As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I find myself cautiously optimistic about the recent developments in the Bitcoin and Ethereum ETF markets. The positive trajectory of the spot BTC ETFs, particularly the inflows into Fidelity’s FBTC, is indeed encouraging. However, I remain mindful of the volatility inherent in these assets, having learned from past bearish cycles that even the most promising trends can quickly reverse.

As an analyst, I’ve been tracking the market trends, and here’s what I’ve observed: Over the past week, US-based Bitcoin spot ETFs have seen approximately $300 million in net inflows, signaling a resurgence of investor confidence following a bearish start to Q4 2024. In contrast, despite a decrease in net outflows, Spot Ethereum ETFs are still struggling to perform positively.

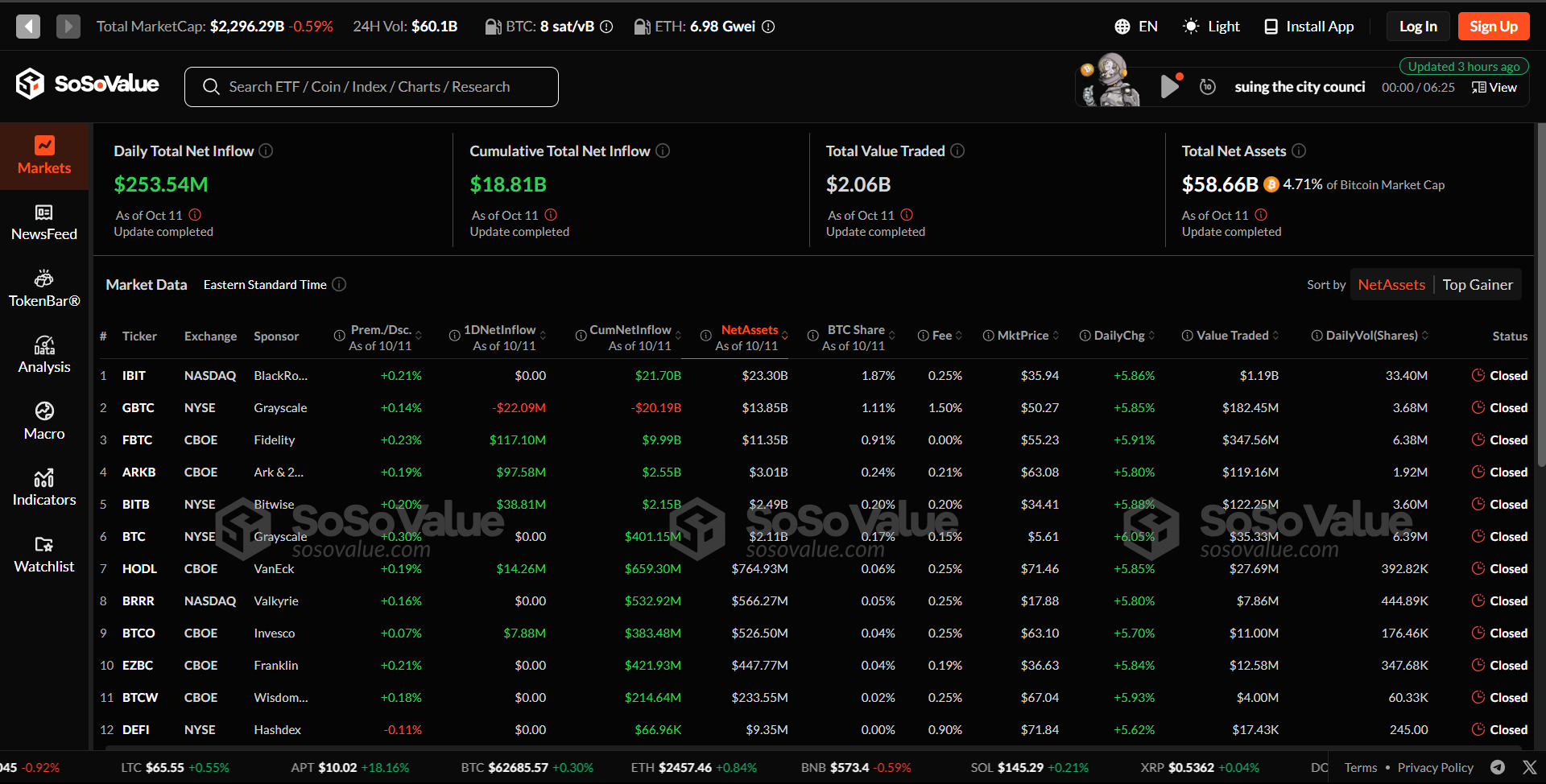

Spot Bitcoin ETFs Halt Three-Day Decline With $254 Million Inflow

Initially showing growth after a $300 million decline in the first week of October, Bitcoin ETF markets started off positively last week with net inflows of approximately $236.19 million on Monday, October 7th. However, this positive trend soon reversed over the next three days, resulting in a cumulative outflow of around $179.98 million between October 8th and 10th.

Last Friday, October 12th, a total of $253.54 million flowed into Bitcoin ETFs, marking the largest single-day investment over the last fortnight. A significant portion of this increase, approximately $117.10 million, was attracted to Fidelity’s FBTC.

Last week, Ark Invest’s ARKB fund and 21 Shares’ ARKB saw investments totaling $97.58 million and $38.81 million respectively, while Bitwise’s BITB attracted $38.81 million from investors. Similarly, VanEck’s HODL and Invesco’s BTCO recorded inflows of $14.26 million and $7.88 million. All other Bitcoin spot ETFs remained unaffected by investments, except for Grayscale’s GBTC which had a net outflow of $22.09 million. BlackRock’s IBIT was among those that saw no inflows.

After a series of weekly growth, the overall value of Bitcoin held in the spot market now stands at approximately $58.66 billion. This represents around 4.71% of the entire Bitcoin market capitalization. Approximately 40% of these assets are managed by BlackRock’s IBIT, which holds 369,640.1 Bitcoins worth roughly $23.30 billion. Initially, Grayscale’s GBTC was the largest Bitcoin spot ETF, with 600,000 BTC tokens. However, due to substantial withdrawals totaling $20.19 billion, the fund now ranks second, holding 220,177.5 Bitcoins worth about $13.85 billion.

Spot Ethereum ETFs Maintain Negative Return Streak

Recently, Ethereum-based ETFs have continued to struggle, with a weekly outflow of $5.22 million. This decrease from the initial October figures by $25.47 million is significant, and it marks the 10th consecutive week of negative returns in the past 12 trading weeks for these ETFs. Intriguingly, there was only one day last week where these funds experienced inflows ($3.06 million).

The total net outflows of spot Ethereum ETFs are currently valued at $558.88 million. Meanwhile, the total value traded in this market stands at $143.54 million.

Currently, Ethereum is trading at around $2,459, representing a 0.78% increase over the past day. In contrast, Bitcoin’s value has risen by 0.22% to approximately $62,725 within the same timeframe and remains steady.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-13 15:04