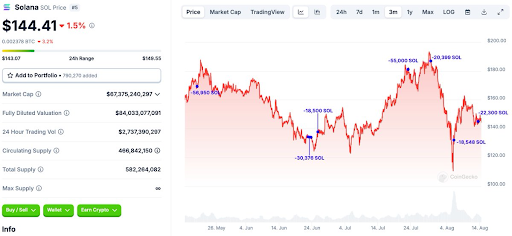

As a seasoned crypto investor with a portfolio that includes Solana (SOL), I find myself cautiously optimistic about its future prospects despite the recent sell-offs by some whales. Having been through multiple market cycles, I’ve learned to read between the lines of on-chain data and market sentiment.

A large investor in Solana (SOL) has been gradually disposing of a substantial portion of their holdings, which might lead to considerable changes in Solana’s price and the potential rise towards $1,000. Despite these sell-offs, Solana’s underlying strength persists, implying that SOL could potentially experience a significant price increase in the future.

Solana Whale Has Sold $86 Million Worth Of SOL This Year

According to a recent post on X (previously Twitter), the data analytics platform Lookonchain has uncovered a major Solana investor who has offloaded approximately 594,000 SOL (equivalent to $86 million) this year. Since January 15, it is believed that this significant investor moved their Solana holdings to exchanges like Coinbase, Binance, and OKX, making a weekly sale on average. The whale’s most recent transaction took place on August 12, when they sold off 5,000 SOL ($720,000).

As a researcher delving into on-chain analysis, I’ve noticed that my observation window indicates approximately 0.1 SOL left in this specific wallet, implying that the selling pressure from this particular investor seems to have subsided. Nevertheless, it’s essential for the Solana community to keep an eye on Pump.fun, a meme coin launchpad on the Solana network, which could potentially be another whale worth monitoring.

According to a recent post on Lookonchain, it was disclosed that the Pump.fun fee account has offloaded approximately 222,073 Solana (SOL) tokens for around 35.54 million US Dollars, with an average price of $160 over the past three months. Despite this sale, Pump.fun retains a substantial quantity of SOL totalling 274,583 tokens, which is roughly equivalent to $39.7 million. This remaining amount could potentially exert significant selling pressure on the token’s price, as per the data observed on the blockchain.

The act of these large-scale Solana investors selling their tokens is definitely cause for concern, given that this could potentially create resistance in Solana’s anticipated climb towards $1,000. Analysts like Ali Martinez forecast that SOL will hit $1,000 during this bull market. He even finds parallels between Solana’s current price trends and the 2021 bull run to demonstrate that the token has the potential to achieve such a lofty goal.

According to crypto expert Crypto Kaleo, if Solana’s growth mirrors Ethereum‘s from the previous market cycle, where Ethereum reached its peak value ($4,800), a realistic goal for Solana could be reaching $1,000.

Solana’s Strong Fundamentals Still Indicate A Significant Price Rally

It’s plausible that Solana’s robust foundations could propel SOL prices up substantially prior to the crypto token reaching its peak during this bull market, although whether it can reach $1,000 is uncertain. One of these strengths is the prospect of a U.S.-based Spot Solana ETF being introduced. If this fund gets approved, it could bring fresh investment into the Solana network.

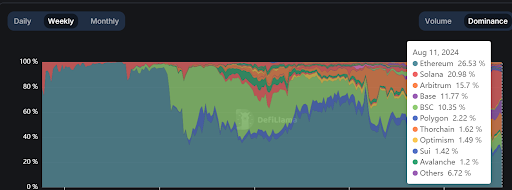

Over the past week, Solana is holding its ground against Ethereum in the realm of decentralized exchange (DEX) trading volume. According to DeFiLlama, a staggering $10.126 billion worth of trades were executed on Ethereum’s DEX platforms, while $8.667 billion was traded on Solana DEXs during the same timeframe.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-15 09:05