As a seasoned crypto investor with a knack for spotting trends, I find myself at a crossroads with Solana (SOL). The past few weeks have been a wild ride, reminding me of my first rollercoaster experience – exhilarating, nerve-wracking, and full of unexpected twists and turns.

After several weeks of unstable price fluctuations and market instability, Solana is currently testing a significant level. Following the Federal Reserve’s decision to lower interest rates, Solana experienced a 26% increase but subsequently dropped by 17%, highlighting the ongoing turmoil in the cryptocurrency sector. This erratic price trend has left numerous investors anxious as they anticipate the next unmistakable indication.

As a crypto investor, I’m keeping a close eye on Solana’s next steps, with some top analysts suggesting the $160 mark as a critical point that could shape its trajectory. If it manages to breach this level, it could spark renewed bullish sentiments. Conversely, if it fails to do so, there might be more downward pressure on the price.

Over the next few days, Solana’s fate hangs in the balance as investors scrutinize market trends and prepare for possible fluctuations. Given SOL‘s significant position, both optimistic buyers (bulls) and pessimistic sellers (bears) are keeping a close eye on it to determine if the price will surge past crucial resistance levels or continue to dip due to further adjustments.

Solana Testing Liquidity Below $160

Over the last fortnight, Solana’s value has seen notable fluctuations, causing unease among investors following its recent decline. Initially, there was optimism about potential growth before the reversal occurred, leading to a more cautious market stance. In this unpredictable trading situation for Solana, attention is now centered on crucial technical thresholds that could signal the next major price shift.

Crypto expert Daan offers his perspective on X, pointing out that Solana has almost reached the same peak approximately thrice near the $160 mark. Moreover, he underscores that Solana (SOL) is consistently hitting lower low points, suggesting a possible accumulation of bullish energy.

Daan posits that this steady rise implies Solana might one day surpass the $160 barrier, marking a significant turning point in the cryptocurrency’s journey.

The importance of the $160 mark cannot be overstated. Should Solana surpass this threshold, it might indicate a surge toward fresh records and revive optimistic trading attitudes among investors. Conversely, if Solana’s price struggles to sustain its upward trend, it may find itself confined within the range of $120 to $160, prolonging its sideways trajectory. The market is on high alert as Solana’s future course could significantly impact its performance for the remainder of 2023.

Price Action: Supply Levels To Break

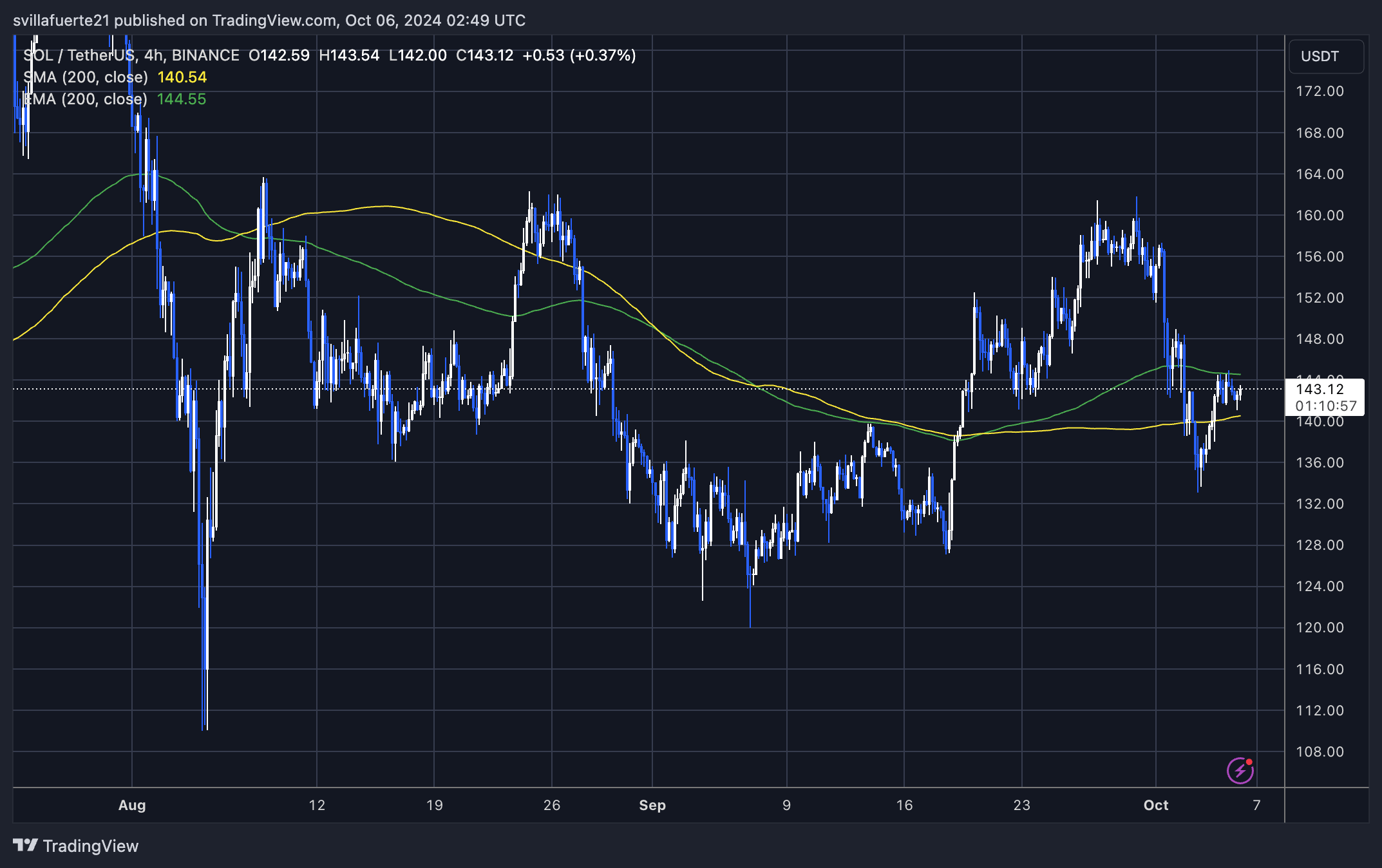

Right now, Solana (SOL) is being traded at approximately $143. Over the past few days, its price movement has been somewhat erratic. The market has been quite unpredictable, and currently, SOL is attempting to surpass the significant 4-hour 200 exponential moving average (EMA) at around $144.55. This EMA level functions as a crucial barrier, and if SOL manages to exceed it, this could suggest that Solana’s bullish trend may continue.

If Solana (SOL) surpasses and maintains its position above the 4-hour exponential moving average (EMA), it’s plausible that the bulls could aim for the $160 mark next. A rise beyond $160 might rekindle optimism, paving the way for potential additional growth. Conversely, if SOL doesn’t surpass the $144.55 resistance level, a pullback towards areas with lower demand is anticipated.

If Solana gets turned away at the 4-hour 200 Exponential Moving Average, it might drop to the $127 support zone. At this point, market participants will be attentive for indications of resilience or potential for additional price declines. The movements in the coming days will play a significant role in deciding whether Solana can rekindle its bullish trend or if it’s headed for a more substantial pullback.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-06 10:16