Ah, Solana (SOL), that once-glorious knight in the crypto realm, now finds itself languishing at its lowest price since the fateful month of September 2024. The entire crypto market, bless its heart, is in a state of utter disarray, beset by fear and a selling frenzy that would make even the most stoic of traders clutch their pearls. In a mere six weeks, Solana has shed over 55% of its value, as if it were a particularly ungrateful houseguest who decided to leave without so much as a thank you note. 🏰

As panic grips the market like a particularly tenacious octopus, traders are beginning to suspect that Solana’s correction might just be the beginning of a long, drawn-out tragedy. Despite the valiant efforts of the bulls to reclaim some semblance of momentum, they have been as effective as a chocolate teapot, failing to defend key demand zones and allowing the bears to frolic about with glee.

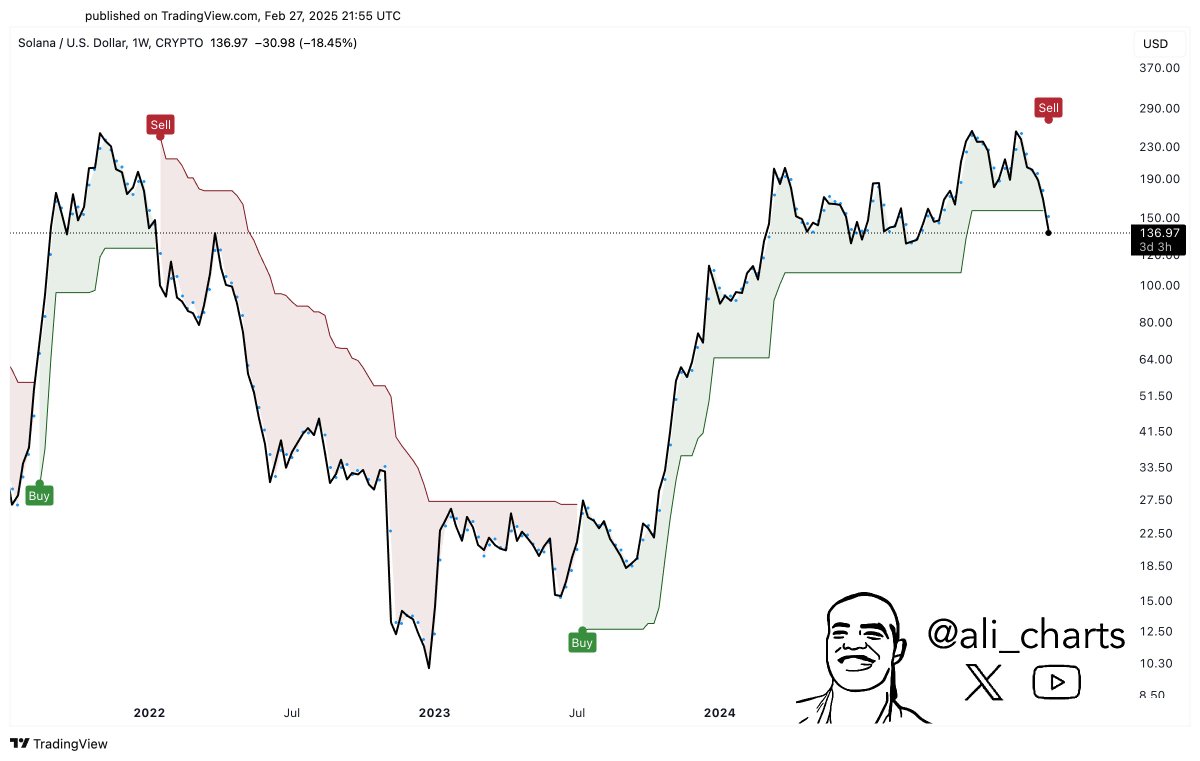

Top analyst Ali Martinez, a chap with a penchant for technical analysis, has taken to X to declare that Solana appears to be undergoing a macro trend shift from bullish to bearish. If SOL doesn’t manage to pull itself together and recover key levels soon, it could very well signal the onset of a deeper downtrend, much to the chagrin of investors who were hoping for a happy ending. 📉

For the time being, investors are watching Solana’s next move with bated breath. Should SOL manage to reclaim those elusive key resistance levels, it might just stabilize and trigger a recovery. However, should it fail to hold above its current prices, we could be looking at an extended bearish phase that would make even the most optimistic of traders weep into their morning tea.

Solana Facing Serious Selling Pressure

Alas, Solana is now trading below crucial daily support levels, effectively invalidating the bullish structure thesis that many traders had clung to like a life raft in a stormy sea. The price action has been as weak as a kitten on a diet, with Solana caught in a high time frame range between $120 and $220. If the bulls fail to defend the lower end of this range, we might as well start preparing for a prolonged bear market, complete with gloomy music and a narrator with a deep voice.

The current price breakdown suggests that the bears are firmly in control, as selling pressure mounts like a particularly unwelcome guest at a dinner party. Solana has struggled to reclaim any semblance of momentum, and the once-mighty uptrend that began in July 2023 is now teetering on the brink of collapse. Analysts are now keeping a watchful eye on whether SOL can hold above the $120 support level, for a failure to do so could trigger a deeper correction that would send shivers down the spines of even the most seasoned investors.

Martinez’s technical analysis suggests that Solana is indeed experiencing a macro trend shift. He explains that the bullish trend that began in mid-2023 is on the verge of breaking, and if SOL continues to lose key demand levels, we could be confirming a long-term bearish phase that would make even the most optimistic of traders reconsider their life choices.

Investors are now waiting for a confirmation move, much like a cat waiting for its human to return home. If Solana can reclaim key resistance levels, bullish momentum could be reestablished, and we might just see a glimmer of hope. However, if the price fails to hold support and breaks below $120, it may very well indicate the start of a bear market for Solana, complete with ominous music and a dramatic exit.

Price Testing Long-Term Demand

At present, Solana is trading at $130 after experiencing a rather dramatic 33% drop in less than two weeks. The market is in full panic mode, with selling pressure overwhelming any bullish attempts to reclaim key levels. The bulls have lost control of the price action, and Solana is struggling to find a strong support that doesn’t resemble a soggy biscuit.

At this juncture, the most crucial level to hold is $120. Should SOL fall below this mark, it could trigger a deeper

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2025-02-28 21:42