As a researcher studying the dynamics of the crypto market, I can’t help but marvel at the groundbreaking moment when Spot Bitcoin exchange-traded funds (ETFs) debuted in the United States. These Spot Bitcoin ETFs, launched on January 11, 2024, have been nothing short of a phenomenon, racking up unprecedented success within the first year, making them the most successful ETF launch ever recorded in history.

Currently, U.S.-listed Bitcoin Exchange Traded Funds (ETFs) have significantly contributed to Bitcoin’s price surge and were instrumental in pushing Bitcoin’s value above $100,000. Now, these U.S.-based ETFs collectively own the largest amount of Bitcoin holdings.

Performance Metrics Of US-Based Spot Bitcoin ETFs

For quite some time, the U.S. Securities and Exchange Commission (SEC) had been reluctant to endorse Spot Bitcoin Exchange-Traded Funds (ETFs). However, their decision to do so in early 2024 marked a significant shift for the cryptocurrency sector. Specifically, on January 10, 2024, the SEC greenlighted the first eleven Spot Bitcoin ETF proposals.

With the exception of Grayscale’s GBTC, all debuting Spot Bitcoin ETFs have shown strong performance in their initial year. The introduction of these Spot Bitcoin ETFs was greeted with unprecedented excitement, as they recorded the highest trading volumes ever seen among any ETF launch during their early operational days.

Besides making it easier for conventional investors to venture into Bitcoin and cryptocurrency markets, who might otherwise shy away from digital currencies, significant Bitcoin owners also found Exchange-Traded Funds (ETFs) an appealing investment method due to the regulatory transparency they offer.

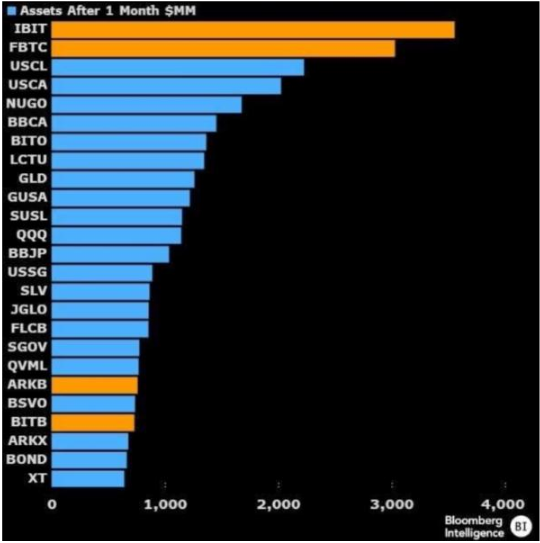

Specifically, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Fidelity Wise Origin Bitcoin Fund have seen significant investment during the year. These two funds rapidly emerged as key players, each receiving more than $3 billion within the initial 20 days of trading.

Currently, US-traded Bitcoin Exchange-Traded Funds (ETFs) are managing approximately $107.64 billion worth of Bitcoin assets. This amount makes up around 5.75% of the overall market capitalization of Bitcoin, as per data from SoSoValue. Since they started trading a year ago, these ETFs have seen a combined total net inflow of roughly $36.22 billion.

Regarding total accumulated inflows, the IBIT has seen the largest influx of approximately $37.67 billion, with FBTC coming in second at $12.16 billion. These significant inflows have helped offset the $21.57 billion outflows from the earlier Grayscale Bitcoin Trust, which was transformed into a Spot Bitcoin Exchange-Traded Fund.

Other Exchange-Traded Fund (ETF) issuers have seen collective net investments grow over the past year. Specifically, the ARK 21Shares Bitcoin ETF and Bitwise Bitcoin ETF had accumulated net inflows totaling $2.49 billion and $2.43 billion respectively, as of the time this statement was made. Yet, six other ETF issuers have not yet surpassed the $1 billion mark in cumulative net inflows, suggesting that investor attention may be more concentrated among a few players within the industry.

Where Do Spot Bitcoin ETFs Go From Here?

In simpler terms, the trajectory for Bitcoin ETFs is predicted to rise steeply, particularly on longer timeframes from 2025 and beyond. Crypto investors are hopeful that a substantial amount of capital will flow into these ETFs due to expectations of pro-crypto policies being implemented by the incoming Trump administration.

At the time of writing, Bitcoin is trading at $94,057.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Is There a MobLand Episode 11 Release Date & Time?

2025-01-12 23:10