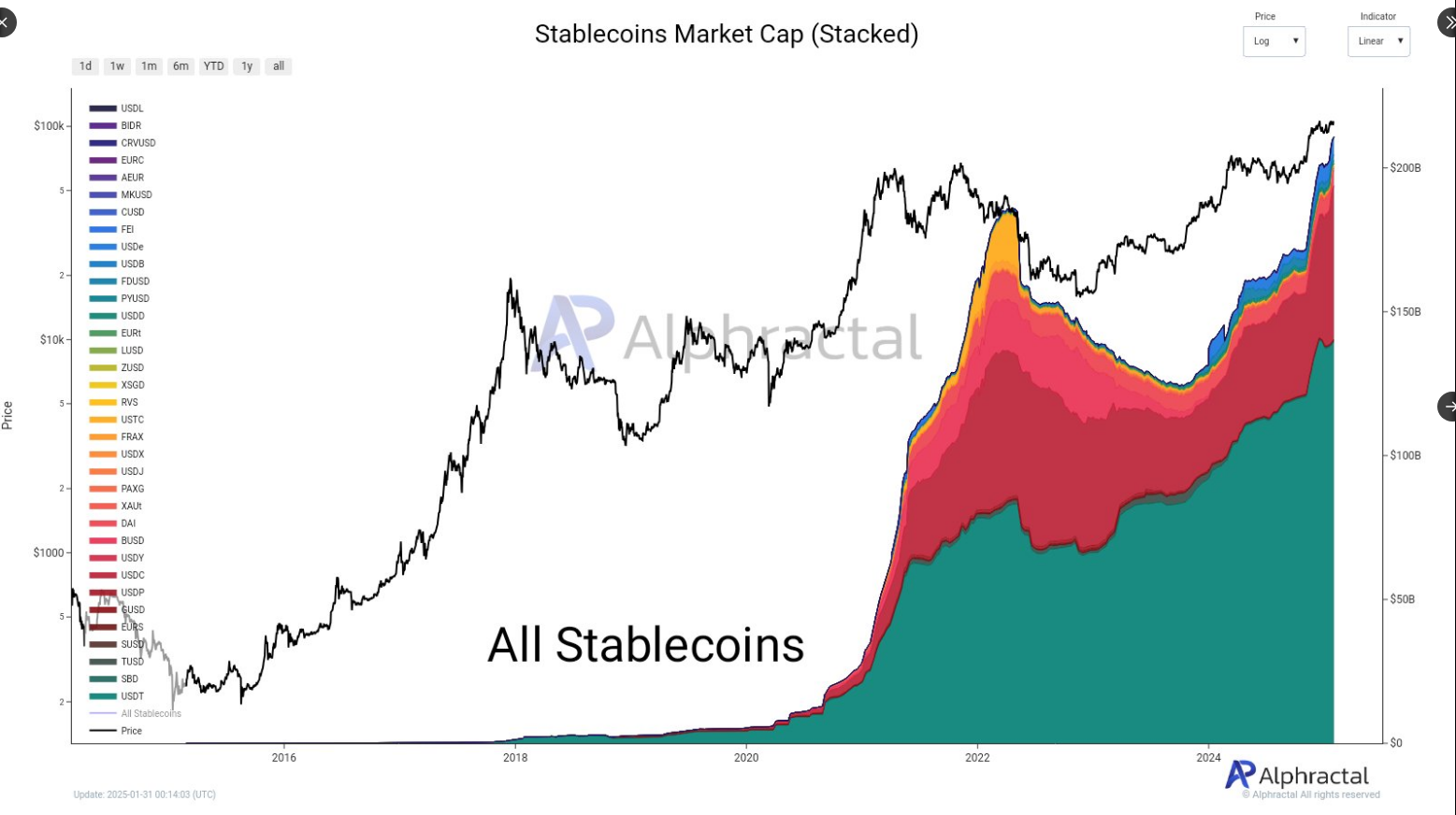

For months, stablecoins have languished in the shadow of their more flamboyant, meme-driven cousins—tokens inspired by politicians, no less. But lo and behold, the unassuming stablecoin has staged a quiet coup, surpassing a $200 billion market cap. How very dull, yet somehow impressive.

According to Alphractal, a name that sounds like a rejected Bond villain, the stablecoin market has ballooned to $211 billion. This record high is the result of months of steady growth, a concept as thrilling as watching paint dry. The growth began in mid-2023, a year best remembered for its lack of drama.

From August 2023’s modest $121 billion, the market cap has surged by 73%. Tether’s USDT remains the primary driver of this growth, though USDC is making a valiant effort to steal the spotlight. How riveting.

Stablecoin Market Cap Surpasses $211B – USDC Gains Momentum!

Since 2023, the stablecoin market has grown significantly, mainly driven by USDT (Tether). However, recently, USDC has been gaining an edge over other stablecoins.

This trend is occurring due to the recent drop in…

— Alphractal (@Alphractal) January 31, 2025

Tether’s USDT: The Relentless Engine of Mediocrity

Since 2023, Tether’s USDT has been the steady hand guiding the stablecoin market to its current valuation of $223 billion. That’s a 0.2% increase from yesterday, a figure so small it’s almost insulting.

USDT and USDC are the current darlings of the stablecoin world, though the rest of the group remains as uninspiring as ever. Tether’s USDT is valued at nearly $140 billion, while USDC sits at a respectable $53 billion. A tale of two coins, one of which is decidedly less interesting.

USDC: The Tortoise of the Stablecoin Race

Alphractal’s Twitter/X post reveals that USDC is slowly gaining ground, a process as exciting as watching grass grow. This is allegedly due to a drop in altcoin prices, with sell-offs being swapped into USDC. How very pragmatic.

USDC’s dominance has hit a key resistance level, reminiscent of 2021, the year that heralded the 2022 bear market. If this metric persists, it could signal a bearish turn, though if it declines, USDC might just claim new highs. A thrilling rollercoaster of uncertainty.

What Lies Ahead for Stablecoins? (Spoiler: Probably More of the Same)

In the last bull run, USDC’s supply peaked in March 2022 after a steady climb. The stablecoin’s market cap grew by 170% from April 2021 to March 2022. If the current trend continues, the market may hit its peak in a few months. Or not. Who knows?

Traditionally, a rising stablecoin market cap reflects growing investor confidence, signaling potential capital inflows. Conversely, it could also mean investors are hedging their bets. Either way, the bullish momentum might persist for a few more months. Or it might not. Such is the thrilling world of stablecoins.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2025-02-01 17:12