As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find Solana’s current predicament intriguing. The recent selling pressure and whale dumping have sent shockwaves through the community, but it’s nothing new in this rollercoaster ride we call cryptocurrency investing.

Currently, Solana’s price (SOL) stands at around $162.0, but it has experienced a significant downward trend due to intense selling pressure. The bulls were unable to sustain the momentum at $185 last week, leading to a drop of over 12% in the past week. This decline has resulted in a loss of more than $8 billion from its market cap, which now stands at approximately $76.30 billion. It seems that large investors (whales) have been offloading their SOL holdings and reaping substantial profits in recent times.

Solana Price Sees Selling Pressure after Whale Dumping

According to the most recent figures from Lookonchain, a prominent “cognizant whale” has just transferred 92,000 Solana (SOL) tokens, equivalent to approximately $14.58 million in value.

starting from November 1st, this whale has unloaded a grand total of about 357,070 Solana tokens, equating to approximately $58.54 million in value. At the moment, the whale still holds around 52,089 JitoSOL tokens, which have an estimated worth of $9.46 million, and a further 126,548 Solana tokens, valued at roughly $20.05 million.

The smart whale with a profit of ~$87M sold another 92,000 $SOL($14.58M) in the past 2 hours.

Since November 1st, the whale has offloaded a total of approximately 357 thousand SOL (equivalent to around 58.54 million dollars) while keeping 52,089 JitoSOL (approximately 9.46 million dollars) and 126,548 SOL (around 20.05 million dollars).

— Lookonchain (@lookonchain) November 5, 2024

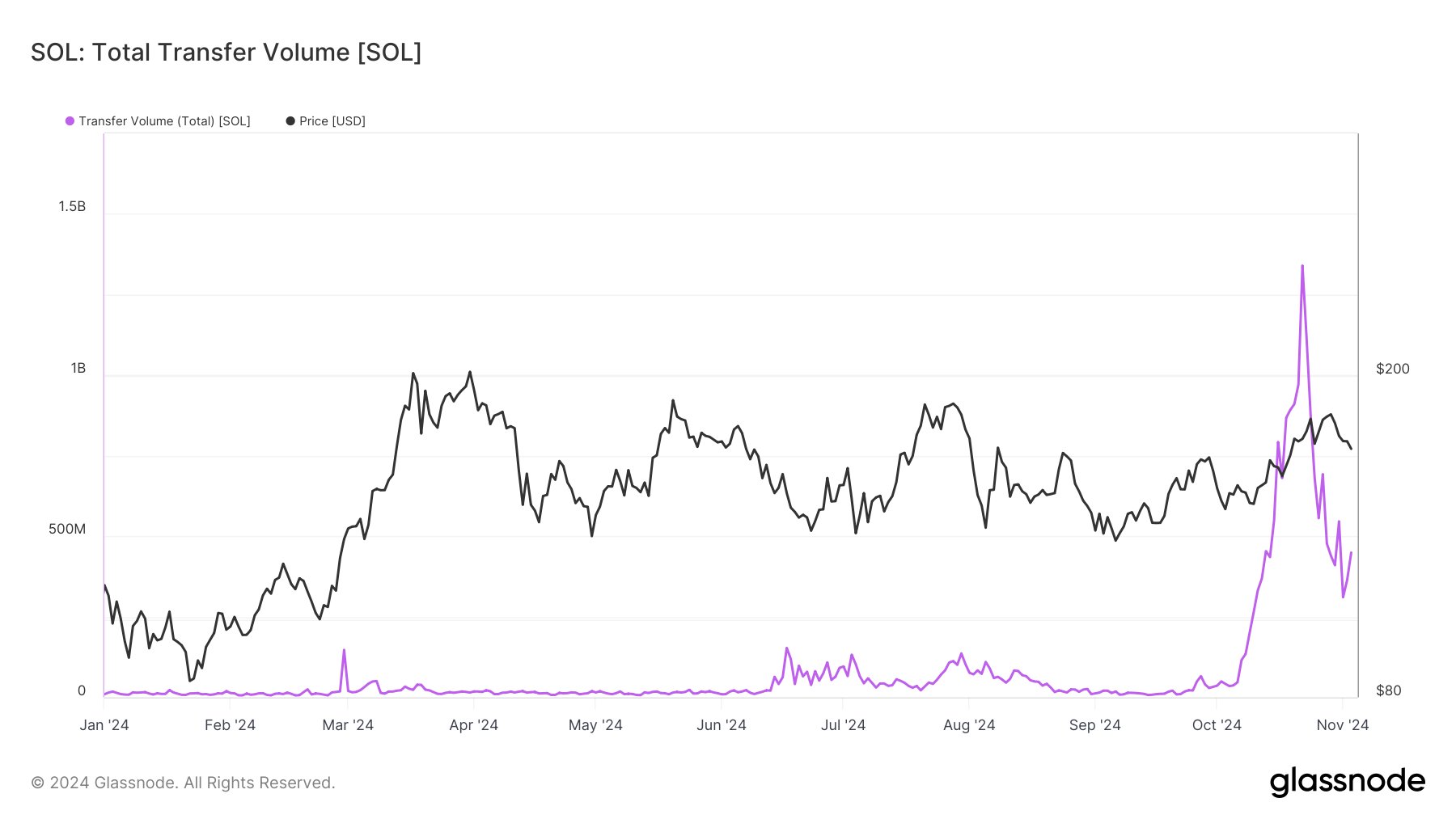

Furthermore, according to blockchain analysis company Glassnode, there’s been an unprecedented surge in daily transaction volume for the cryptocurrency Solana. This volume peaked at an astounding $224 billion, which is nearly three times Solana’s total market capitalization of approximately $76 billion.

It’s widely thought that this surge in activity was mainly driven by a frequent-use digital wallet, presumably an arbitrage bot, operating across several accounts. This wallet seems to have escalated its transactions starting from early October, which may have played a significant role in the recent increase in fees, a subject of debate within the community, as pointed out by Glassnode.

Courtesy: Glassnode

SOL Defends $155 Support, a Trend Reversal Soon?

This afternoon, Solana’s price rebounded from significant support points at $155 and is now increasing by 1% to $162.14, giving the coin a market value of approximately $76.35 billion. Notably, well-known crypto trader IncomeSharks decided to close his short position for SOL after this recovery.

In simpler terms, we achieved our goal of a $155 price point for our short position, and considering the current supertrend level, I’m choosing to close this short trade as anticipated. The on-balance volume (OBV) provided the entry signal, while the supertrend offered the exit cue.

— IncomeSharks (@IncomeSharks) November 5, 2024

Other market experts are likewise forecasting that the SOL price might surge toward $200. One expert believes that Solana is poised for a significant leap if Bitcoin can exceed its previous all-time high (ATH). Such an event could ignite robust bullish trends, potentially launching Solana into a new period of expansion within the crypto market.

In this rapidly changing market setting, Solana’s durability stands out. It might be worthwhile for investors to closely monitor SOL, as analysts are suggesting a favorable forecast for its possible growth trajectory within the present market conditions.

Courtesy: TradingView

To reach $200, Solana’s price needs to be convincingly pushed above the $170 threshold first. Current trading behaviors suggest a potential uptrend, which may strengthen if Solana successfully breaches a significant resistance level. Interestingly, the Awesome Oscillator (AO) has switched to green bars, hinting at growing momentum, but recent red bars might indicate a potential decrease in buying enthusiasm.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-05 12:51