As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless bull and bear cycles. The recent 13% pullback in SUI, the native token of the Sui Network, has certainly caught my attention.

Over the last week, SUI, the token of the Sui Network, has experienced a 13% decline, pausing its upward trend. This sudden break from a one-month pattern has sparked a pessimistic outlook among investors, who anticipate more drops in the value of this cryptocurrency.

SUI Loses Key Support Zone

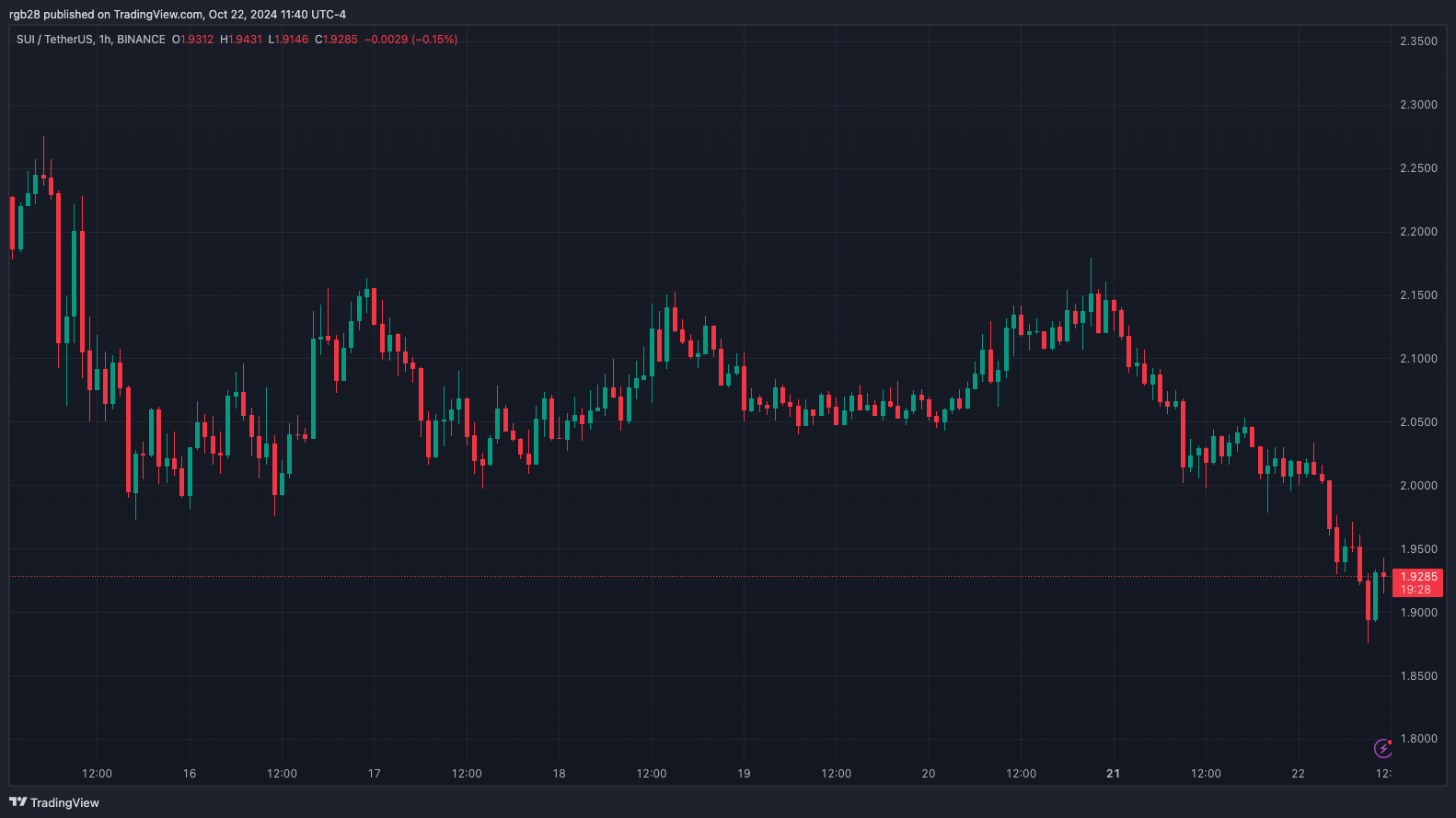

SUI has been on a downtrend this week, losing the recently gained levels alongside most of the market. The cryptocurrency saw a 5.3% drop in the last 24 hours, which has worried some investors and crypto analysts.

During Q3, the token stood out with exceptional performance, taking the lead among the market’s alcoins that showed gains, as most were in positive figures across various timeframes. To kick off the month, SUI experienced a 15% weekly growth spurt, propelling it towards a fresh record high (ATH).

Moreover, the token experienced an increase of 25%, surpassing the $2 mark and touching a fresh high of $2.35 in value. Yet, this upward trend was marred by accusations of insider trading on October 13th.

According to the market analyst LightCrypto, it’s been suggested that the ongoing selling of SUI tokens by insiders, amounting to approximately $400 million, could potentially impact SUI’s overall performance.

After the accusations surfaced, the cryptocurrency experienced a 15% adjustment in its value each day, but it stayed above the crucial $2 support point. Since that time, the cryptocurrency has been moving steadily, staying within the $2 to $2.15 price range until now.

On Tuesday morning, SUI fell below the $2 support level, causing it to dive approximately 6.5%, nearing the $1.87 point before regaining stability in the $1.90 region. This downward movement signified a 13% decrease from its price a week prior and an 18.4% fall from its all-time high (ATH).

Is A 30% Pullback Looming?

After the latest fluctuations in SUI’s value, some cryptocurrency experts are predicting another potential dip might occur. One such expert, Altcoin Sherpa, has shared his insights into the current market trends, which have slowed down following Bitcoin reaching $69,000 on Sunday.

Sherpa observes that the market’s upward trend appears temporarily halted, noting that many alternative cryptocurrencies are either retreating or holding steady. In his view, tokens such as Bittensor (TAO) and SUI, which experienced substantial growth in September, still have “some more downturn” before resuming their uptrend.

The analyst forecasted a 25% to 30% correction toward the $1.4 support zone or lower, detailing that there will probably be “plenty of bounces” along the way. Similarly, crypto investor Doji noted that the cryptocurrency broke “a massive 1-month stricture to the downside.”

The investor revealed that the token dropped below the lower trendline of a broadening wedge pattern on its 1-month chart. Doji suggested that SUI will retest the pattern before dropping lower toward the lower liquidity spot at $1.4. Nonetheless, he expects “to see the middle of the macro range at some point.”

Although there was a decrease, SUI experienced an impressive 30.7% increase over the monthly period, currently valued at $1.92 as we speak.

Read More

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- What Alter should you create first – The Alters

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-23 15:04