As a seasoned researcher with over a decade of experience in the crypto markets, I have seen my fair share of bull runs and bear markets. The current volatility surrounding Solana (SOL) has piqued my interest, given its potential for substantial gains if it manages to break through the $160 resistance level.

Since last Monday, Solana (SOL) has shown considerable volatility and fluctuating price trends. A crucial turning point is emerging that will likely shape its trajectory over the next few weeks. With the market trending upward, many analysts and investors are optimistic about a possible spike in SOL’s value, given the signs of weakening resistance at the $160 level due to recent bullish pressure.

The crypto world is keeping a keen eye on these advancements, as surpassing this significant barrier might result in considerable profits for alternative coins.

Top analyst and investor Carl Runefelt recently shared a technical analysis that paints an optimistic picture for Solana’s price action in the next few hours. According to Runefelt, the weakening resistance could pave the way for a breakout, with bullish momentum carrying SOL to higher targets.

As the market continues its ups and downs, faith in Solana’s capacity to surmount present hurdles is increasing. If the supply threshold is broken, it might signal the beginning of an uptrend, making SOL a key focus for traders seeking chances within the current trading environment.

Over the coming days, I find myself closely observing the behavior of Solana’s market trends. As an investor, I anticipate a potential surge, and my focus is on whether the price action will indeed validate this forecasted uptick.

Solana Bullish Pattern Signals Momentum

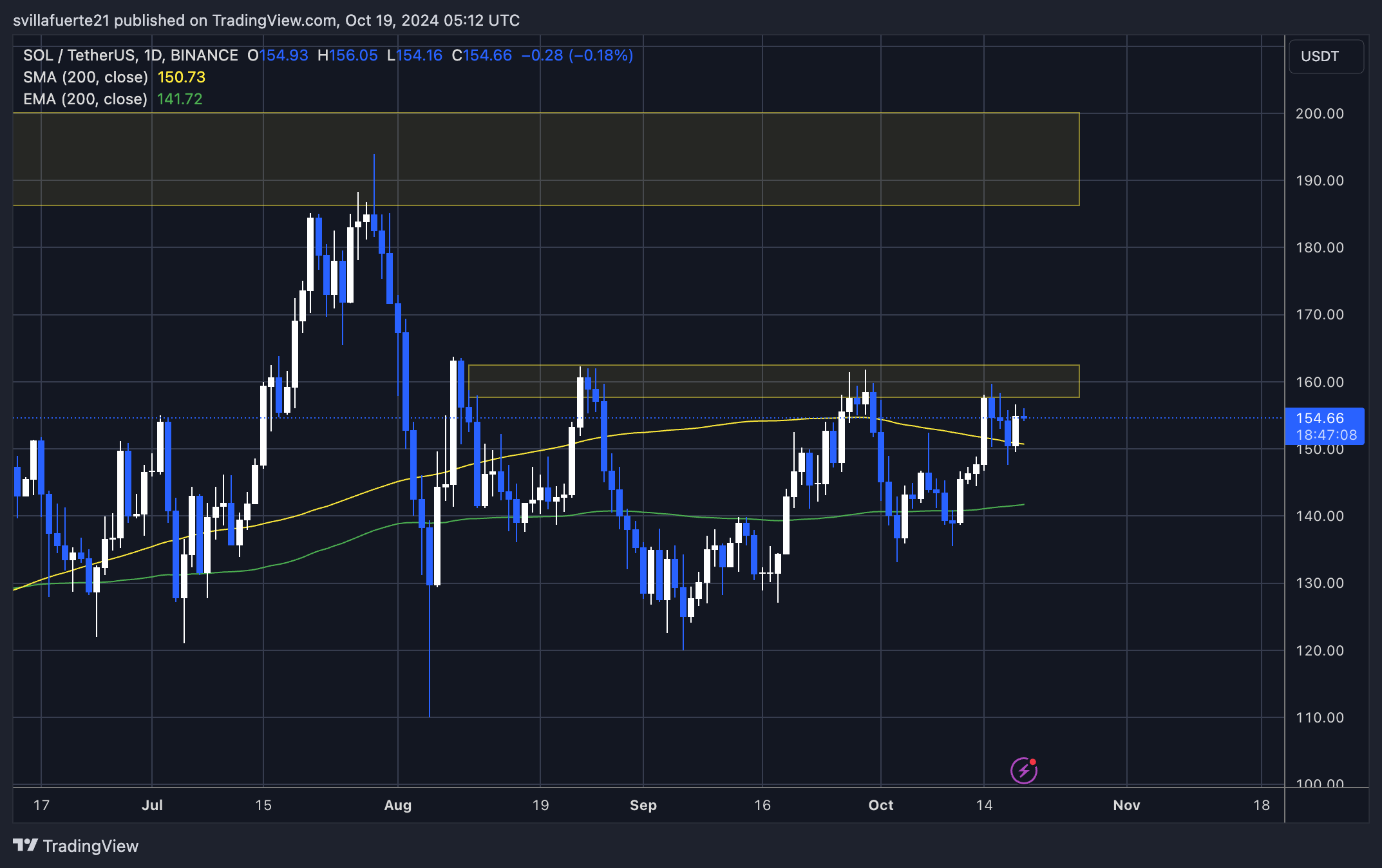

Over the past few days, the entire cryptocurrency market has shown increased volatility, and Solana is no exception. Its price has oscillated between roughly $148 and $160 since Monday. This period of stability has sparked curiosity among traders about which direction this altcoin might move in the near future.

Runefelt recently shared a technical analysis on X, highlighting that Solana is breaking out of a 1-hour Falling Wedge pattern, a bullish signal.

If reached and maintained, the short-term goal is set at approximately $159.6. Reaching this point might trigger a strong upward trend potentially propelling Solana towards $185 – a substantial jump that would bring it close to its highest value this year.

Although the conditions seem favorable, the market continues to proceed with caution, and there’s a possibility that Solana might not regain significant levels. If the price finds it challenging to surpass and maintain above the $159.6 resistance, this current consolidation could continue or even lead to a potential decline, with potential downside targets around $148. Such an occurrence would be disheartening for bulls anticipating a surge, potentially affecting market morale temporarily.

A clear and persistent price surge might indicate the start of a fresh bull market, enticing both individual (retail) and professional (institutional) investors.

Nevertheless, there’s a significant chance that Solana might not succeed in breaking out, which leaves market participants nervous. They are closely monitoring Solana’s actions because its next step will probably determine its trend for the upcoming weeks. If it manages to surpass resistance, SOL could be heading towards testing its yearly peaks.

Technical Levels To Watch

At present, Solana is being exchanged at $154, having found backing at the significant 200-day moving average (MA) of $150.7. This MA has traditionally served as a crucial signal of long-term resilience if it continues to function as a demand area. In the past, this MA has been a reliable barometer for market tendencies, and remaining above it would bolster the optimistic viewpoint on SOL.

To keep the positive trend going, the value of bulls (Solana) should exceed its 200-day moving average and aim to surpass the significant barrier at $160. Overcoming this hurdle would suggest a possible price increase, paving the way for more potential growth in the forthcoming weeks.

As a crypto investor, if Solana (SOL) doesn’t manage to maintain its position above the 200-day moving average and can’t break through the resistance at $160, it might trigger a correction. Dipping below the 1-day 200 MA could initiate a downward trend that may push SOL towards the crucial support level of $140. This level will significantly impact the direction Solana’s price movement takes in the near future.

Keeping a close eye on these significant points, both bulls and bears are eagerly waiting. The upcoming action might determine Solana’s trend in the short run.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2024-10-19 22:16