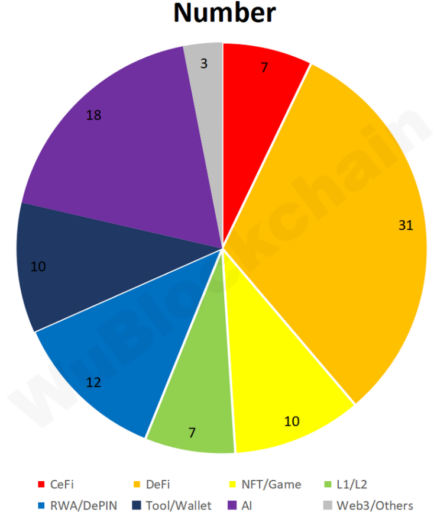

Oh, and AI—because nothing modern can breathe without muttering the sacred “artificial intelligence.” Prime Intellect clutched $15 million, with industry darlings like Andrej Karpathy and Clem Delangue applauding from the stage. A year ago, DeFi led at 31.6%, with AI timidly trailing at 18.4%. NFTs, GameFi, CeFi, and others? Think of them as the petty nobility of crypto’s ongoing Dostoevskian epic.

Source: Wu Blockchain

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-03-03 23:36