As a seasoned crypto investor with a knack for spotting promising opportunities, I find myself intrigued by the recent performance of SUI, the native cryptocurrency of the Sui blockchain network. Having navigated through numerous market cycles and witnessed my fair share of bull runs and bear markets, I have learned to read between the lines when it comes to price action and technical indicators.

Currently, the cryptocurrency native to the Sui blockchain network, SUI, is experiencing a surge in buying interest after a period of altcoin selling pressure. Following an all-time high of $2.36 reached on October 12th this month, the SUI price experienced intense selling pressure and dipped to $1.75 lows before reversing its course last week.

Over the past day, the value of SUI increased by another 10%, reaching $2.02 and currently holding a market capitalization of approximately $5.59 billion. On the technical front, the altcoin has displayed strength once more, with its SUI/USD 1-day chart indicating that it may soon reenter an ascending parallel channel, which it had briefly left on October 22.

In the picture you see, the channel’s incline suggests a positive or bullish trend for the SUI price, as it fluctuates between two paralleling lines that guide its movement.

Courtesy: TradingView

When a price falls beneath a particular range and then tries to rise again, it could be a sign of an upcoming change in direction, possibly a recovery or reversal. The fact that SUI might re-enter its channel indicates a surge in buying interest, which may suggest that the earlier breakout was potentially a trap set by bears.

Additionally, a bear trap refers to an instance where the asset temporarily falls outside its channel or trendline but swiftly rebounds, demonstrating strong buying activity from the bulls. A bear trap is typically marked by increased trading volume, suggesting significant buying interest at lower prices. It appears that SUI may have experienced this scenario as its trading volume has surged by 39% in the last 24 hours, peaking at $1.34 billion.

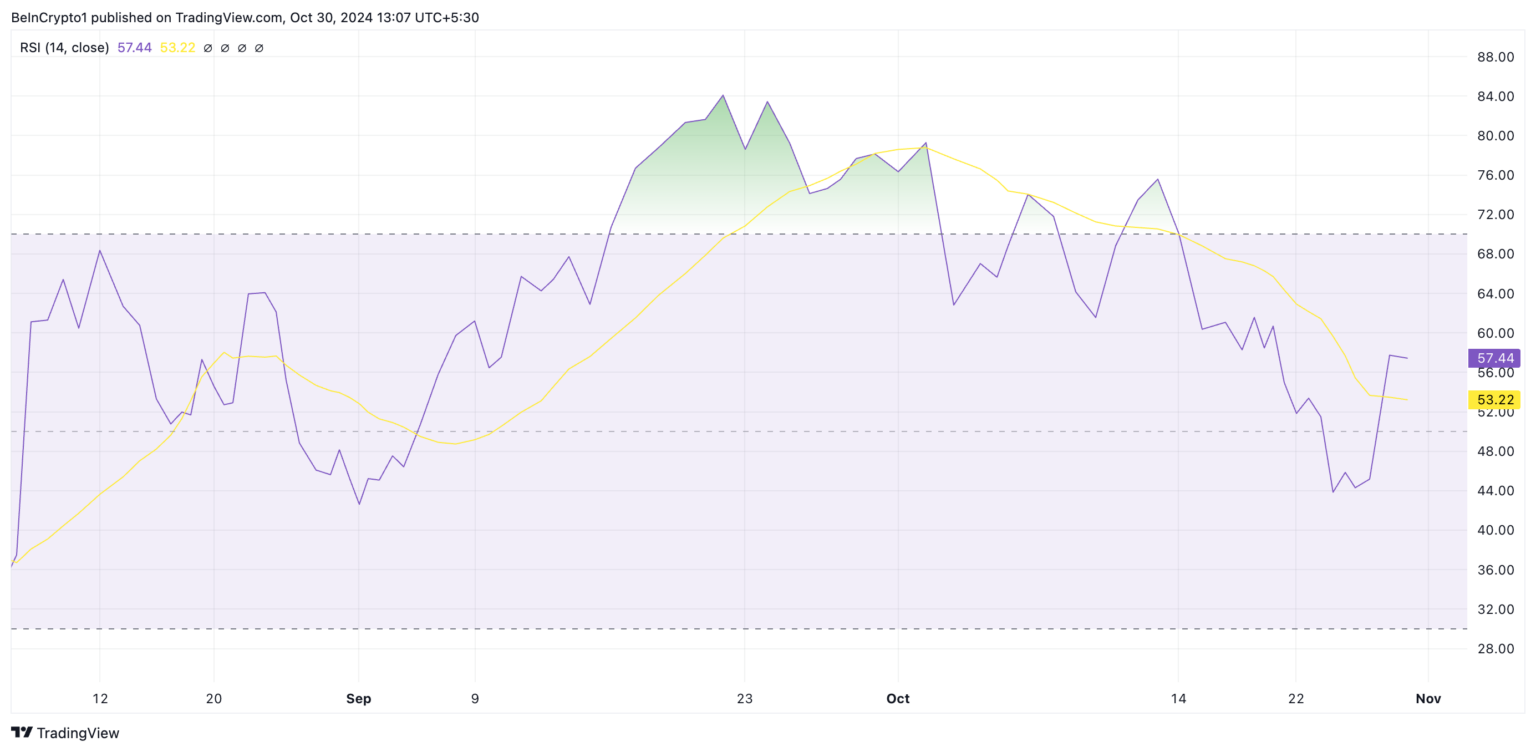

To add more, another indicator, the Relative Strength Index (RSI) of SUI, aligns with the increase in demand. At present, the RSI is on an upward trajectory at 57.44, demonstrating that buying momentum is gaining strength over the selling activity, signifying a rise in demand.

Courtesy: TradingView

Is SUI Price Gearing for a New All-Time High?

Earlier in the year, the value of SUI peaked at an unprecedented $2.35, but it’s currently encountering a significant barrier at $2.30. If it manages to surge beyond this point and rejoin its usual pattern, it could potentially regain its previous record high of $2.36 from October 13.

However, should SUI not manage to surpass the $2.30 barrier, the current optimistic view may prove incorrect, potentially causing the price to fall towards the $1.64 support zone instead.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-10-30 16:53