As a seasoned crypto investor with a knack for spotting trends and a portfolio that has weathered countless market fluctuations, I must say the recent surge of Solana (SOL) has caught my attention. Having witnessed the crypto market’s volatility firsthand, I’ve learned to read between the lines and understand the underlying dynamics at play.

Over the past month, Solana price

SOL

$212.0

24h volatility:

0.9%

Market cap:

$100.65 B

Vol. 24h:

$11.45 B

outperformed several cryptocurrencies surging past the crucial resistance of $200 and hitting a three-year high of $225. However, with nearly 40% gains on the monthly chart, the SOL price rally could halt amid the current profit-taking and waning buying pressure. Some on-chain metrics suggest that there’s a possibility of the pullback under $200 again.

Currently, Solana’s (SOL) price stands at approximately $207 and boasts a market capitalization of around $97.6 billion. Over the past 24 hours, there has been a 5% decrease in its price. Interestingly, despite this decline, the trading volume has seen a more significant drop by 22%, reaching about $9.38 billion during the same period.

It appears that optimism towards the fourth largest cryptocurrency is decreasing compared to last week. Consequently, this decline might invite more bearish activity, potentially causing the Solana rally to weaken even further.

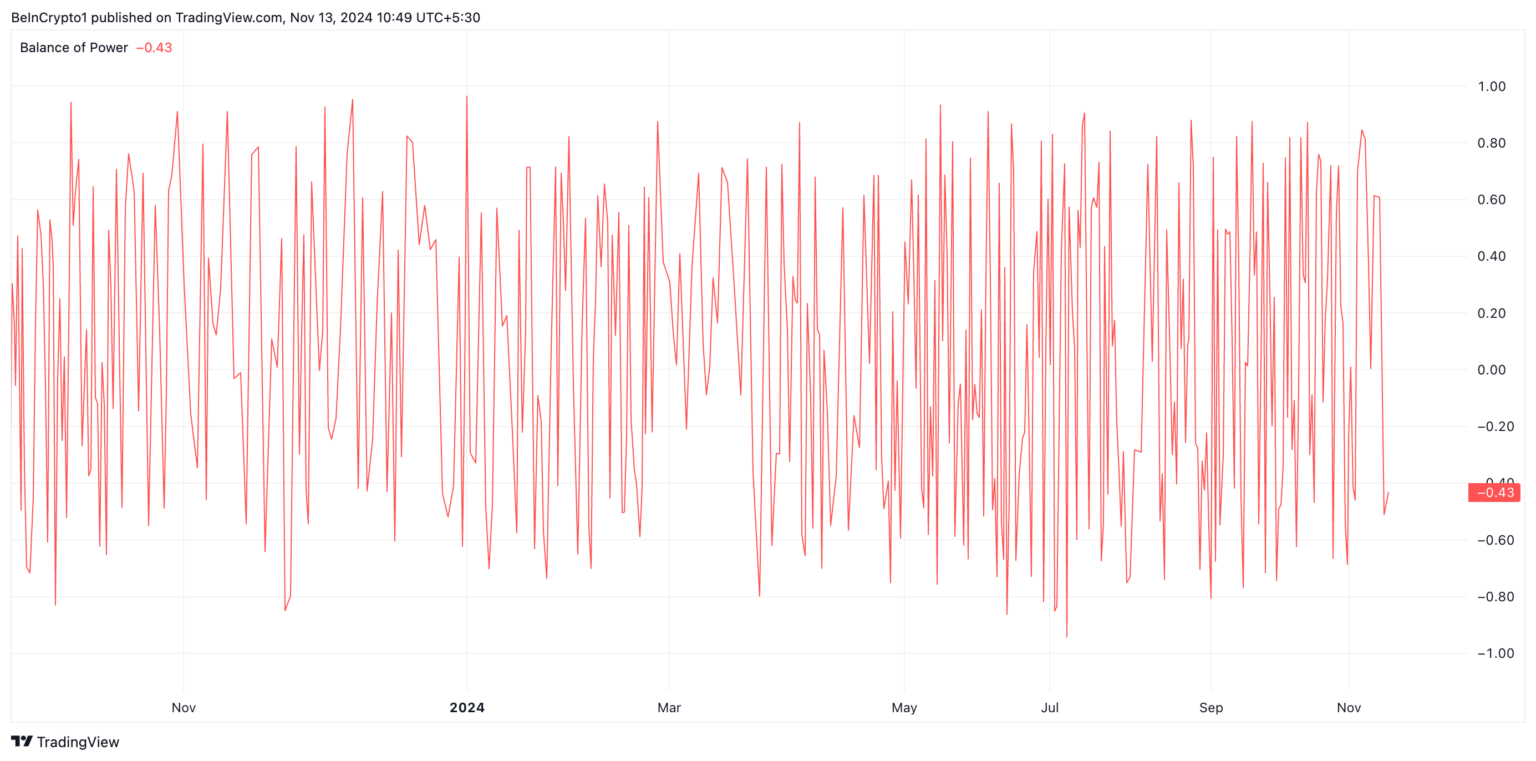

Furthermore, Solana’s Balance of Power (BoP) currently standing at -0.43 supports the bearish perspective. This measure evaluates the dominance of buyers over sellers. A negative BoP suggests that sellers have the upper hand and are probably pushing the asset’s price downward.

Courtesy: TradingView

Where Is Solana Price Heading Next?

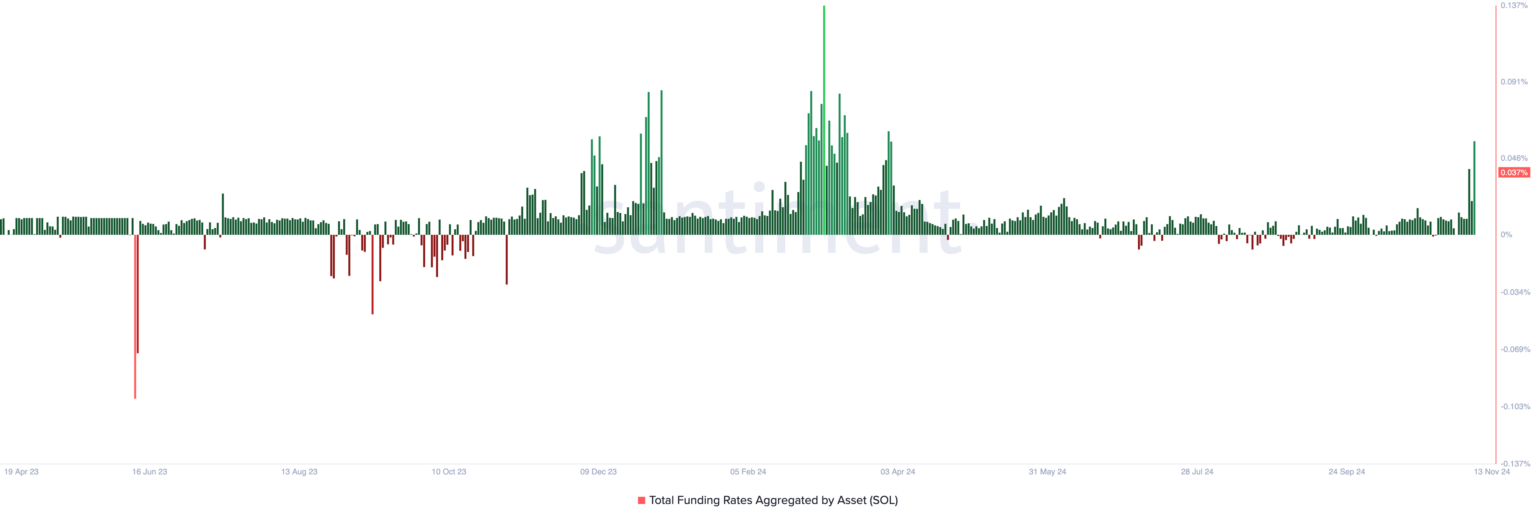

The high Solana funding rate indicates that there might be an extended downtrend, potentially driving the SOL price below $200. At present, the Solana funding rate reached a peak it hasn’t seen in eight months, at 0.037%.

Courtesy: Santiment

In simpler terms, the funding rate within perpetual futures contracts helps keep the contract’s price and the actual asset’s current price in sync. A sudden increase in the funding rate usually indicates a major market discrepancy, often with buyers holding more power. This situation is often seen as a bearish signal, implying that a possible price drop might occur soon.

Currently, at the moment I’m typing, Solana (SOL) is valued at approximately $202.51. This price is slightly higher than its significant support point of $193.92. If there’s increased selling pressure, it might cause SOL to challenge this crucial support. In case the bulls can’t hold the line here, it would suggest a downward trend, possibly leading Solana to fall lower, around $169.36.

Courtesy: TradingView

On the contrary, if there’s a strong argument defending this support level, it might lead to a comeback and ignite another surge in Solana’s price. If this holds up, Solana’s upward trend could regain enough strength to attempt reaching its three-year peak of $225.21 again.

Contrarily, the Solana blockchain has achieved significant landmarks in recent times. Notably, Solana surpassed Ethereum in decentralized exchange (DEX) trading volumes, reaching an all-time peak beyond mid-April.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-13 17:15