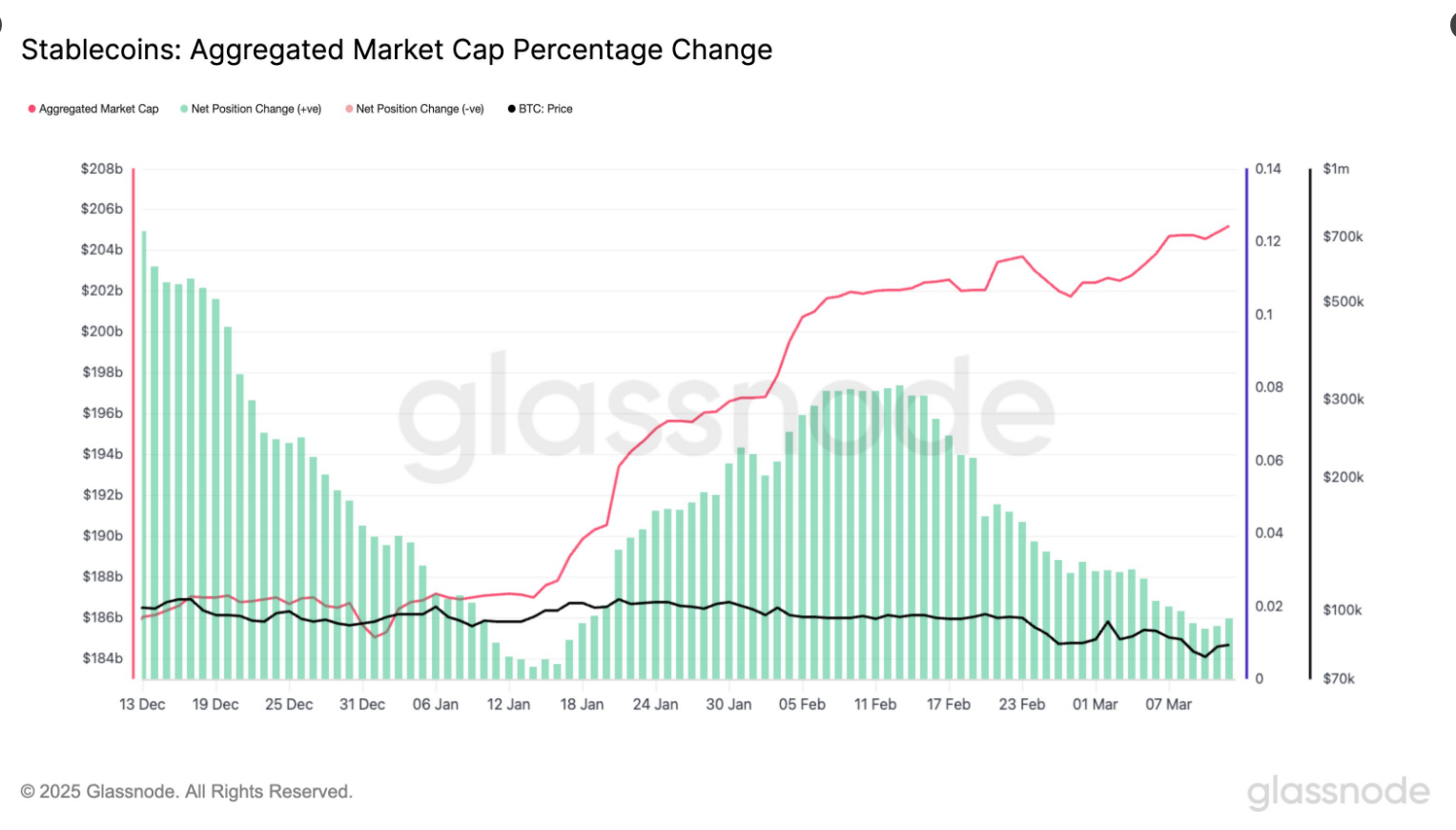

Ah, 2025—a year that began with the stablecoin market flaunting a $20 billion increase in its total supply, as if it had just discovered the secret to eternal youth. With a 10% rise since January, the supply now hovers around $205 billion, a figure so grand it could make even the most stoic investor blush. According to Glassnode, this spike follows a rather unceremonious dip in late 2024, when the supply shrank from $187 billion to a paltry $185 billion. How very dramatic.

Stablecoins: The Comeback Kids

Stablecoins, those steadfast companions of the crypto world—USDT and USDC, to name a few—often serve as a cozy reserve for investors biding their time to pounce on assets like Bitcoin. This recent surge suggests that investor interest has reawakened, perhaps after a long nap during last year’s sluggishness.

Since Jan 1, the aggregate #stablecoin supply has increased by $20.17B (+10.9%), now reaching more than $205B.

For comparison, the December peak clocked in at $187B, but the supply actually contracted in the last two weeks of 2024 and dropped to $185B by January 2025.

— glassnode (@glassnode) March 13, 2025

This rebound is particularly noteworthy, given the steady decline throughout most of 2024. While past patterns hint that Bitcoin’s price might be influenced, whether this surge will lead to a crypto shopping spree remains as uncertain as the weather in London.

Bitcoin Investors: The Eternal Optimists

A growing stablecoin supply is often interpreted as a bullish omen for Bitcoin. Historically, Bitcoin’s price has risen in tandem with the stablecoin count, as if the two were engaged in a delicate dance. The logic is simple: more stablecoins mean more potential capital, just waiting to be unleashed into the market like a caffeinated bull in a china shop.

Some analysts believe this fresh injection could propel Bitcoin to new heights. However, not all stablecoins are destined for trading. Many are held for remittances, payments, or as a hedge against inflation, particularly in countries where local currencies are as stable as a house of cards in a hurricane.

Stablecoin Exchange Holdings Drop 21%

While the total supply is on the rise, only 21% of stablecoins are currently lounging on exchanges. This is a significant drop from 2021, when over 50% of the supply was readily available for trading, as Glassnode revealed. This shift suggests that while new coins are being minted, they’re not all being deployed into the crypto markets immediately. Perhaps they’re on a sabbatical.

This could indicate one of two possibilities: either stablecoins are being used more frequently outside of exchanges, or investors are still waiting for the perfect moment to strike. If the latter is true, the impact on Bitcoin might be as underwhelming as a soufflé that didn’t rise.

The stablecoin market is currently enjoying a resurgence, which is generally a positive development for the cryptocurrency sector. However, whether this will translate into a short-term boost for Bitcoin’s price remains as uncertain as the plot of a telenovela. Stablecoin utilization has been as unpredictable as a cat on a hot tin roof, and additional economic factors will undoubtedly play a role in this unfolding drama.

At the time of writing, Bitcoin was trading at 82,264, down 1.1% and 6.9% in the daily and weekly frames. A minor setback, or the calm before the storm? Only time will tell.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The games you need to play to prepare for Elden Ring: Nightreign

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- The Babadook Theatrical Rerelease Date Set in New Trailer

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2025-03-15 00:42