As an analyst with a background in blockchain technology and cryptocurrency markets, I find Justin Sun’s recent $5 million investment in Ethereum intriguing. According to reports, Sun has been actively accumulating ETH since February 2024, spending over $1.1 billion on the cryptocurrency so far. With Ethereum’s upcoming Spot ETF launch and the market’s growing FOMO around it, Sun might be positioning himself strategically for potential gains.

Justin Sun, the creator of Tron, a decentralized blockchain platform, recently added a $5 million stake to his holdings of Ethereum (ETH), the globe’s second-largest digital currency, fueled by the excitement surrounding the proposed Spot Ethereum Exchange-Traded Funds (ETFs).

Tron Founder Buys $5 Million Worth Of ETH

As an analyst, I recently came across a noteworthy discovery on July 11th, uncovered through my work with Spot On Chain, an advanced AI-driven on-chain analytics platform. This platform indicated that a transaction allegedly originating from Sun, the founder of Tron, involved a $5 million purchase of approximately 1,614 ETH tokens. The price per token in this transaction was around $3,097.

As a crypto investor, I’ve come across some intriguing news from Spot On Chain. They’ve uncovered that Sun allegedly bought a staggering amount of Ethereum tokens since February 8, 2024. Specifically, they claim Sun purchased 362,751 ETH tokens, which cost an estimated $1.11 billion in total. That equates to an average price of approximately $3,047 per token. This significant Ethereum transaction was processed through three different crypto wallet addresses.

As a crypto investor keeping a close eye on market movements and transactions, I’ve noticed an intriguing development. The analytics platform revealed that the Tron founder recently transferred 45 million USDT to Binance, a well-known cryptocurrency exchange. This deposit raises speculation about potential plans to purchase more Ethereum in the near future. The founder has a history of receiving ETH coins from Binance shortly after depositing his stablecoin into the platform.

It’s intriguing that Sun recently made another purchase of Ethereum, as there’s increasing excitement in the cryptocurrency world about the imminent launch of Spot Ethereum ETFs. Back in June, Gary Gensler, SEC Chair, declared that trading for these ETFs would commence during the summer. Consequently, the crypto market has been eagerly anticipating the debut of this digital asset, which could potentially lead to a significant surge in ETH‘s value.

Sun suffered a significant loss of approximately $66 million following Ethereum’s 10% decline on July 7, which came before his purchase of ETH worth $5 million. According to reports from Spot On Chain, this setback wiped out the initial profit of around $58 million that Sun had made only a day prior.

Ethereum Whales Enter Accumulation Phase

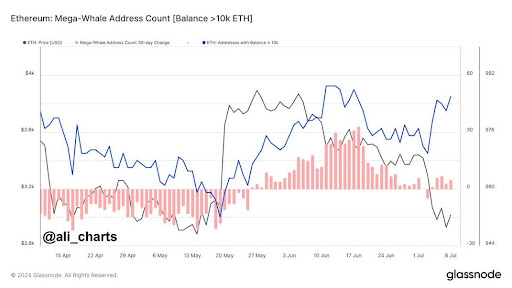

Despite Ethereum’s recent setbacks, the hype and anxiety surrounding Ethereum-backed ETFs have possibly shifted market perception and increased investor interest in the cryptocurrency. As reported by renowned crypto analyst Ali Martinez, major Ethereum investors are once again purchasing large quantities of ETH.

The analyst revealed that the cryptocurrency underwent a short spell of dispersion, possibly instigated by Ethereum’s poor market showing and subsequent drop to $3,055 at present. Furthermore, Bitcoin (BTC) has experienced a substantial decrease, falling over 14% in value during the last month.

As whales exhibit increased enthusiasm towards Ethereum, cryptocurrency analysts forecast a possible downward trend in the digital currency’s price after the introduction of Spot Ethereum ETFs. Nevertheless, with the increasing demand for Ethereum ETFs and improving market stability, Ethereum’s price might surge as high as $8,000 during this market cycle.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2024-07-12 14:46