Solana’s Fate Hangs in the Balance: Will Bulls Reclaim the Throne? 🤔

Mon ami, Solana has been in a bit of a pickle, n’est-ce pas? 🤣 Since late January, it’s been on a downward spiral, losing over 60% of its value. Oui, it’s been a rough ride, but the bulls are still holding on for dear life.

But, as they say, “hope springs eternal,” and some investors are still optimistic about a quick recovery. They argue that market conditions could shift rapidly, especially if the broader economic factors and liquidity conditions improve. Ah, mais oui, it’s a possibility, n’est-ce pas?

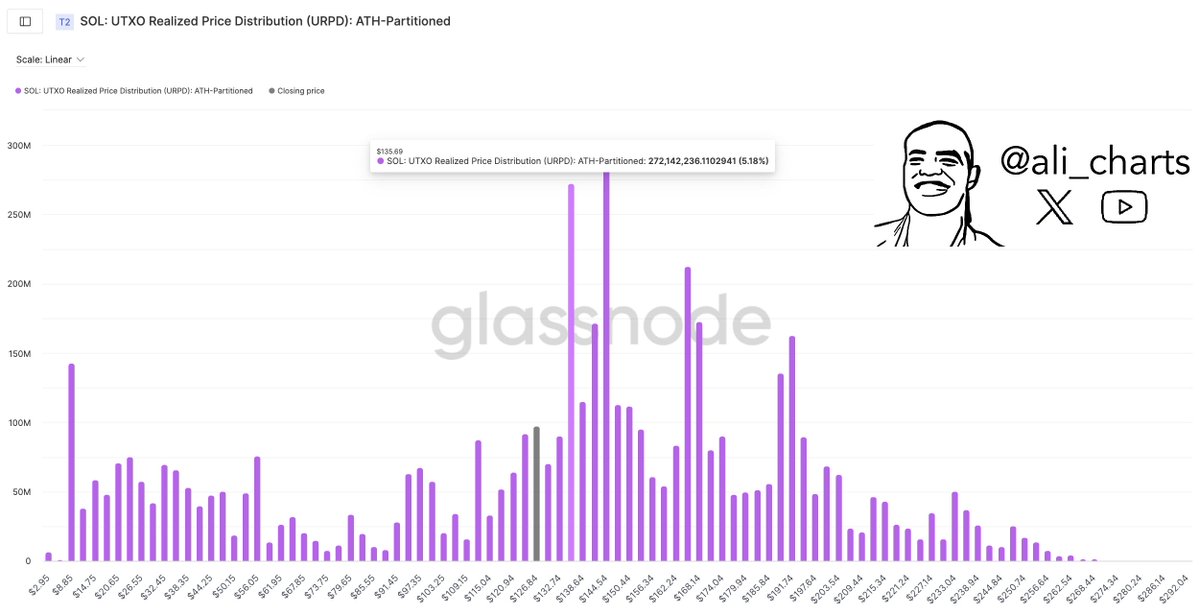

Now, let’s get to the good stuff. On-chain data from Glassnode reveals that Solana faces a major test, my friends. The UTXO Realized Price Distribution (URPD) indicator says that $135 is the most important resistance level. Oui, it’s a critical level, where large amounts of SOL have previously changed hands. If Solana can break and hold above $135, it could signal a trend reversal and open the door for a potential recovery. Mais, if it fails, oh mon dieu, it could result in further downside, reinforcing the bearish outlook.

So, the question on everyone’s mind is: will Solana reclaim the throne? 🤔 The coming weeks will be crucial in determining Solana’s next major move. Will the bulls push through and reclaim $135, or will the bears take control and send the price tumbling? 🤯 Only time will tell, mes amis.

La Bataille de Solana: Bulls vs. Bears

Solana has been trading under heavy selling pressure, struggling to reclaim key levels after weeks of market uncertainty. Oui, it’s been a tough battle, but the bulls are still fighting. However, speculation about a prolonged bear market is rising, and the price remains stuck below key resistance. Ah, c’est difficile, n’est-ce pas?

Top analyst Ali Martinez shared his insights on X, revealing that Solana faces a major test at the $135 level. Oui, it’s a critical level, and if Solana can break and hold above it, it could act as strong support and signal a trend reversal. Mais, if SOL fails to break above it, bears could reinforce selling pressure, leading to further downside. Ah, la vie est difficile, n’est-ce pas?

The URPD indicator is an on-chain metric that tracks the price levels at which coins were last moved. Oui, it’s a clever tool, showing where investors have previously bought and sold. When many tokens have changed hands at a specific price, that level becomes a critical support or resistance zone. In Solana’s case, $135 represents a level where a large amount of SOL was last transacted. Ah, c’est intéressant, n’est-ce pas?

La Bataille de Solana: Key Support Test at $126

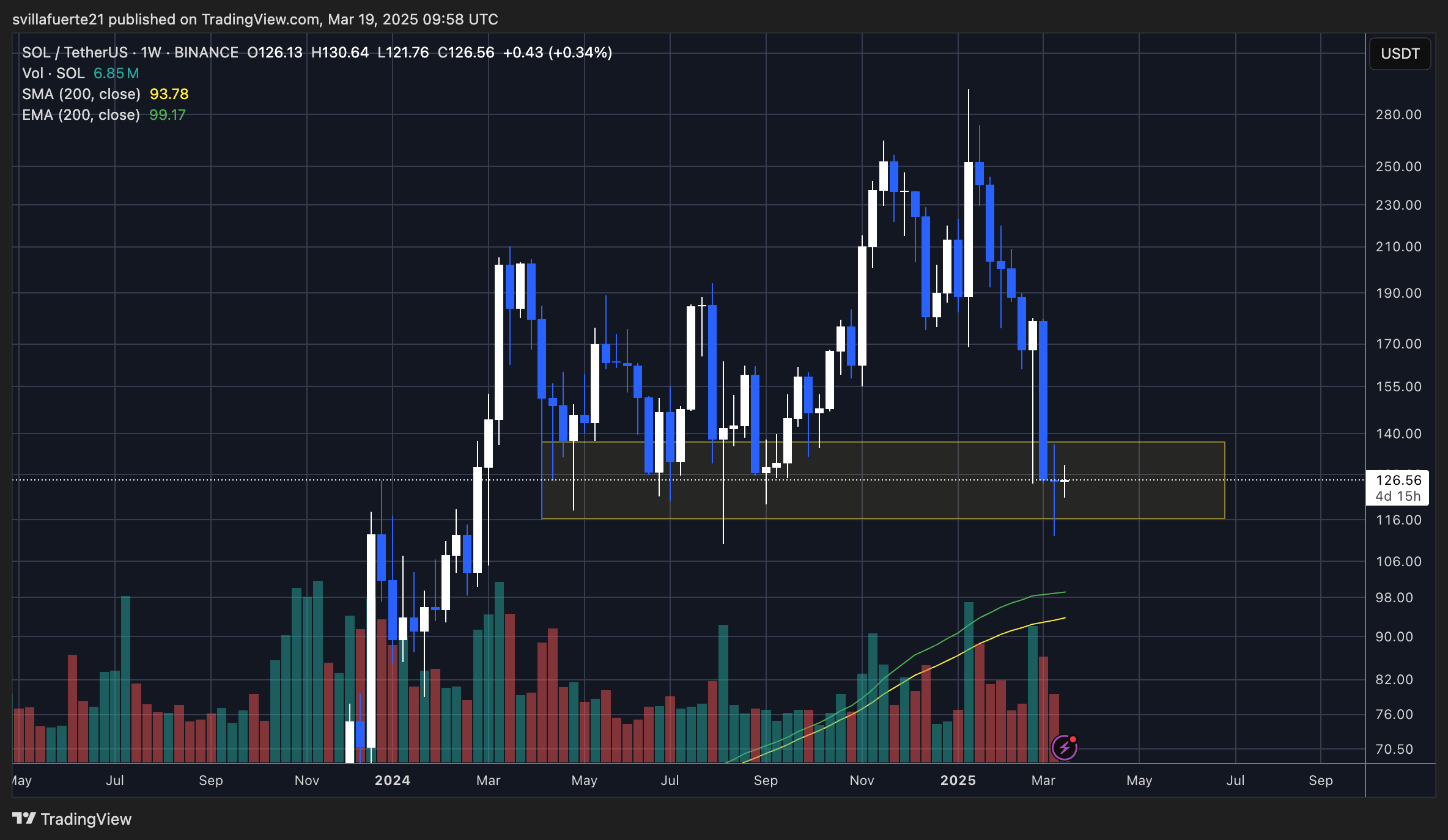

Solana (SOL) is trading at $126 after experiencing massive selling pressure in recent weeks. Oui, it’s been a wild ride, but the price has been in a strong downtrend, failing to reclaim key levels as market-wide uncertainty and volatility continue to drive sentiment. Ah, c’est difficile, n’est-ce pas?

Currently, SOL is sitting at a crucial weekly demand level, which bulls must defend if they want to initiate a recovery or at least establish a consolidation phase around current prices. Oui, it’s a critical moment, and holding this support could provide the foundation for a relief rally. Mais, the market remains fragile, and if SOL loses the $120 level, selling pressure could intensify, potentially sending the price toward the $100 mark or even lower. Ah, mon dieu, what a mess!

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2025-03-19 22:36