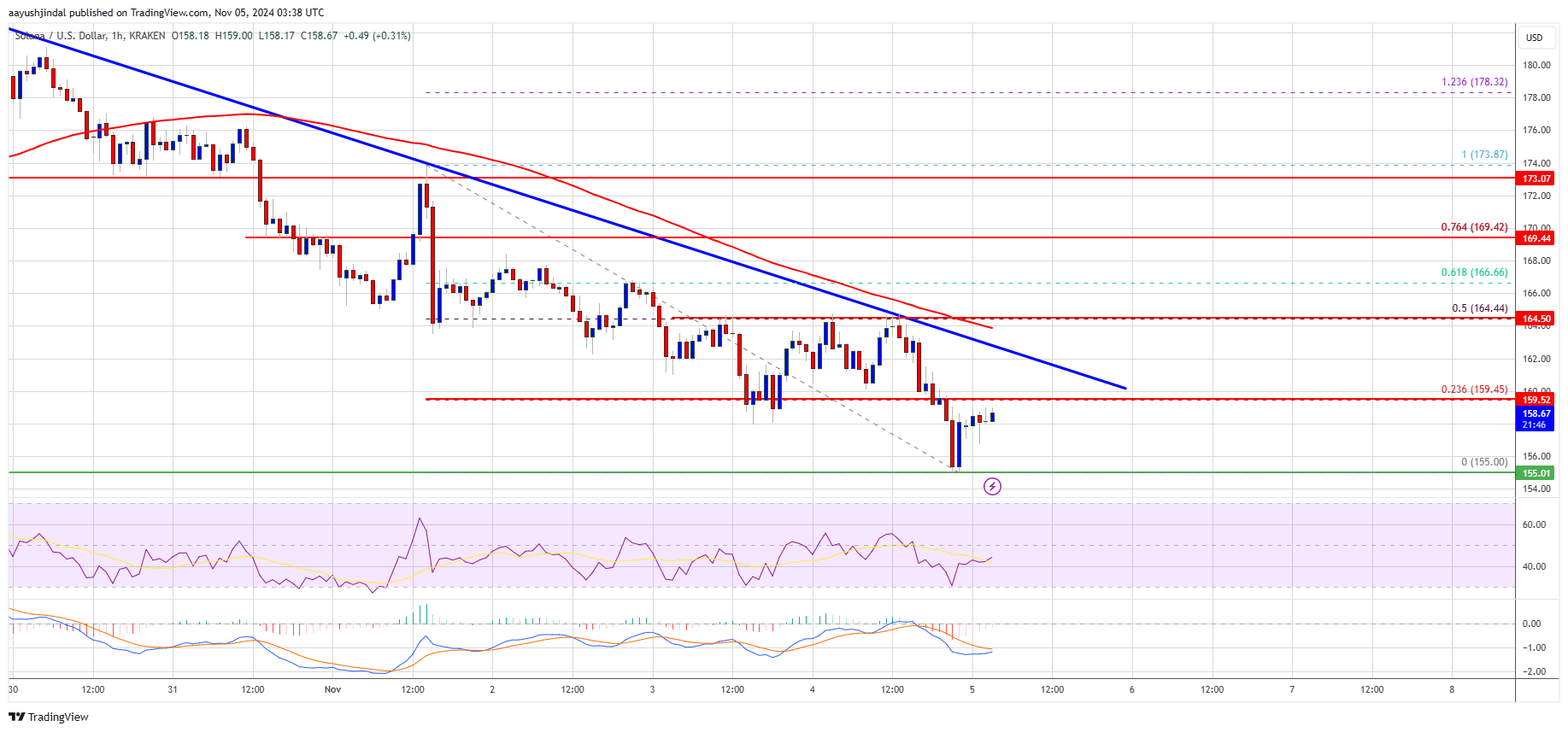

Solana experienced a dip and now trades beneath its $172 support level. The value of SOL appears to be stabilizing, potentially facing difficulties in rebounding beyond the $165 resistance point.

- SOL price started a fresh decline after it struggled near the $175 zone against the US Dollar.

- The price is now trading below $170 and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $162 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a decent upward movement if it stays above the $155 and $150 support levels.

Solana Price Extends Losses

The price of Solana found it challenging to surpass the $180 barrier, instead, it began to slide downwards, much like Bitcoin and Ethereum. This decline resulted in a drop beneath the support levels at $175 and $172.

The bears even pushed the price below $165 and tested the $155 support zone. A low was formed at $155 and the price is now consolidating losses below the 23.6% Fib retracement level of the downward move from the $173 swing high to the $155 low.

Currently, Solana’s trading value is less than $162 and it’s below its 100-hour moving average. If it tries to move upwards, it might encounter a barrier around $160. A stronger resistance lies at $162, and there’s also an emerging bearish trendline at the same level on the hourly chart of Solana/USD pair.

The main resistance could be $165 or the 50% Fib retracement level of the downward move from the $173 swing high to the $155 low. A successful close above the $165 resistance level could set the pace for another steady increase. The next key resistance is $172. Any more gains might send the price toward the $180 level.

More Losses in SOL?

If SOL doesn’t manage to break through the $165 barrier, it might keep falling instead. A potential floor for its descent lies at around $155. The primary significant support can be found around $150.

Dropping below the $150 mark could potentially push the price down towards the $135 region. Should we see a closing figure below the $135 resistance, it’s possible that the price might fall towards the $124 support level in the short term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $155 and $150.

Major Resistance Levels – $162 and $165.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-05 08:28