As a seasoned financial analyst with over two decades of experience, I have witnessed the evolution of financial markets from traditional assets to digital currencies like Bitcoin. The recent announcement by Texas to establish a strategic Bitcoin reserve is an intriguing development that reflects the growing acceptance and recognition of cryptocurrencies in mainstream finance.

Texas is progressing with proposals to establish a strategic Bitcoin reserve. Representative Giovanni Capriglione revealed yesterday that he has proposed legislation allowing the state to receive donations, charges, and taxes in Bitcoin format, under the stipulation that these funds must be kept for at least five years.

As an investor, I firmly believe that one of the most formidable challenges we face is inflation. However, considering this predicament, establishing a strategic Bitcoin reserve and investing in Bitcoin could prove to be mutually beneficial for our state, offering both protection against inflation and potential growth opportunities.

As an analyst, I’m observing a significant development in the US financial landscape: Texas is contemplating the integration of Bitcoin into its fiscal strategy, making it the second state to do so after my analysis. In November this year, legislation was proposed in Pennsylvania for the creation of the Pennsylvania Bitcoin Strategic Reserve. If passed, this plan envisions setting aside up to 10% of the state’s treasury reserves as an investment in Bitcoin.

Following the approval of the so-called Bitcoin Rights Bill by the Pennsylvania House of Representatives in October, Pennsylvania residents now have the opportunity to use Bitcoin as a possible form of payment. This legislation also ensures that residents can independently manage their own cryptocurrencies while protecting their rights.

Representative Mike Cabell proposes this bill aims to turn the Commonwealth into a welcoming environment for blockchain advancements, thereby equipping our citizens with secure means to participate in the digital economy.

The decisions taken by Texas and Pennsylvania to create strategic Bitcoin reserves are encouraging news for the cryptocurrency economy, even though these actions are currently happening at a state level, not federally. Yet, Dennis Porter, CEO of NPO Satoshi Action Fund who collaborated with Capriglione on drafting the legislation, remains optimistic.

In a recent interview on CNBC New York, he expressed his viewpoint, stating that “the ideal location to foster political support for bitcoin lies at the state level“. He further explained that “the most effective action we can take is to pass this legislation at the state level. This will generate momentum for federal legislation.

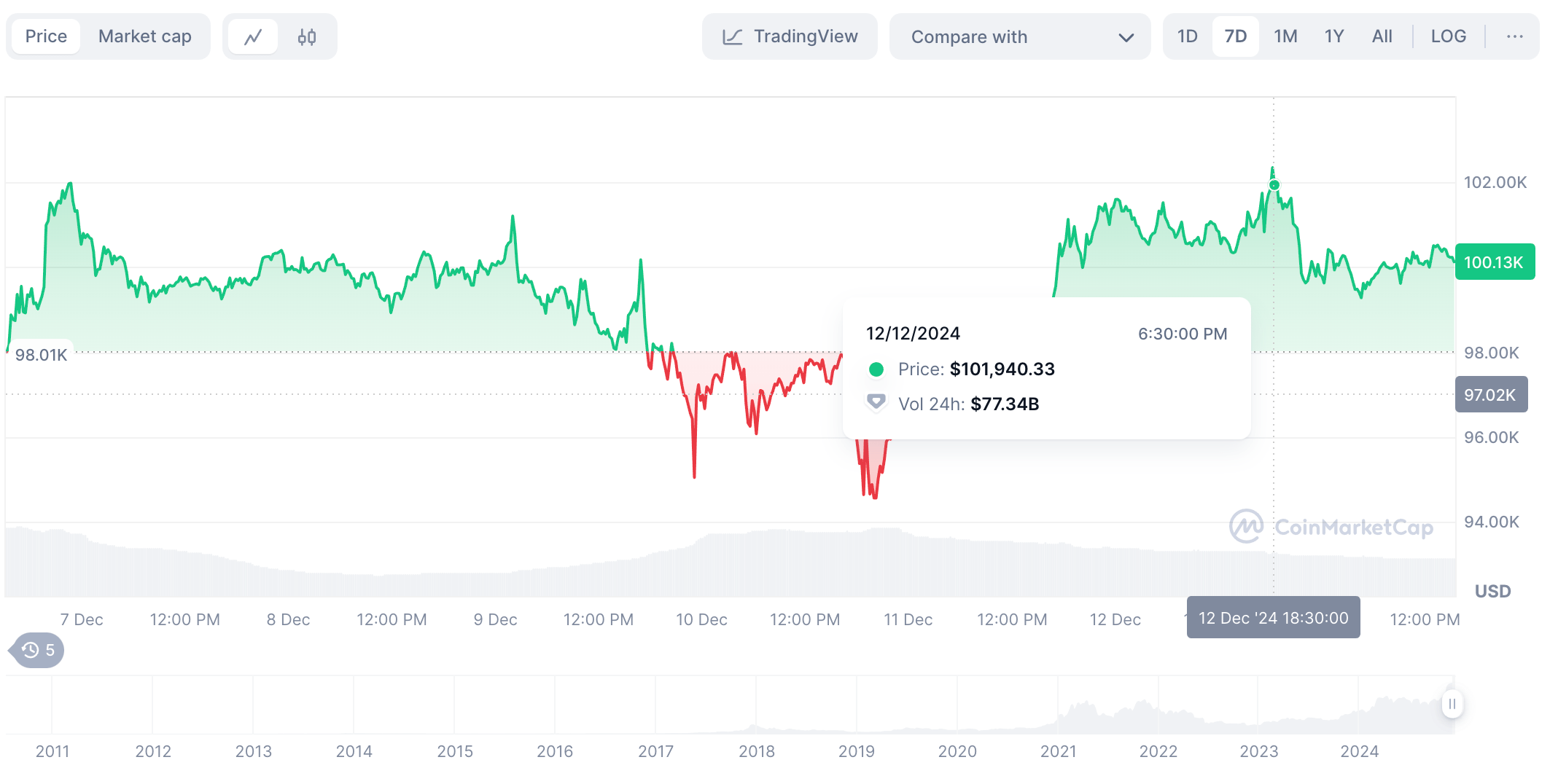

Following the surge after the U.S. election and hitting the significant mark of $100k, Bitcoin continued its upward trend in response to Texas’ announcement about establishing a Strategic Bitcoin Reserve. However, at the moment of this writing, it has seen a minor dip.

In a recent report, asset manager BlackRock acknowledged that throughout its brief existence, Bitcoin has experienced significant price increases and drops. At present, BlackRock’s Bitcoin Trust ETF oversees approximately $53.8 billion in assets.

As a researcher delving into the dynamic world of cryptocurrencies, I find myself pondering over the Black Rock report’s assertion that Bitcoin’s inherent volatility and distinctive traits prompt the question: What is its ideal position within investment portfolios? The financial titan recommends that investors cap their Bitcoin holdings at a modest 2% of their total portfolio.

It’s Not Only Bitcoin That’s In The Pound Seat

The surge in Bitcoin’s value brings positive implications for other digital currencies, as they often follow a similar trend. This includes popular meme coins, as well.

Consider the example of the meme coin/DeFi token known as Crypto All-Stars ($STARS). At present, it’s being offered during a presale phase. With an impressive annual percentage yield (APY) of 200%, and growing anticipation for its upcoming MemeVault, Crypto All-Stars has already demonstrated significant success.

With only seven days remaining before the official launch of $STARS, they’ve already managed to secure over $15.3M in funding. If you’re interested in buying $STARS at a presale discount, now is the time! Just remember to do your own research (DYOR) to make an informed decision. To get started, check out Crypto All-Stars on platform X and begin your investigation.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-13 17:28