As a seasoned crypto investor with over a decade of experience in this volatile yet exciting market, I’ve seen my fair share of bull runs and bear markets. The current surge in SUI, a promising Layer 1 project, has caught my attention. With its impressive performance, reaching new all-time highs and showing uncanny resemblance to Solana’s historic rally, it’s hard not to get excited about this altcoin.

The cryptocurrency market has surpassed a total value of over $3.7 trillion, and within this, the market cap of Layer 1 tokens has climbed to approximately $950 billion. One standout performer among these Layer 1 projects is SUI, which is currently experiencing increased interest. As of now, SUI’s price stands at around $4.35, with a 24-hour volatility rate of 18.5%. Additionally, its market cap is approximately $12.72 billion, and it has traded a volume of roughly $4 billion over the past 24 hours.

Boasting a market capitalization of approximately $12.42 billion, its value has surged by an impressive 14.81% in the last day. Notably, it just broke through a new record following its leap beyond the significant $4.2595 threshold.

SUI’s Successful Breakout Rally

Today, the price of SUI reached an unprecedented peak of $4.2595, breaking its previous record high. This significant increase in demand has successfully overpowered the substantial resistance from sellers that had caused a reversal earlier today.

Source: Tradingview

Previously, the price dip ended below the significant resistance range between $3.84 and $3.89. Yet, optimistic market feelings boosted the altcoin value, leading to a succession of bullish trends.

As a crypto investor, I’m seeing a positive development: The 50 and 100 simple moving average lines have crossed over, suggesting the uptrend might continue. Additionally, the DMI indicator is indicating a significant increase in trend momentum, as evidenced by the upward tick in the ADX line.

At present, the altcoin is poised to close robustly above the $4.1785 level, which corresponds to the 1.272 Fibonacci retracement level. Such a closure would boost the likelihood of the SUI price trajectory touching the $4.5832 mark, representing the 1.618 Fibonacci extension level. This prospective high would establish a new record peak for the asset.

Will SUI Mimic Solana’s Rally?

At present, the total value locked (TVL) in SUI stands at approximately $2.915 billion, which is around 10% above the TVL of Solana, valued at $23.11 billion.

Moreover, the number of transactions processed each second on the Sui network stands at approximately 28. In contrast, Solana boasts a much greater transaction per second rate of around 4,447.

Although there’s a significant gap between these networks, the price movements exhibit a striking similarity. As noted in Cleanwater.sui’s latest post, the SUI price trend mirrors Solana’s, showing a sharp rise following a period of consolidation or bearish movement. This suggests that SUI might continue its steep upward trajectory.

The ETF Effect

Filing Grayscale’s 19b-4 form with the US Securities and Exchange Commission (SEC) to list their Solana Trust as an Exchange Traded Fund (ETF) has positively influenced Solana’s market value. In other words, from our perspective, Grayscale is overseeing a Solana Investment Trust (SUI Trust).

In August 2024, we officially started managing our trust’s assets and they currently stand at a total of $6,344,000. Additionally, the Net Asset Value (NAV) per share has increased to $0.5488, contrasting with an initial launch price of $10.24.

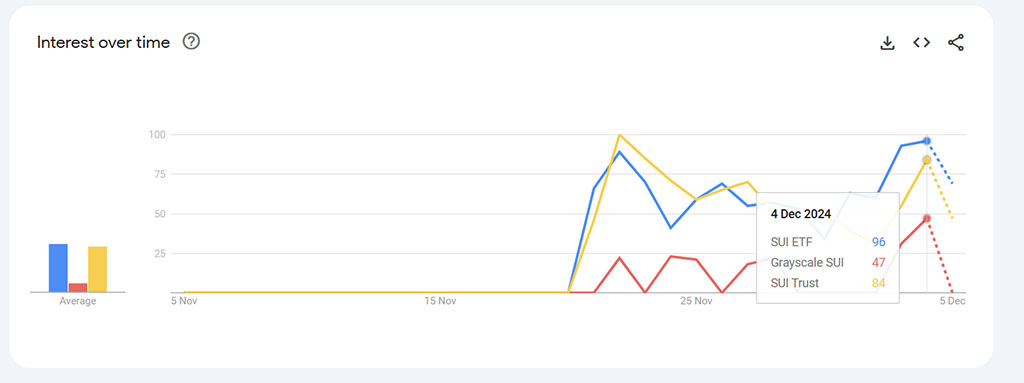

As a researcher, I’ve observed an exceptional 5x surge in the performance of Grayscale’s SUI Trust. With the growing pro-cryptocurrency sentiment under the Trump administration, the potential for ETF approvals is on the rise. Interestingly, this optimism seems to be reflected in the increasing number of searches related to SUI ETFs, as indicated by Google Trends.

Over the last month, worldwide searches for SUI ETF have risen significantly. Consequently, conversations about SUI ETF are becoming more frequent.

In summary, with the price aiming towards $4.58 in the near term, the shifting cryptocurrency market conditions are fueling the upward trend. In a favorable regulatory environment for crypto, the growing talks about ETF could serve as the next significant positive factor driving the market higher.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

2024-12-05 18:03