As a researcher with a background in cryptocurrencies and blockchain technology, I have been closely monitoring the Ethereum market for quite some time now. The anticipation of the approval of the spot Ethereum ETF in the United States has created a buzz in the community, leading to heavy accumulation of ETH by investors. The increasing number of staked ETH and its proximity to its all-time high is a clear indication of this trend.

As a researcher studying the Ethereum market, I’ve observed that analysts anticipate the approval of the Ethereum ETF in the United States within the next two weeks. Consequently, investors in ETH have been actively buying large quantities of the cryptocurrency in preparation for the expected price surge following the approval. According to on-chain data, the total amount of staked ETH in circulation currently reaches an all-time high, while the circulating supply remains relatively stable.

Julio Moreno, CryptoQuant’s head of research, wrote:

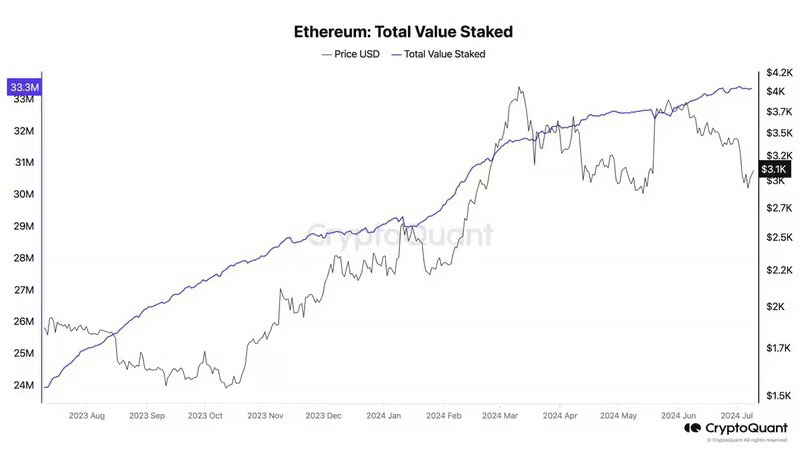

As a researcher studying the Ethereum network, I’ve observed that the amount of ETH being staked has persistently risen and presently hovers close to its record high, reaching approximately 33.3 million ETH or around 27.7% of the entire supply.

As an analyst, I’ve noticed that the rising Ethereum supply has brought back its inflationary nature. This trend poses a challenge to Ethereum’s role as a reliable store of value. To combat this issue, one potential solution is staking Ethereum. By staking my ETH for a predetermined duration and removing it from circulation, I can help decrease the overall supply and potentially mitigate the inflationary effects.

As a market analyst, I’ve observed that the Ethereum (ETH) supply is expanding once more, albeit at a leisurely pace. However, the allure of ultra-sound money has waned, and currently, the total supply stands at its highest point since December 11, 2023.

Photo: CryptoQuant

A Look into Ethereum Liquidity

As a market analyst, I’ve observed some intriguing trends in the spot trading volumes of Ether (ETH) and Bitcoin (BTC) recently. According to my analysis, ETH’s spot trading activity has been nearly equal to that of Bitcoin, with ETH’s volume ranging from 80% to 90% of Bitcoin’s volume over the past few weeks.

Approximately 12% of the entire Ether supply is being used in smart contracts and inter-blockchain bridges as per CoinMetrics’ data. Moreover, about 40% of Ether’s cryptocurrency stockpile is considered “secured” or “immobilized,” meaning it isn’t being actively traded in the market when we take into account tokens that are staked.

40% of Ethereum supply is locked~28% staked~12% smart contracts and bridges

ETH ETF flows are going to rapidly move this market

— Tom Dunleavy (@dunleavy89) July 9, 2024

The current attention is solely on the approval process for an Ethereum spot Exchange-Traded Fund (ETF). Akin to Bitcoin, the acceptance of this Ethereum ETF could lead to a significant surge in investment, potentially pushing Ethereum’s price to unprecedented highs, such as $5,000 or even surpassing that. Analysts anticipate massive inflows worth billions of dollars into Ethereum ETFs shortly after approval.

12 hours ago, Justin Sun (@justinsuntron) allegedly spent 5M $USDT to buy 1,614 $ETH at ~$3,097.

Starting February 8th, it’s possible that Justin Sun purchased approximately 362,751 Ethereum tokens ($ETH), which would amount to around $1.11 billion based on the estimated price of $3,047 per token at the time. This transaction is recorded across three different wallets (for further information, please refer to previous posts 👇).

Note that he also deposited 45M $USDT to…

— Spot On Chain (@spotonchain) July 11, 2024

Justin Sun, the founder of Tron, has amassed a significant amount of Ethereum, totalling over $1.1 billion in value during the previous months.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-07-11 14:33