As a seasoned analyst with years of experience navigating the ever-evolving cryptocurrency landscape, I find the current Ethereum (ETH) staking trend particularly intriguing. The 69.2% institutional participation in ETH staking, with the majority using third-party platforms, underscores a significant shift in the Ethereum ecosystem since the network’s transition to proof-of-stake (PoS).

Approximately 7 out of 10 institutional investors in Ethereum (ETH) are involved in ETH staking, and around 61% of these investors prefer to use external staking platforms for this purpose.

Ethereum Staking Landscape At A Glance

Based on findings from Blockworks Research, it’s noted that approximately two-thirds (69.2%) of institutional investors who own Ethereum are actively participating in staking the Ethereum network’s native ETH token. Interestingly, a significant majority (78.8%) of these participants belong to investment firms and asset management companies.

Approximately a quarter of the surveyed institutional investors, representing about 22.6%, have reported that Ethereum (ETH) or an Ethereum liquid staking token (LST) makes up over 60% of their overall investment portfolio.

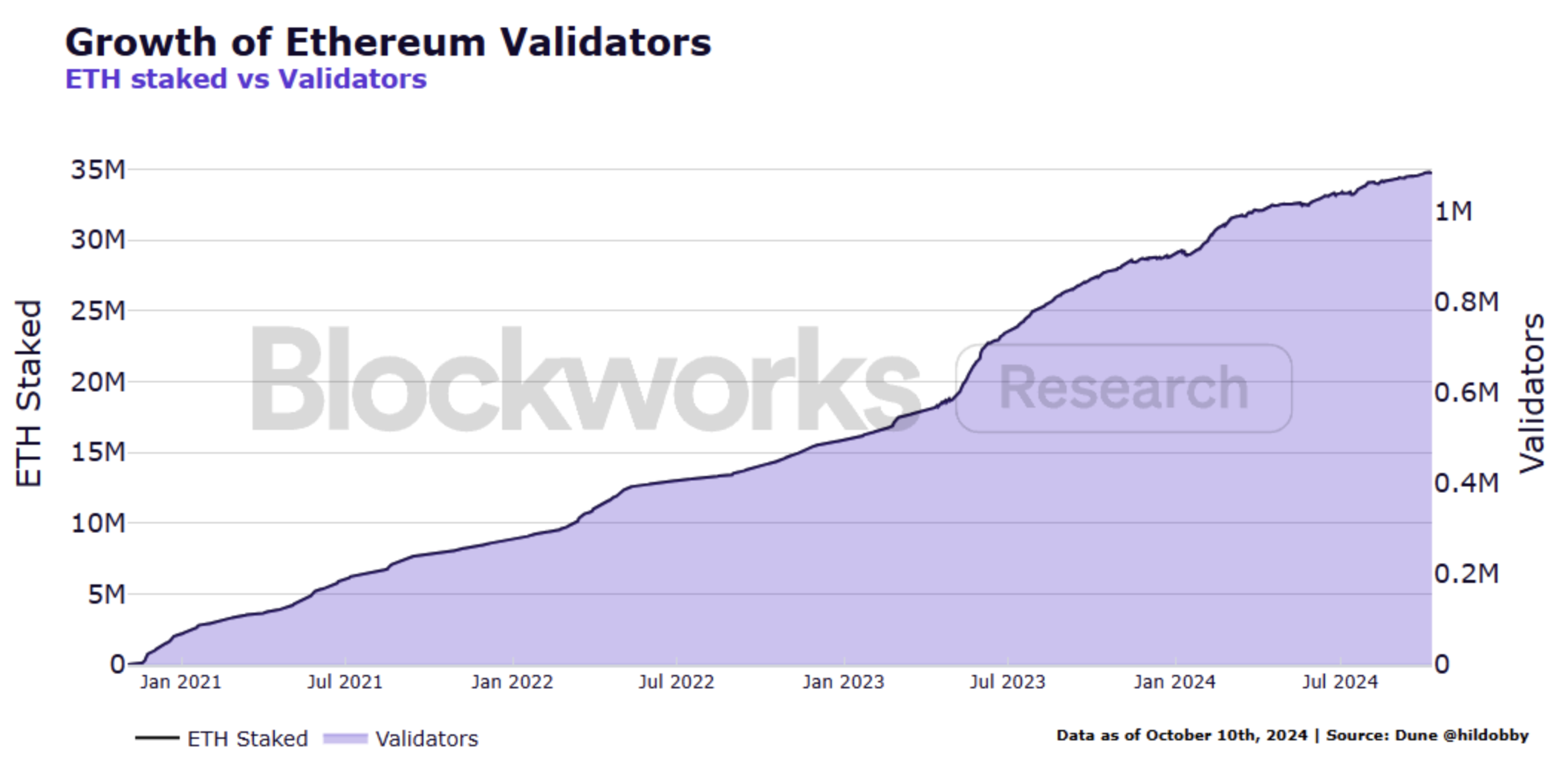

The report highlights significant changes in the Ethereum staking environment, as the network moved from a proof-of-work to a proof-of-stake consensus model with the Merge update.

Currently, approximately 1.1 million validators have staked around 34.8 million Ether on the network. After the Merge, Ethereum network members could not withdraw their Ether until the Shapella update, which took place in April 2023.

Following the initial withdrawal period for ETH, there has been a consistent increase in deposits into the network, suggesting a robust interest in ETH staking. Currently, approximately 28.9% of the entire ETH supply is being held in staking contracts, making it the network with the highest monetary value of locked assets, estimated to be worth more than $115 billion.

As a crypto investor, I find it significant to mention that the yearly return on staking Ethereum (ETH) typically hovers around 3%. Yet, as more ETH gets staked, the return rate gradually decreases in proportion. Nevertheless, network validators have an opportunity to collect extra Ether through transaction fees during peak network activity, which can be quite lucrative.

Third-Party Staking Overshadows Solo Staking

It’s possible for anyone to engage in Ethereum staking, whether they choose to do so independently (solo staking) or by transferring their Ethereum to a different party for staking (delegating ETH to a third-party platform). Solo staking allows the individual complete control over their Ethereum, but it also carries a substantial initial investment requirement of at least 32 ETH, which currently equates to over $83,000 based on the current market price of approximately $2,616 per ETH.

On the flip side, holders can stake as little as 0.1 ETH via third-party services, but they will have less control over their assets. Lately, Ethereum co-founder Vitalik Buterin has emphasized the importance of lowering the entry barriers for solo stakers of ETH to foster greater network decentralization.

At present, approximately 18.7% of individuals involved in staking are choosing to go it alone. Yet, recent data indicates a decrease in popularity for solo staking, primarily because of its high barrier to entry and the ineffectiveness of capital that is tied up during this period. The report highlights these reasons as the main contributors to this trend.

When you secure ETH in staking, it becomes unavailable for other financial transactions within the DeFi (Decentralized Finance) sector. This implies that you can’t offer liquidity to various DeFI building blocks, nor use your ETH as collateral to borrow funds. This situation involves an opportunity cost for individual stakers, who must also consider the fluctuating reward rates of staked ETH to optimize their risk-balanced returns.

Due to its increasing appeal, external staking options are gaining traction among Ethereum stakers. Yet, these platforms, mainly controlled by centralized exchanges and liquid staking methods, spark worries regarding the potential centralization of the network.

Approximately half of Ethereum (ETH) stakers who use external staking services rely on a single integrated platform like Coinbase, Binance, or Kiln, along with other similar platforms.

The report highlights key factors driving institutional investors to use third-party platforms, including platform reputation, supported networks, pricing, ease of onboarding, competitive costs, and platform expertise.

Despite the expanding Ethereum staking environment, ETH’s price hasn’t mirrored this growth yet. For quite some time, ETH has lagged behind BTC in terms of performance, but it’s started to pick up steam following the US Federal Reserve’s (Fed) move to reduce interest rates.

Nonetheless, some crypto research firms remain optimistic about ETH’s potential comeback against BTC later this year. As of press time, ETH is trading at $2,616, up 0.8% in the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-10-19 04:17