As a researcher who has spent a significant portion of my career studying financial systems and their impact on developing economies, I find the rapid adoption of stablecoins in Sub-Saharan Africa particularly fascinating. Growing up in a region where currency devaluations were an all-too-familiar occurrence, it’s heartening to see how technology is empowering people to seek more stable financial options.

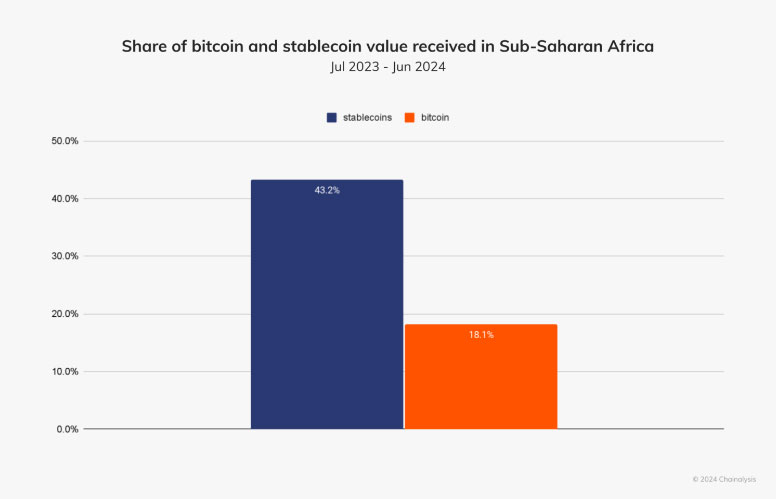

In Sub-Saharan Africa, there’s a notable surge in the use of Stablecoins, accounting for about 43% of all crypto transactions. This substantial increase is primarily because of the depreciation of local currencies, causing people and businesses to seek more reliable financial solutions as they grapple with economic uncertainties. A Chainalysis report from October 2, 2024, highlights this trend particularly in regions experiencing significant economic instability.

Photo: Chainalysis

Frequent depreciation of national currencies often leads individuals to switch towards more reliable digital alternatives like stablecoins, which are often linked to stronger currencies such as the US dollar. As outlined by Eric Jardine, Head of Cybercrimes Research at Chainalysis, when local currencies lose their worth, there’s a growing trend for people to use USD-backed stablecoins instead.

According to Jardine, it’s logical to anticipate a swift increase in the use of stablecoins when local currencies depreciate, but they can also see rapid growth in other situations as well.

Stablecoins Empower Africa’s Economies

As a crypto investor, I’ve witnessed firsthand Nigeria’s impressive influence on global crypto adoption, stretching beyond the African continent. Over the period from July 2023 to June 2024, we’ve observed an astounding $59 billion in crypto transactions within our borders. The majority of these trades were below the $1 million mark, demonstrating a blend of individual and professional engagement. What’s particularly striking is the growing popularity of smaller, frequent transactions, suggesting that cryptocurrencies are becoming more integral to everyday financial activities.

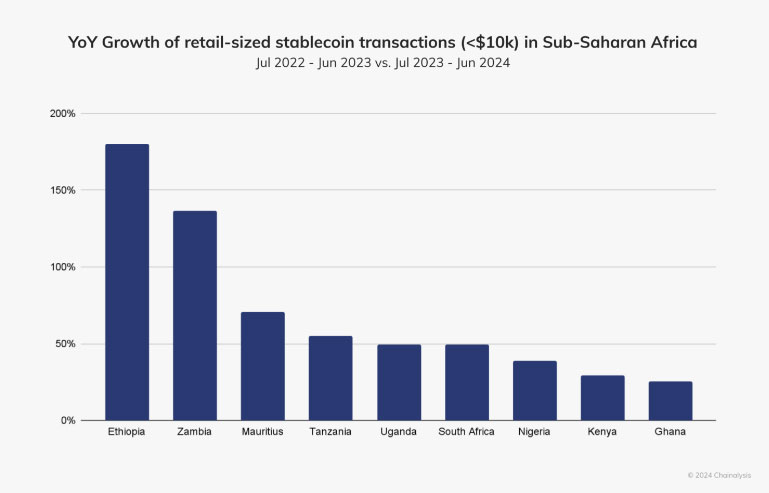

Photo: Chainalysis

Likewise, there’s been a significant surge in stablecoin adoption within Ethiopia, particularly among its population. This growth spike, amounting to 180% over the past year, can be attributed to the Ethiopian government’s decision in July to loosen restrictions on currency exchange, which was aimed at securing assistance from the International Monetary Fund (IMF). Subsequently, the value of the Ethiopian birr (ETB) dropped by approximately 30%.

Chris Maurice, the CEO of African cryptocurrency platform Yellow Card, underscores the significance of stablecoins in addressing local financial difficulties. In his explanation, he highlights that…

When the value of the naira decreases, there is an observable increase in the inflow of stablecoins used for transactions below $1 million. This trend is particularly noticeable during times of substantial currency devaluation, when these periods are more pronounced.

Institutional Shift from Bitcoin to Stablecoins

It’s clear that institutional clients in South Africa are adopting stablecoins, according to Rob Downes of Absa Group. He emphasizes their importance for managing liquidity and minimizing risk from currency fluctuations, referring to them as a “game-changer.” This trend mirrors the fact that stablecoins have become the most frequently received cryptocurrency in South Africa, even surpassing Bitcoin.

Examining the ways cryptocurrencies are embraced in Africa provides essential knowledge about how they can be effectively utilized worldwide. As Africa’s hands-on experiences with practical crypto applications grow, it might lead the continent to become a pioneer in the global cryptocurrency sphere. This implies that the lessons gathered from this region could play a crucial role in fostering broader acceptance of cryptocurrencies across the globe.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-02 18:36