As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed numerous trends and fluctuations that have shaped this dynamic sector. The recent performance of Solana (SOL) has certainly piqued my interest, particularly when compared to Bitcoin (BTC) and Ethereum (ETH).

Glassnode, a firm focusing on blockchain analysis, has shed light on the possible cause for Solana’s (SOL) recent underperformance in comparison to Bitcoin (BTC) and Ethereum (ETH).

Solana Realized Cap Growth Has Slowed Down Recently

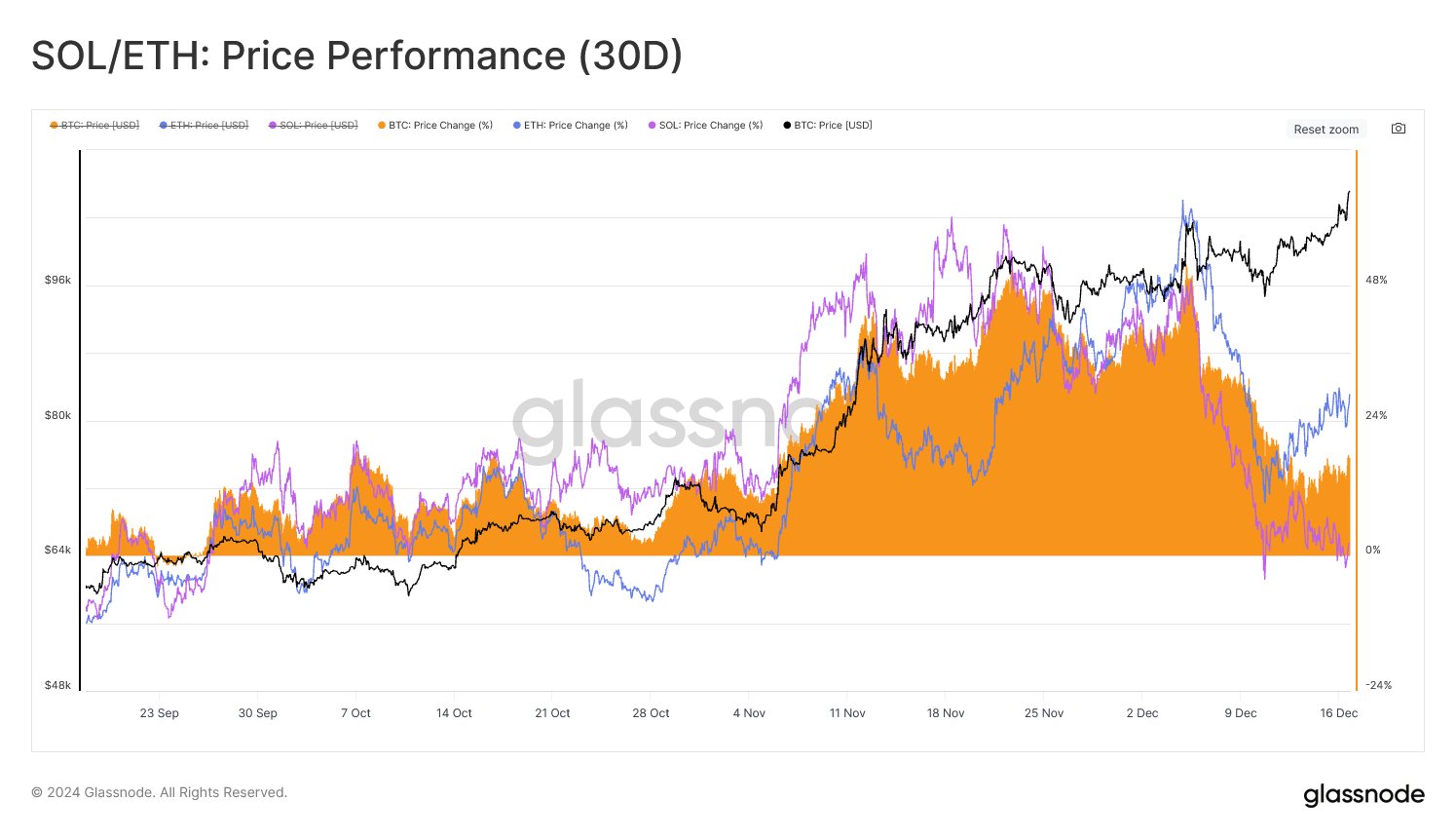

As an analyst, I’ve been examining the competition between Solana (SOL), Ethereum (ETH), and Bitcoin (BTC) in Q4 of 2024. Interestingly, SOL surpassed both ETH and BTC in terms of price performance for much of this period. However, starting from early December, ETH has shown remarkable growth, outperforming SOL and BTC.

Currently, Bitcoin has increased by approximately 18% over the last month, while Ethereum has risen by 28%. Remarkably, Solana has experienced a growth of 3%, which indicates a noticeable decrease in performance compared to its previous position as the market leader.

Could it be due to some underlying factors causing this market change? It might be worth investigating the patterns of money movement, particularly within the realm of cryptocurrencies, which have recently displayed interesting trends.

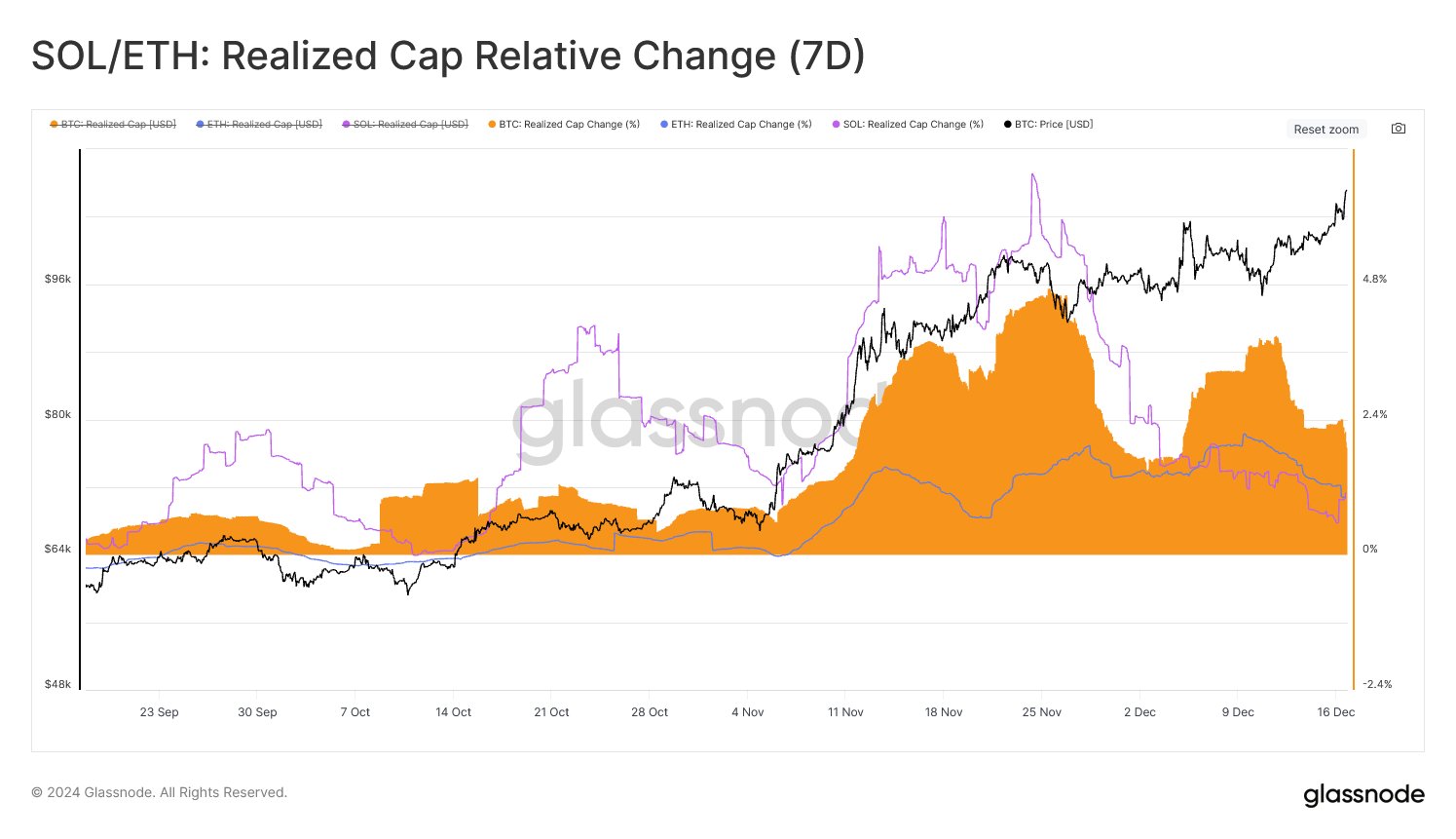

To determine the capital flows for assets, Glassnode employs the Realized Capital indicator. This term, “Realized Capital,” represents a model for on-chain capitalization that calculates the total value of any digital asset by considering that the actual worth of each token in circulation is the price at which it was last traded on the blockchain.

In simpler terms, whenever a coin is transferred, it’s probably the last time it was traded. The price at that moment can be seen as its initial investment cost. Therefore, the Total Realized Capital refers to the total sum of these initial investment costs for all coins in circulation, or, put another way, it represents the overall capital invested by all investors in the cryptocurrency.

In this perspective, fluctuations in the Realized Cap are essentially a representation of the capital flowing into or out of an asset. The following chart, provided by the analytics firm, demonstrates these capital movements occurring within Solana and other assets over a 7-day period.

Based on the graph, it’s clear that the Realized Capital Increase over a 7-day span showed significant growth from September to early December. During this time, both Bitcoin and Ethereum experienced capital influxes as well, but Solana (SOL) was increasing at an unusually rapid rate compared to them.

This month, however, there’s been a change in the sector as Bitcoin and Ethereum have surpassed Solana. The previous strong influx of capital might have fueled SOL’s superior performance, but with those funds diminishing, it’s logical for the leading two assets to regain their dominance.

SOL Price

While Bitcoin and Ethereum have experienced a recent upward trend, Solana’s price movement has remained relatively horizontal, currently hovering near $221.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

2024-12-18 06:04