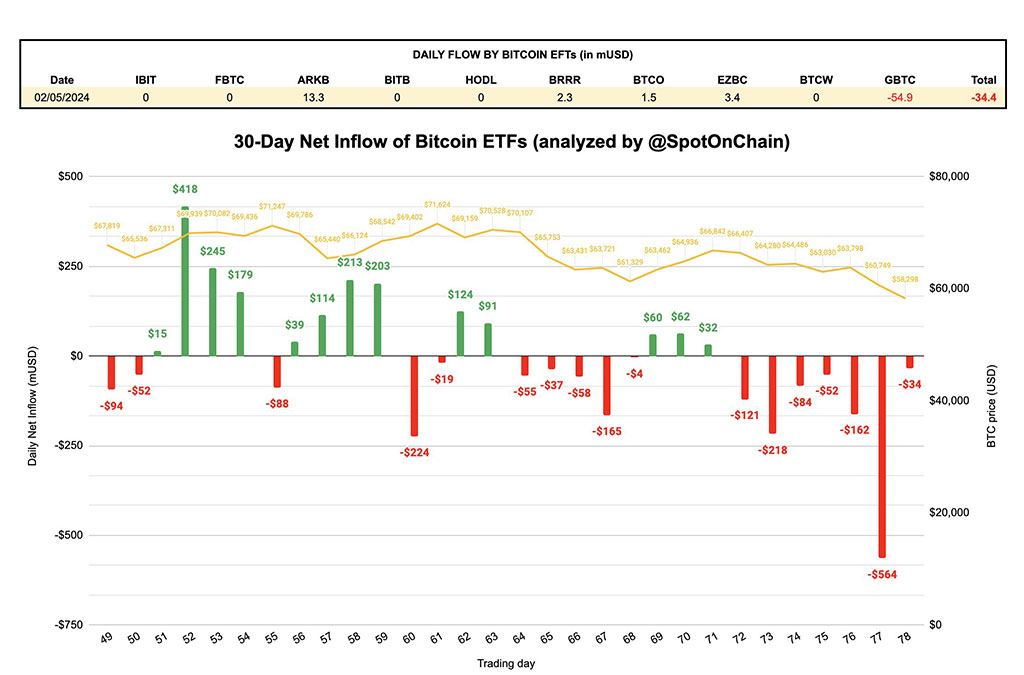

As a researcher with a background in finance and experience following the cryptocurrency market closely, I find the recent trend of Bitcoin exchange-traded funds (ETFs) in the United States to be intriguing. While it’s true that Thursday saw a modest net outflow of $34.4 million, which is lower than the previous day’s record-breaking $563.7 million outflow, we must maintain perspective.

On Thursdsay, May 2nd, 2024, US-listed Bitcoin exchange-traded funds (ETFs) experienced a relatively small net withdrawal of approximately $34.4 million. This is a noticeable decrease from the massive net outflow of around $563.7 million witnessed on the preceding day.

Although the deceleration brings some reassurance, it’s essential to keep things in proportion. Last Thursday, Grayscale’s Bitcoin Trust (GBTC) recorded outflows worth $55 million. This continuous withdrawal pattern from GBTC has been a source of worry for investors.

As a researcher, I’ve observed that ARK Invest’s ARKB experienced the greatest inflow of funds on Thursday, with a substantial intake of approximately $13 million. Additionally, Franklin Templeton, Valkyrie, Invesco, and Galaxy Digital recorded more modest inflows collectively totaling around $6 million towards spot Bitcoin ETFs. This trend suggests that some investors remain optimistic about Bitcoin as a potential investment opportunity.

It’s intriguing to note that the Bitcoin ETFs from BlackRock and Fidelity, which hold the second and third largest assets respectively, experienced no new inflows whatsoever on Thursday. According to Bloomberg analyst James Seyffart, such occurrences are quite common within the ETF market.

Photo: SpotOnChain

Hong Kong’s Bitcoin ETF Appeal

As a crypto investor, I’ve noticed an intriguing development in the Hong Kong ETF market. According to recent reports, there has been a significant increase of approximately $248 million in assets under management (AUM). This growth can be attributed in part to a distinct advantage that some Hong Kong ETFs provide: the ability to make direct contributions of Bitcoin itself, instead of being limited to market purchases.

Bitcoin’s price recovery is adding positivity to the market perspective. After dropping to $56,500, the front-runner cryptocurrency bounced back to $59,000, suggesting a solid foundation underneath. This upward trend underscores investors’ faith in Bitcoin’s future prospects, regardless of temporary price swings.

The wider cryptocurrency sector has demonstrated robustness, with Ethereum surpassing $3,000 and several alternative coins experiencing significant growth. This uptrend underscores the increasing mainstream acceptance and faith in the crypto world’s future prospects.

BNP Paribas Invests in BlackRock

The announcement that European banking behemoth BNP Paribas had invested in BlackRock’s Bitcoin ETF, IBIT, served to strengthen investor faith. Though the bank’s initial investment amounted to only $41,684, it underscored the increasing institutional appetite and favorable sentiment towards the cryptocurrency sector at large.

The decrease in Bitcoin ETF withdrawals lately brings a faint sense of optimism, yet the picture is still uncertain. The direction of Bitcoin’s price trend and regulatory updates are key factors that will shape the future course of the cryptocurrency market.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-03 15:24