As a seasoned crypto investor with a decade of experience under my belt, I must admit that the recent performance of US-based spot Bitcoin ETFs has been nothing short of impressive. The $3 billion inflows in just 11 days is a testament to the growing institutional interest in Bitcoin and a strong indication that we might be on the verge of a significant breakout towards $100K, as suggested by popular analyst Michaël van de Poppe.

In the last seven days, Bitcoin ETFs based in the U.S. have delivered another impressive feat by attracting close to $1 billion collectively. On the other hand, Ethereum ETFs in the same region have faced difficulties in staying afloat as outflows have been more prevalent than inflows during the same timeframe.

Spot Bitcoin ETFs Attract $3 Billion In 11 Days

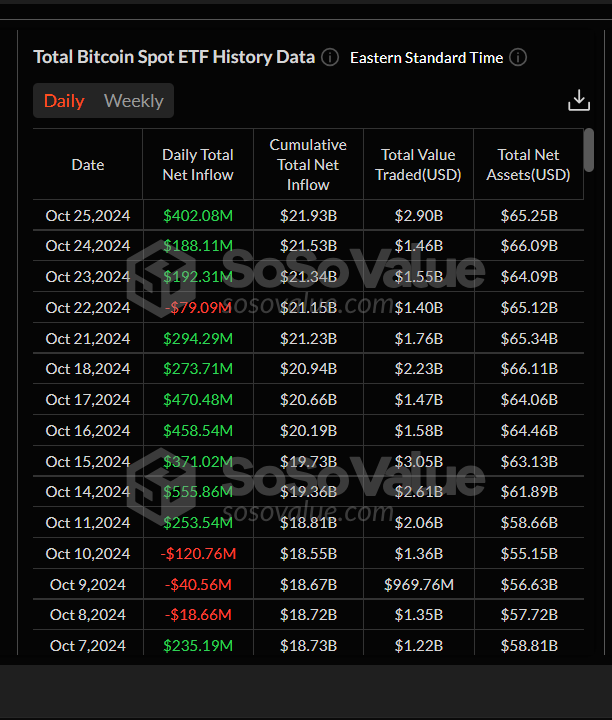

After an impressive third week in October with institutional Bitcoin ETFs garnering $2.18 billion in market inflows, these funds continued to captivate investors the following week, amassing a total weekly inflow of $997.70 million. As per data from SoSoValue, the Spot Bitcoin ETFs displayed a positive net flow on all weekdays except for October 22nd, where there was an outflow of $79.09 million.

On that particular Friday, October 25th, the largest inflows totaling approximately $402.08 million were recorded. Notably, BlackRock’s IBIT accounted for a significant portion of this amount with an inflow of $291.96 million, bringing its total cumulative net inflows to a staggering $23.99 billion.

In a comparable manner, Fidelity’s FBTC came in second place with an inflow of $56.95 million, while Ark & 21 Shares’s ARKB received investments worth $33.37 million on Friday. Other ETFs that contributed to the increase include Bitwise’s BITB, Grayscale’s BTC, and VanEck’s HODL, with inflows of $2.55 million, $5.92 million, and $11.34 million respectively.

It’s noteworthy that the large sums flowing into Bitcoin ETFs over the past eleven trading days, totaling approximately $3 billion on Friday alone, signifies strong institutional investment in Bitcoin. This observation was echoed by well-known crypto analyst Michaël van de Poppe, who expressed the widespread enthusiasm within the crypto community about this development. The substantial inflows suggest a significant level of interest in Bitcoin from institutions.

Van de Poppe said:

Since October 10th, over $3 billion has poured into Bitcoin ETF, indicating a potential surge towards $100K, suggesting a significant increase in Bitcoin’s value is imminent.

Currently, the accumulated total net investments in Spot Bitcoin ETFs amount to approximately $21.93 billion. This has brought their combined asset value to around $65.25 billion, which corresponds to roughly 4.93% of the overall Bitcoin market share.

Ethereum ETFs See Negative Returns Again

Meanwhile, the challenges in the Ethereum Exchange-Traded Fund (ETF) sector continue, as they experienced withdrawals amounting to approximately $24.45 million during the last week. This marks their 11th consecutive week with negative returns since launching on July 26. The combined net assets of these Ethereum ETFs now stand at around $6.82 billion, but they have seen a total net outflow of approximately $504.44 million since inception.

Currently, as we speak, Bitcoin is being exchanged for approximately $67,077, while Ethereum trades at around $2,484. This is after a slight dip in value for both cryptocurrencies over the last 24 hours.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-10-27 20:46